Lenskart IPO: Should You Apply for India’s Hottest Eyewear IPO?

By

Arihant Team

Lenskart IPO opens on 31Oct. While the company is a market leader and has transformed the Indian eyewear sector, it grapples with poor profitability. Should you apply?

In This Article

- Introduction

- About Lenskart Solutions Ltd.

- Lenskart IPO Details

- Industry Outlook

- Lenskart IPO Objectives

- Lenskart Financials

- Strengths of Lenskart

- Final Thoughts

- Lenskart IPO – Key Questions

Introduction

After revolutionizing how Indians buy eyewear, Lenskart Solutions Ltd. is now bringing its success story to Dalal Street. The company is all set to make a grand market debut with its ₹7,278 crore IPO, a mix of fresh issue and offer for sale (OFS). The issue opens on October 31, 2025, and closes on November 4, 2025, with a price band of ₹382–₹402 per share.

As one of India’s fastest-growing direct-to-consumer (D2C) brands and the country’s leading eyewear retailer, Lenskart IPO has become the buzzword among investors eyeing high-growth consumer-tech stories. Founded in 2008, the brand has built an empire of over 2,700 stores worldwide, blending technology, retail, and design innovation.

Lenskart is backed by marquee investors like SoftBank, Abu Dhabi Investment Authority (ADIA), and KKR, Lenskart IPO represents not just a consumer brand’s listing, but a bet on India’s fast-growing lifestyle and retail tech ecosystem.

With its ₹7,278 crore issue, Lenskart is ready to test investors’ appetite for a high-growth, tech-driven retail play in India’s eyewear market. But should you invest? Let’s break it down in detail.

About Lenskart Solutions Ltd.

Lenskart Solutions Ltd. is a technology-driven eyewear company engaged in the design, manufacturing, branding, and retailing of spectacles, sunglasses, contact lenses, and accessories.

Its direct-to-consumer (D2C) model enables it to control everything — from product design and lens fitting to last-mile delivery.

Key Highlights:

