Groww IPO: Should You Apply for India's Biggest Fintech IPO in 2025

By

Arihant Team

Groww’s ₹6,632.30 crore IPO opens Nov 4–7, priced ₹95–₹100 per share. With 1.39 crore active clients, India’s top fintech company aims to scale its cloud, credit, and margin trading reach.

In This Article

- Introduction

- Groww IPO Details

- About Groww

- Industry Outlook

- Groww IPO Objective

- Groww Strengths & Risks

- Financial Overview

- Peer Comparison

- Groww IPO GMP

- Takeaway for Investors

- Frequently Asked Questions

Introduction

After reshaping how Indians invest, Billionbrains Garage Ventures Ltd., the parent company of Groww, is preparing for its market debut with one of India’s most-awaited fintech IPOs. Groww’s ₹6,632.30 crore IPO will be one of the biggest IPOs of 2025, so far. The offering opens on November 4, 2025 and closes on November 7, 2025, with a price band set at ₹95–₹100 per share.

Equity participation in India is still low, and a lot of first-time investors are just getting started. Groww tapped into this gap early with an easy-to-use platform driven by tech, helping it emerge as a major player in online investing. Over the years, Groww has evolved from a mutual fund platform into a diversified financial services platform offering investment, UPI and credit.

Through this IPO, the company plans to transition into a full-stack wealth platform by expanding its investment product offerings beyond equities and mutual funds to portfolio management services (PMS), commodities and advisory. “We are not just a broking company. We are building India’s largest wealth platform, and we have multiple businesses,” said Lalit Keshre, Co-founder and CEO of Groww

Groww IPO Details

At current issue price of ₹95-₹100 per share, Groww is targeting a $7-8 billion valuation, which is consistent with its last private funding round.

Here’s a quick overview of the Groww IPO:

About Groww

Groww is a Bengaluru-based fintech company founded in 2018 by four ex-Flipkart colleagues — Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh. What began as a mutual fund investment app has now evolved into one of India’s leading online investment and wealth management companies with its own AMC.

The company operates under its parent entity, Billionbrains Garage Ventures Ltd., and offers a diverse range of financial products, including stockbroking, mutual funds, fixed deposits, futures & options, and US stock investments. Its intuitive mobile app and website enable users to invest, track, and manage their portfolios effortlessly, eliminating the complexities of traditional investing.

Key Highlights:

- Groww currently holds 26.27% market share with over 1.29 crore NSE active clients and 1.39 overall active users. Its total customer assets standing at more than ₹2.6 lakh crore.

- It operates a 100% digital, direct-to-consumer (D2C) model with a presence across all major financial products.

- The company is backed by marquee investors such as Peak XV Partners (formerly Sequoia Capital India), Ribbit Capital, and Tiger Global.

- It generates revenue primarily from brokerage income, interest on margin funding, and distribution commissions.

