Shadowfax Technologies IPO: What the Numbers Say Behind the Network

Shadowfax Technologies IPO offers a look into India’s fast-growing logistics backbone. With strong revenue growth, a wide delivery network, and rising market share, the company faces thin margins, high client concentration, and working capital pressure in a high-volume, low-margin business

In This Article

- Introduction

- Shadowfax Technologies Business

- Shadowfax Financials

- Shadowfax IPO Valuation

- IPO’s Bigger Picture

Introduction

India’s delivery ecosystem has expanded quietly but rapidly.

Every year, billions of parcels move across warehouses, sort centres and doorsteps.

While we usually only care about the "out for delivery" notification on our phones, there is a massive, invisible engine running in the background, and Shadowfax Technologies is basically the main character of that execution layer. They don’t own the flashy apps where you do your late night scrolling, but they are the ones doing the heavy lifting that involves moving billions of parcels across warehouses and sort centres to your doorstep.

The company now plans to list on the stock exchanges through a ₹1,907 crore IPO, opening on January 20 and closing on January 22.

Key IPO Details

- IPO price: ₹118 to ₹124

- IPO Dates: 20-22 Jan 2026

- Issue size: ₹1,907.27 crore

- Minimum Investment: ₹14,160

- Lot size: 120

- Lead Managers: ICICI Securities, Morgan Stanley India, and JM Financial

Shadowfax Technologies Business

Shadowfax started in 2016 with a simple mission: to make deliveries faster and more reliable across India. Today, the company helps e-commerce brands get parcels to client’s doorstep quickly, offering smart logistics solutions that go beyond just moving a box from point A to point B.

Instead of owning every single truck or building, they operate as an asset-light platform. By using a nationwide network of leased hubs and a massive army of over 2 lakh gig-based delivery partners, they’ve managed to scale up to nearly 15,000 pin codes without the heavy baggage of owning all that infrastructure.