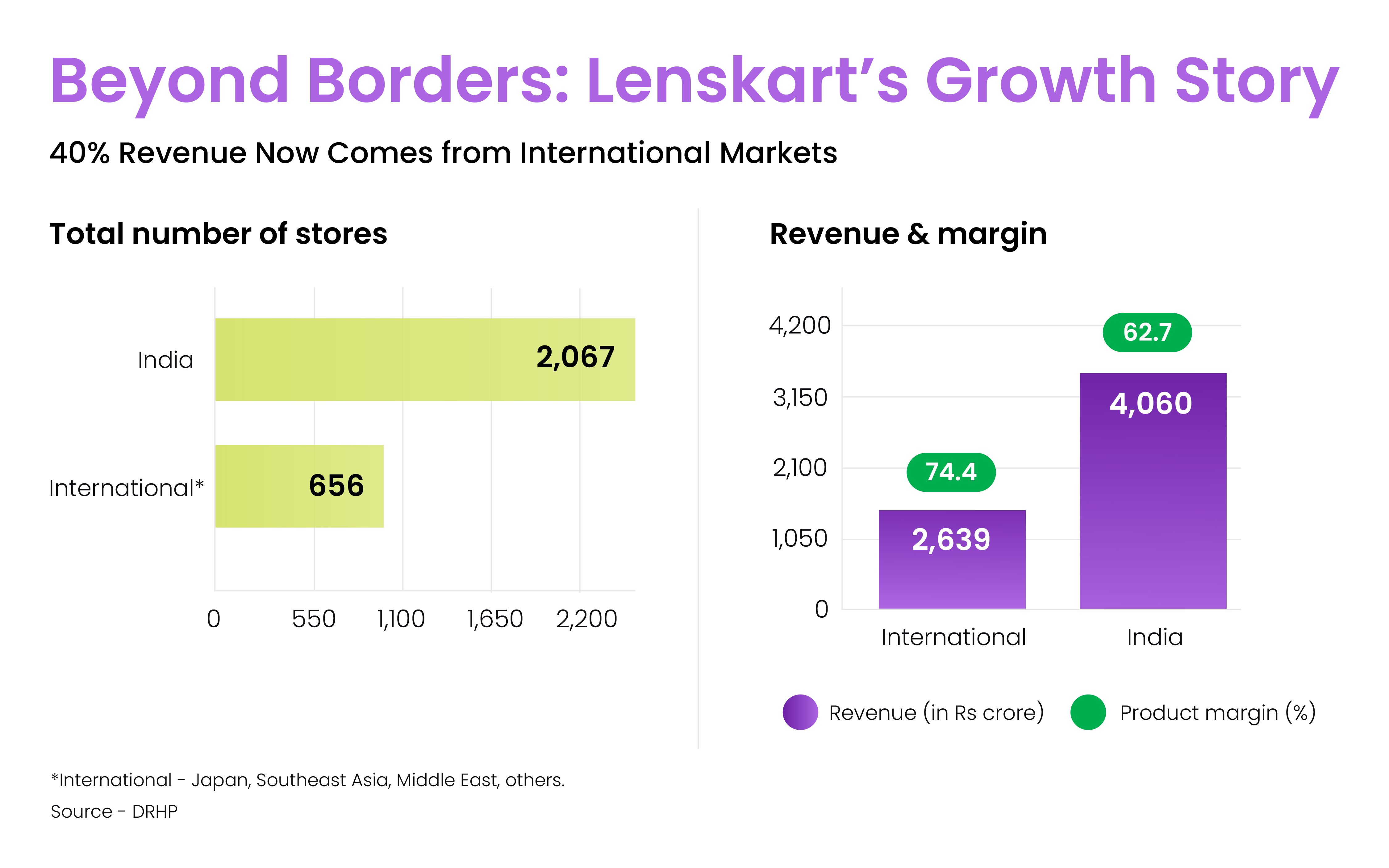

- Operates 2,723 stores globally including 656 stores overseas, which 🌍 pull about 40% of its revenues.

- Manufacturing hubs in Bhiwadi and Gurugram, with facilities in Singapore and the UAE.

- Next-day delivery in 40 Indian cities; 3-day delivery in 69 cities.

- 100 million+ app downloads and a tech team of 532 members.

- 105 new collections launched in FY25, including celebrity collaborations.

Simply put, Lenskart Solutions is more than just a retail brand — it’s an integrated tech-retail platform.

Lenskart IPO Details

Here’s a quick snapshot of the IPO:

Particulars | Details |

IPO Dates | October 31to November 4, 2025 |

Price Band | ₹382 – ₹402 per share |

Face Value | ₹2 per share |

Issue Size | ₹7,278.02 crore |

Fresh Issue | ₹2,150 crore |

Offer for Sale (OFS) | ₹5,128.02 crore |

Lot Size | 37 shares |

Minimum Investment (Retail) | ₹14,874 |

Allotment Date | November 6, 2025 |

Listing Date | November 10, 2025 (BSE, NSE) |

Registrar | MUFG Intime India Pvt. Ltd. |

GMP (as of Oct 27) | ₹68 (expected listing gain 16–17%) |

Industry Outlook

India’s eyewear market is poised for exponential growth, driven by lifestyle changes, screen exposure, and rising awareness about vision care.

- Market Size: Estimated to reach ₹28,000 crore by FY30.

- Growth Drivers: Rising smartphone usage, digital eye strain, affordable eyewear, and increasing fashion consciousness.

- Trend: Shift from unorganized to organized retail — a key tailwind for Lenskart.

The sector’s long-term potential remains attractive, especially for brands with omnichannel presence and strong recall value.

What makes the Lenskart IPO interesting

Here’s why investors are eyeing the Lenskart IPO closely:

- High-visibility consumer brand – among India’s top D2C success stories.

- Fast-growing revenue – over 75% growth between FY23–FY25.

- Omnichannel dominance – seamless online-to-offline experience.

- Strong global footprint – presence in UAE, Singapore, Japan, and Thailand. The company’s subsidiary, Neso Brands, invested $4 million in a "significant stake" in the Paris-based eyewear brand Le Petit Lunetier. It has set up a joint venture Bao Feng Framekart in China to manufacture frames and made other strategic investments in San Francisco, Japan and Israel.

- Cost advantage – The company runs the whole process from design to manufacturing, allowing it to produce at a much cheaper cost hence maximising its profits, which makes it a good investment opportunity.

- Attractive listing buzz – Lenskart IPO GMP is ₹68, hinting at possible short-term listing gains (high-risk).

Lenskart IPO Objectives

The Lenskart IPO is a mix of fresh issue of ₹2,150 crore and OFS is of ₹5,128.02 crore, taking the total issue size to ₹7,278.02 crore.

The company plans to deploy the net proceeds from the fresh issue toward the expansion of its store network, technology enhancements and marketing initiatives to strengthen its retail presence and brand leadership. Investments in tech and cloud infrastructure will further strengthen its omnichannel retail model, while marketing and inorganic acquisitions indicate the company’s intent to scale both organically and through strategic takeovers.

Here is how Lenskart Solutions intends to use the funds: -

S.No. | Objects of the Issue | Expected Amt (in crore) |

1 | Capital expenditure towards setting up new company-owned (CoCo) stores in India | ₹272.62 |

2 | Expenditure for lease, rent, and license-related payments for CoCo stores operated by the company in India | ₹591.44 |

3 | Investment in technology and cloud infrastructure | ₹213.38 |

4 | Brand marketing and business promotion expenses for enhancing brand awareness | ₹320.06 |

5 | Unidentified inorganic acquisitions and general corporate purposes | — |

Risks to Watch Out For

- Competition: Faces tough rivalry from Titan Eye+, SpecsMakers, and global players.