Industry Outlook

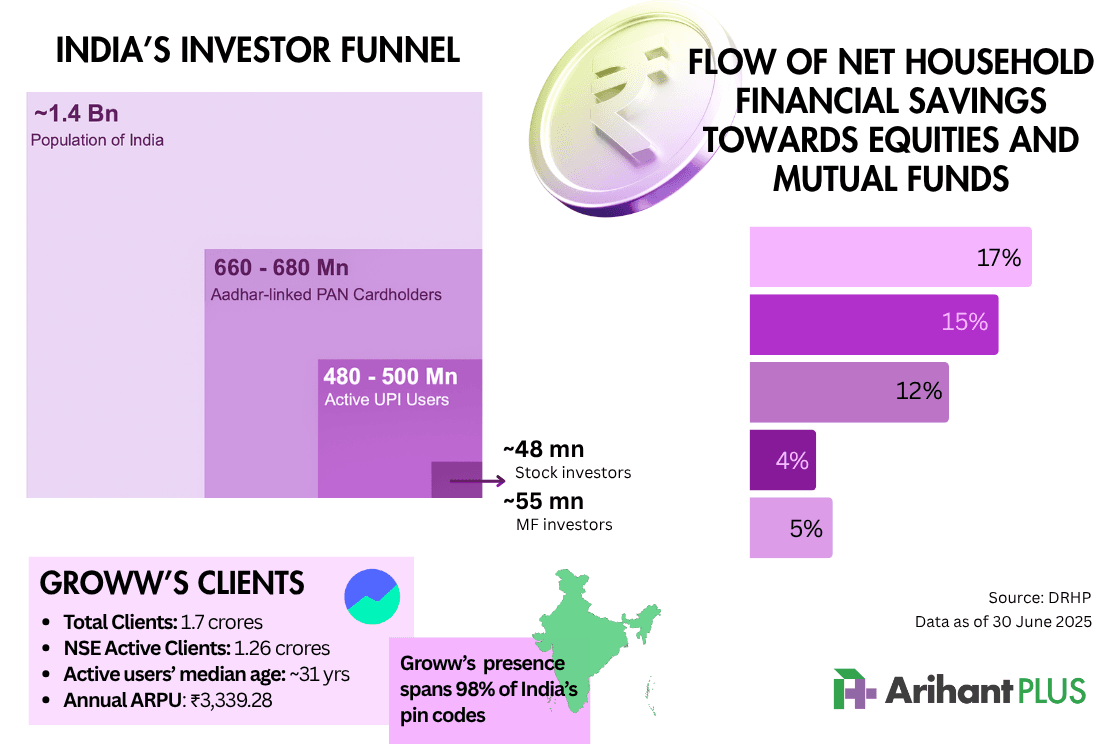

India’s investment and wealth management industry is expanding, thanks to the rising incomes, digital adoption, and favourable demographics.

According to the Redseer Report (September 2025):

- The total addressable market (TAM) for investment and wealth management in India stood at ₹1.1 lakh crore in FY2025.

- It is projected to grow to ₹2.2–₹2.6 lakh crore by FY2030, driven by increasing participation in financial assets.

- The number of investors is expected to nearly double from 6.6–7.2 crore to 12–13 crore during this period.

- This growth is fuelled by rising financial literacy, smartphone penetration, and easy access via digital platforms like Groww.

Wealth management assets are also growing strongly:

- Portfolio Management Services (PMS) AUM rose from ₹3 lakh crore in 2015 to ₹13 lakh crore in 2025, registering a 16% CAGR.

- The affluent and upper-middle-class segments are steadily expanding, with more savings flowing from traditional assets to equities and mutual funds.

- The sector’s growth is digitally driven and regulation-supported, paving the way for sustained, inclusive, and transparent long-term expansion.

Groww IPO Objective

The Groww IPO comprises a fresh issue of ₹1,060 crore and an offer for sale (OFS) of ₹5,572.3 crore, taking the total issue size to ₹6,632.30 crore. This means 84% of the money raised through the IPO will go into existing shareholder's pocket and not for company's growth.

The 16% of the IPO proceeds from the fresh issue will be utilised to upgrade cloud infrastructure, strengthen marketing and brand-building initiatives, and invest in its key subsidiaries, Groww Creditserv Technology Pvt. Ltd. (GCS) and Groww Invest Tech Pvt. Ltd. (GIT), to enhance their capital base and expand the margin trading facility business. The company also plans to allocate funds toward inorganic growth opportunities and general corporate purposes.

| IPO proceed spend towards | Estimated amount |

|---|---|

| Cloud infrastructure | ₹152.5 cr |

| Brand building & performance marketing | ₹225 cr |

| Investment in GCS (NBFC) for capital augmentation | ₹205 cr |

| Investment in the GIT and MTF business | ₹167.5 cr |

Note: The combined amount for inorganic growth and corporate purposes will not exceed 35% of the gross proceeds.

