How Your Gold Profits Are Taxed And Budget 2026 Expectations For Gold

Gold prices have surged, pushing investors toward digital gold like ETFs. Budget 2026 may tweak tax rules to incentivise gold, align policy with behaviour, and reduce reliance on physical gold.

In This Article

- Introduction

- From lockers to apps: How gold investing is evolving

- Gold prices are up. So, what about taxes?

- How Are Profits from Selling Gold Taxed in India?

- Budget 2026: Why incentives for digital gold make sense

- What changes could Budget 2026 bring?

- The bottom line

Introduction

Over the last 12 months, gold prices in India have surged by more than 76%. That’s a massive jump by any standard. Yet, if history is anything to go by, this sharp rise hasn’t dimmed India’s love for gold one bit.

Gold has always been more than just an investment for Indian households. It’s tradition, security, and a hedge against uncertain times. But what has changed over the years is how Indians choose to invest in gold.

Open a free account today

Invest in tomorrow with just one click

From lockers to apps: How gold investing is evolving

A few years ago, gold mostly meant jewellery, coins, and bars tucked away in lockers. Today, the story looks very different. Investors are increasingly turning to digital modes of investing in gold such as:

- Gold Exchange-Traded Funds (ETFs)

- Gold mutual funds

- Digital gold

- Sovereign Gold Bonds (SGBs) (new issues discontinued)

These options are easier to buy, safer to store, more transparent, and far more tax-efficient in some cases. You don’t need a locker, you don’t worry about purity, and you can buy or sell with just a few clicks.

In fact, gold ETFs have become one of the most popular ways of investing in gold today. Just last year, in 2025, Indians invested over ₹36,000 crores in gold ETF, ranking India third globally in terms of highest inflows in gold ETFs.

This shift clearly shows that investors are becoming more financially aware — and policy needs to keep pace with this change.

Gold prices are up. So, what about taxes?

With gold prices touching record highs, many of you might be thinking of booking some profit and selling part of your gold holdings. That’s where taxation comes into play.

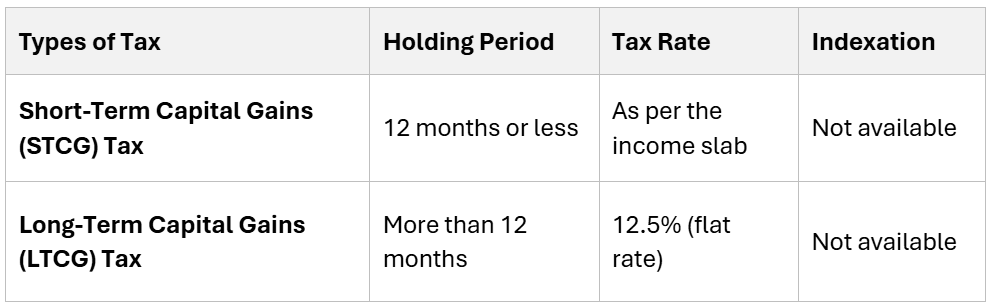

In India, gold is treated as a capital asset. This means any profit you make from selling gold — whether physical or digital — is taxable. However, the tax treatment depends on two things:

- The form of gold you hold

- How long you have held it

How Are Profits from Selling Gold Taxed in India?

- Physical gold (jewellery, coins, bars): Profits made from selling physical gold is taxed as capital gains. If you sell within 24 months, you pay a short-term capital gains tax on your gains, that is taxed as per your slab. Long-term gains (if you sell after 24 months) are taxed at a flat rate of 12.5% (without indexation).

- Sovereign Gold Bonds (SGBs): This is where things get interesting. If you hold SGBs till maturity, capital gains are completely tax-free. Only the interest earned is taxable.

- Gold ETFs and gold mutual funds: How are your gold ETFs and gold mutual funds taxed depends on when you sell them, but they are taxed as capital assets. Short-term gains follow your income tax slab rates, while long-term gains are taxed at a flat rate.

This clear difference in taxation already makes SGBs one of the most attractive ways to invest in gold. However, unfortunately, SBGs have been discontinued by the government. Only the previously issued bonds are traded on exchanges.

Budget 2026: Why incentives for digital gold make sense

With investors steadily moving away from physical gold, there’s a strong case for the government to actively incentivise digital and regulated gold products in Budget 2026. Here’s why:

- Less physical gold, fewer economic leakages: Physical gold often leads to storage costs, security risks, and in some cases, unaccounted transactions. Digital gold products are fully transparent and traceable.

- Better investor protection: Gold ETFs and mutual funds are regulated products. Investors know exactly what they own and how it is priced.

- Lower dependence on gold imports: Encouraging financial gold reduces the need for importing and storing physical gold, helping manage India’s current account deficit.

- Aligning tax policy with investor behaviour: When investors are already choosing digital gold, tax rules should reward this shift, not treat all forms of gold the same way.

What changes could Budget 2026 bring?

While nothing is confirmed yet, expectations include:

- More favourable tax treatment for gold ETFs and mutual funds.

- Continued support and clarity around Sovereign Gold Bonds

- Possible differentiation between physical and financial gold for tax purposes.

- Measures to promote long-term holding rather than short-term speculation.

If implemented, these steps would further strengthen the move toward modern, efficient gold investing.

The bottom line

Gold remains deeply embedded in Indian portfolios — and that’s unlikely to change anytime soon. What is changing is the form in which people hold gold. As prices soar and investors become more tax-aware, digital gold products like gold ETFs are no longer niche options — they’re fast becoming mainstream.

Budget 2026 presents a real opportunity for policymakers to encourage this transition by aligning tax rules with modern investing habits. Incentivising digital gold isn’t just good for investors — it’s good for the economy as well.

Related Topics