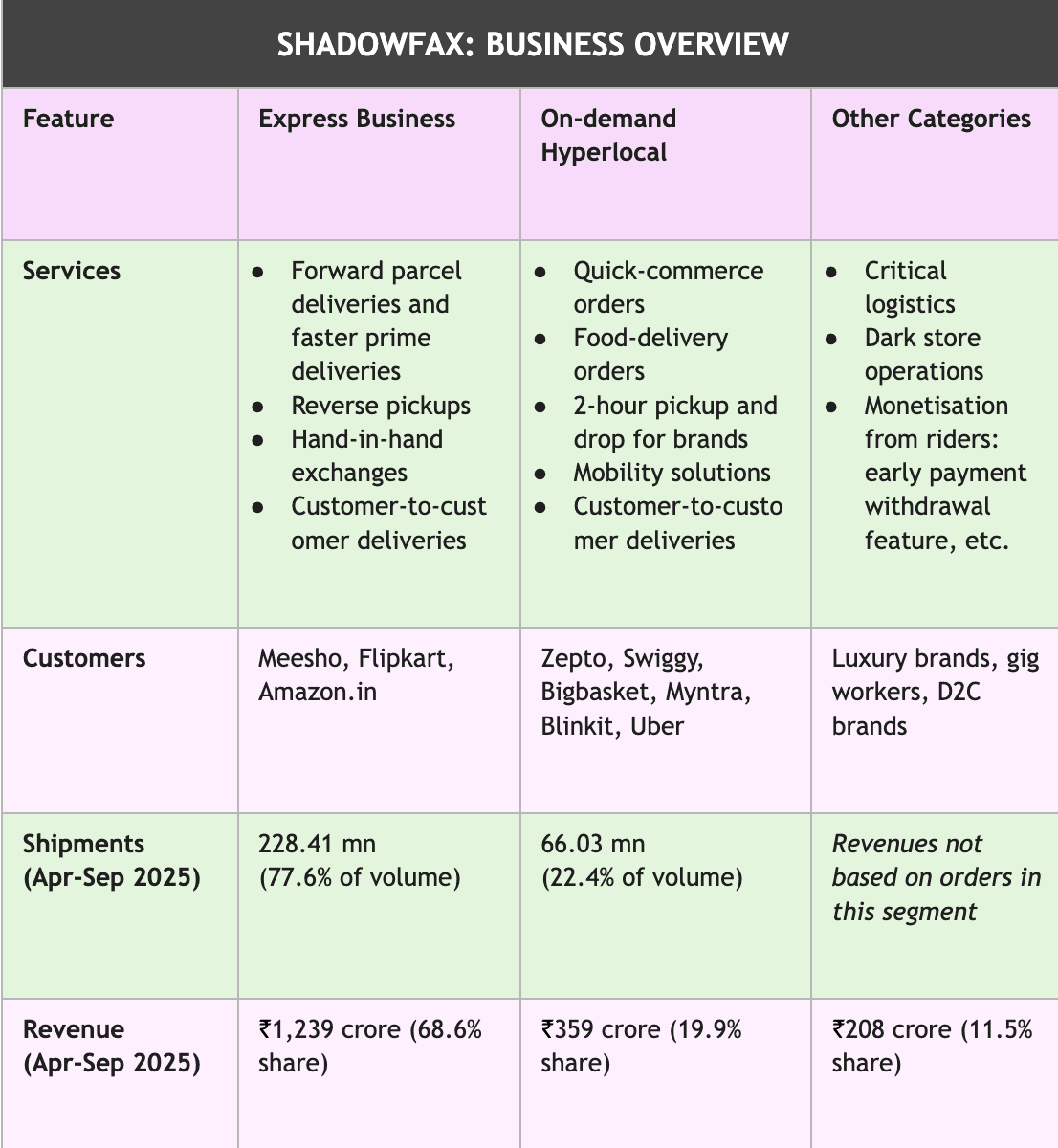

It’s an impressive feat of coordination, especially when you realize they are currently the only big third-party logistics player in India that handles everything from standard e-commerce deliveries to those hyper-fast 10 minute quick commerce orders and food deliveries.

Importantly, Shadowfax is one of the few companies that can deliver both big e-commerce parcels across cities and fast local orders like food or groceries.Most logistics firms do only one of these, but Shadowfax handles both at a large, nationwide scale.

India’s e-commerce and D2C segments are expected to grow at a 20-25% CAGR between 2025 and 2030. Quick commerce is expanding even faster.

But logistics behaves differently from most growth businesses. While volumes rise quickly, margins do not!

Logistics is a highly seasonal and operationally cumbersome industry. It is also capital intensive and tends to face pricing pressure from large platform clients.

Hence the technology systems, compliance costs and network readiness do not scale down during slow periods. Meaning scale is not a competitive advantage, it is a requirement to remain viable.

Shadowfax’s growing footprint has helped it increase market share in third-party e-commerce logistics to ~23% in FY25, up from ~8% in FY22. However, profitability remains structurally constrained. At large volumes, logistics becomes a coordination problem.

Shadowfax Financials

For Shadowfox, revenue growth has been strong:

But here is the "ick" factor for some: while the revenue is massive, the profit margins are paper-thin. We are talking about a PAT margin of around 1%. This is consistent with industry trends, even established players have struggled to achieve sustained profitability.

It’s a brutal reminder that even though India’s e-commerce scene is booming, nobody really wants to pay for delivery. This puts companies like Shadowfax in a position where they have to be absolutely perfect at every turn just to squeeze out a tiny bit of profit from every parcel they move.

This thin margin leads into another major toxic trait of the logistics business: the massive dependency on a few big clients.

For Shadowfax, nearly 49% of their revenue in the last six months came from just one single client (Meesho), and their top ten clients account for a staggering 84% of their total income. If one of those major clients decides to build their own delivery fleet or switches to a competitor, it’s a total heartbreak for the balance sheet.

Because they are a B2B provider, they don't have the brand loyalty of individual consumers to fall back on; they are only as good as their last delivery and their lowest price. This concentration limits their ability to raise prices, especially when they’re competing against other giants who are also desperate for volume.

Beyond the client drama, there’s the "working capital" grind, which is basically the financial equivalent of waiting for a text back that never comes.

In this business, Shadowfax has to pay their delivery partners and vendors almost immediately to keep the network moving, but the big corporate clients they serve often take their sweet time to settle the bills. As the company grows and moves more parcels, this funding gap gets wider and wider, creating a constant need for fresh cash.

That’s essentially why they are heading to the stock exchanges with this ₹1,907 crore IPO. The objective of the IPO is to bridge that gap and fuel the next stage of their expansion, with about ₹1,000 crore of the new money going straight into the company’s pocket to pay for new sorting centers and tech upgrades.

The rest of the IPO money, roughly ₹907 crore, is an "Offer for Sale," which means early investors like Flipkart and various institutional funds are using this moment to partially cash out and take some of their chips off the table.

Shadowfax IPO Valuation

At the price band of ₹118 to ₹124, the company is being valued at about ₹7,168 crore. For an investor, that’s the price you pay to own a piece of the backbone of India’s digital economy. It’s a bet on the idea that as we all keep ordering more stuff online, the sheer volume will eventually turn those tiny 1% margins into something more substantial. It’s a high-volume, low-margin game that requires insane discipline and long-term stamina.

IPO’s Bigger Picture

Shadowfax’s listing reflects how India’s internet economy is maturing. Demand is strong and execution has improved, but turning scale into steady profits remains a long grind. This isn’t a business where margins expand just because volumes rise. Success depends on operational discipline, reliable delivery partners, and stable relationships with large platform clients.

For investors, the stock is a trade-off between fast revenue growth and the structural limits of an industry built around “free delivery.”

Let us know what you think about the Shadowfax IPO & for more such IPO deep dives keep Arihant Plus blogs on your watchlist!

Source: https://arihantresearch.arihantcapital.com/mumbai_research/Shadowfax_Technologies_IPO_Note.pdf

Related Topics