Groww Strengths & Risks

Here’s why Groww IPO is capturing investor attention:

- High-visibility fintech brand: One of India’s fastest-growing D2C financial platforms, trusted by over 1.7 crore users. According to company's DRHP, 83% of their customers are acquired organically.

- Rapid revenue growth: Average revenue per user (ARPU) expected to rise from ₹15,900–₹17,200 to ₹18,600–₹20,200 by FY2030, reflecting higher engagement and monetisation.

- Diversified financial ecosystem: The company offers an integrated platform where you can invest in mutual funds, derivatives, and stocks; apply for loans against securities; and engage in margin trading. This enables smooth customer engagement across all major retail investment and credit products. Expansion into “W by Groww” (wealth management) and trading APIs positions the company beyond broking into a full-stack financial services player.

- Untapped market potential: Only 16–18% of India’s adults currently have a demat account, versus 62% in the US, leaving significant growth headroom. Strong macro tailwinds: Rising income levels, digital adoption, and growing financial literacy continue to drive India’s equity and mutual fund participation.

Risks to Watch Out For

While Groww’s growth story remains strong, investors should be aware of key risks that could impact its performance and profitability:

- Concentration: Dependence on the broking segment, contributing 84.5% of overall revenue, makes Groww sensitive to market fluctuations and regulatory shifts.

- Competition: Indian broking and wealth management is fiercly competitive. Groww faces intense rivalry from Zerodha, Upstox, AngelOne and traditional banks, which could pressure pricing, margins and impact its market share. Entry of Jio, and the disruption it could bring, may also impact the company.

- Market Volatility: Revenue depends heavily on trading activity; market downturns or policy shifts can impact investor participation and income.

- Regulatory Changes: Alterations in SEBI or RBI norms on fees, compliance, or licensing could affect operations and profitability.

- Integration Risks: Managing multiple subsidiaries like Groww Creditserv and Groww Wealth Tech may pose challenges around cost control and execution.

Financial Overview

Groww has reported a strong financial performance in FY25, clocking a profit of ₹1,824 crores in FY25 compared to a ₹805 crore loss in FY24. This reflects both scale and profitability improvement. The company’s revenue surged from ₹1,141.53 crore in FY23 to ₹3,901.72 crore in FY25. The revenue jumped 50% year-on-year, driven by an expanding user base and higher trading activity. However, Q1FY26 witnessed a 10% decline in revenue to ₹904 crores, though profit increased 11% to ₹378 crores. Company's EPS for FY25 was 3.34.

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 | 30 Jun 2025 | 30 Jun 2024 |

|---|---|---|---|---|---|

| Assets | ₹10,077.31 | ₹8,017.97 | ₹4,807.78 | ₹12,713.18 | ₹10,819.10 |

| Total income | ₹4,061.65 | ₹2,795.99 | ₹1,260.96 | ₹948.47 | ₹1,047.58 |

| Profit after tax | ₹1,824.37 | -₹805.45 | ₹457.72 | ₹378.37 | ₹338.01 |

| EBITDA | ₹2,371.01 | -₹780.88 | ₹398.78 | ₹418.75 | ₹482.66 |

| Networth | ₹4,855.35 | ₹2,542.64 | ₹3,316.75 | ₹5,995.45 | ₹2,886.28 |

| Reserves & surplus | ₹4,445.62 | ₹2,477.76 | ₹3,251.92 | ₹5,506.76 | ₹2,821.41 |

| Total Borrowing | ₹544.36 | ₹24.06 | NA | ₹500.73 | ₹117.66 |

The company’s ongoing investment in technology pushed its tech expenses to ₹440.9 crores, accounting for 27.6% of total costs, as it continues to enhance platform scalability and resilience.