- Premium Valuation: At ₹402, the IPO isn’t cheap in terms of earnings multiple.

- Global Expansion Costs: Overseas operations may pressure margins.

- Dependence on Online Sales: Tech disruptions could affect user experience.

- Consumer Sentiment: Discretionary spending slowdown may impact demand.

Peer Comparison & Valuation

While Lenskart doesn’t have a perfect listed peer, Titan’s eyewear business offers some benchmark context.

Company | Revenue (FY25) | EBITDA Margin | PAT (₹ Cr) | P/E (Est.) |

Lenskart Solutions | ₹7,009 Cr | 13.80% | ₹297 | ~70x |

Titan Eye+ (Titan Co.) | ₹1,800 Cr (est.) | 17% | NA | ~80x |

Nykaa | ₹6,200 Cr | 5% | ₹110 | ~100x |

Trent (Westside, Zudio) | ₹14,600 Cr | 14% | ₹1,350 | ~85x |

At the upper band, Lenskart IPO values the company at ~₹45,000 crore, reflecting its growth potential rather than current earnings.

For a fast-scaling D2C brand with improving profitability, that premium may be justified but short-term volatility can’t be ruled out.

Outlook & Recommendation

The Lenskart IPO combines brand strength, technology, and a proven omnichannel model. With improving margins and global scalability, it’s a strong long-term story.

However, at the ₹382–₹402 price band, valuations appear rich compared to near-term profitability.

For long-term investors, it’s a play on India’s premium consumer and digital retail growth story.

For short-term investors, listing gains look likely given the strong brand visibility and positive GMP trends.

Wait for anchor investor data and QIB subscription before applying heavily — these will indicate institutional confidence.

Lenskart Financials

Lenskart has a huge profit turnaround, from a ₹63 crore loss in FY23 the company made its first profit of ₹297 crore in FY25. Its EBITDA growth nearly had a 4x jump in two years and its net borrowings halved since FY23. However, some are questioning this profit turnaround story just before the IPO?

At the upper band of ₹402, the issue is valued at a PE ratio of 238x, based on a EPS of INR 1.71 per share. That raises a serious concern about the company's valuation.

Let’s look at how the company’s numbers stack up:

Particulars | FY23 | FY24 | FY25 |

Revenue | ₹3,927.97 | ₹5,609.87 | ₹7,009.28 |

EBITDA | ₹259.71 | ₹672.09 | ₹971.06 |

PAT | -₹63.76 | -₹10.15 | ₹297.34 |

Total Assets | ₹9,528.28 | ₹9,531.02 | ₹10,471.02 |

Net Worth | ₹5,444.48 | ₹5,642.38 | ₹6,108.30 |

Borrowings | ₹917.21 | ₹497.15 | ₹345.94 |

Strengths of Lenskart

- Brand Power: Among the most recognized D2C names in India.

- In-house Manufacturing: Ensures cost efficiency and control over quality.

- Tech-led Operations: AI-based frame fitting and AR-enabled shopping.

- Omnichannel Reach: Strong offline presence + robust digital ecosystem.

- Diversified Portfolio: Eyeglasses, sunglasses, lenses, and accessories across price points.

- Consistent Growth: Multi-year revenue and EBITDA expansion.

Final Thoughts

Lenskart’s journey from a startup to India’s leading eyewear brand has been remarkable. The company has built a powerful tech-retail ecosystem that’s difficult to replicate.

The Lenskart IPO gives investors a chance to participate in that growth story — one that combines innovation, affordability, and brand aspiration.

If India’s eyewear market continues to expand as expected, Lenskart Solutions could well be the next big retail success story on the stock market. With the issue priced at 238x PE, are the valuations justified?

Lenskart IPO – Key Questions

1. What is the Lenskart IPO price band?

Lenskart IPO price band is ₹382–₹402 per share.

2. What are the Lenskart IPO dates?

Lenskart IPO opens on October 31, 2025, and closes on November 4, 2025.

3. What is the Lenskart IPO GMP?

Lenskart IPO GMP is around ₹68 as of October 27, 2025.

4. How much should a retail investor invest?

Minimum 1 lot = 37 shares = ₹14,874 (at upper band).

5. When will the Lenskart IPO allotment be finalized?

Expected on November 6, 2025, with listing on November 10, 2025.

6. Should you apply for the Lenskart IPO?

Lenskart offers a unique investment proposition in India's retail space and the company's transition to profitability adds confidence. You can apply in Lenskart IPO through the ArihantPlus app in just a few clicks.

Related Topics