Overall, the company has demonstrated robust topline growth and improving margins, supported by strong customer traction and efficient cost management. Here is a quick snapshot of key financial metrics over the last few financial years:

Peer Comparison

Below is a quick comparison of key competitors of Groww and their financials from the DRHP. However, its key competitors in digital space like Zerodha and Upstox are missing as they are not listed:

| Company Name | PE (x) | Revenue (in crores) | EPS | RoNW | Net Asset Value per Equity Share |

|---|---|---|---|---|---|

| Groww | 29.94 | ₹39,017.23 | ₹3.34 | 37.57% | ₹8.89 |

| Angel One Limited | 17.52 | ₹52,383.79 | ₹130.05 | 20.85% | ₹623.72 |

| Motilal Oswal Financial Services Limited | 22.39 | ₹83,390.50 | ₹41.83 | 22.64% | ₹185.24 |

| 360 One WAM Limited | 40.98 | ₹32,950.90 | ₹27.14 | 14.37% | ₹188.89 |

| Nuvama Wealth Management | 23.99 | ₹41,582.69 | ₹276.66 | 28.22% | ₹979.11 |

| Prudent Corporate Advisory Services | 59.40 | ₹11,035.61 | ₹47.25 | 29.3% | ₹161.25 |

Groww IPO GMP

According to media reports and online platforms like investorgain.com and ipowatch.in, the unlisted shares of Groww's parent Billionbrains Garage Ventures are trading at ₹112, indicating a grey market premium (GMP) of 12%, or ₹12, over the upper price band of ₹100.

Disclaimer: Grey Market Premium (GMP) is not regulated or recommended by the stock exchanges or SEBI. ArihantPlus does not endorse or facilitate trading in the grey market. Investors are advised to conduct their own research or consult an expert before making any investment decisions.

Takeaway for Investors

The Groww IPO has generated strong investor interest on the back of its rapid growth, expanding user base, and clear leadership in India’s digital investment space.

The company’s technology-first approach, diversified financial offerings, and scalable business model make it a key player in the country’s fast-evolving fintech ecosystem. However, its heavy dependence on the broking segment exposes earnings to market volatility and regulatory changes. While valuations appear ambitious, they also reflect Groww’s strong brand equity, profitability turnaround, and the long-term potential of India’s capital market and wealth management sector.

For investors, Groww represents a long-term play on India’s rising retail participation and digital finance growth story. That said, it may be prudent to do your own research before making an investement decision.

Frequently Asked Questions

What is the Groww IPO price band?

Groww IPO price band is ₹95–₹100 per share.

What is the Groww IPO GMP?

Groww IPO GMP is around ~₹12 as of October 30, 2025.

Who are the key selling shareholders?

Under the OFS, the major selling shareholders include Peak XV Partners Investments VI-1 (formerly Sequoia Capital India), YC Holdings II LLC, Ribbit Capital V, L.P., Internet Fund VI Pte. Ltd., and Kauffman Fellows Fund, L.P., among others.

What is the IPO structure and reservation?

The IPO follows a 100% book-built process under SEBI ICDR Regulations: QIBs (Qualified Institutional Buyers), not less than 75% of the offer Non-Institutional Investors (NIIs), not more than 15% Retail Individual Investors (RIIs), not more than 10%.

On which stock exchanges will the shares be listed?

After the IPO, Groww will be listed on NSE and BSE and will be available for trading on both these exchanges thereafter.

Who are the book running lead managers (BRLMs)?

The following are the lead managers for the Groww IPO:

- Kotak Mahindra Capital Company Limited

- J.P. Morgan India Private Limited

- Citigroup Global Markets India Private Limited

- Axis Capital Limited Motilal Oswal Investment Advisors Limited

Should you apply for the Groww IPO?

Groww IPO offers a unique investment proposition in India's capital market and wealth management space that is quite under-penetrated and has the potential to grow. The company's transition to profitability and focus on tech and branding adds confidence. You can apply in Groww IPO through the ArihantPlus app in just a few clicks.

Related Topics