8 Things to Know Before Investing in the Lenskart IPO

By

Arihant Team

Lenskart, India’s leading eyewear brand, is launching its ₹7,278 crore IPO from October 31 to November 4, 2025. The fully integrated and tech-focused eyewear brand has expanded globally with its innovative D2C model. The IPO values the company at ₹70,000 crore, and offers investors a chance to participate in one of India’s fastest-growing retail success stories.

In This Article

- Introduction

- 1. Vertical Integration

- 2. Growing Eyewear Market: A Multi-Billion Opportunity

- 3. Smart Business Model: Quick Payback and Loyal Customers

- 4. Focus on Design and Global Marketing Initiatives

- 5. Smart Global Expansion

- 6. Profit Turnaround But High Valuation

- 7. Higher Other Income: Not from Business

- 8. Promoters Offloading Stake

- Final Takeaway

Introduction

India’s leading eyewear brand, Lenskart Solutions Ltd., is all set to make its market debut with a ₹7,278 crore IPO, opening for subscription on October 31, 2025, and closing on November 4, 2025.

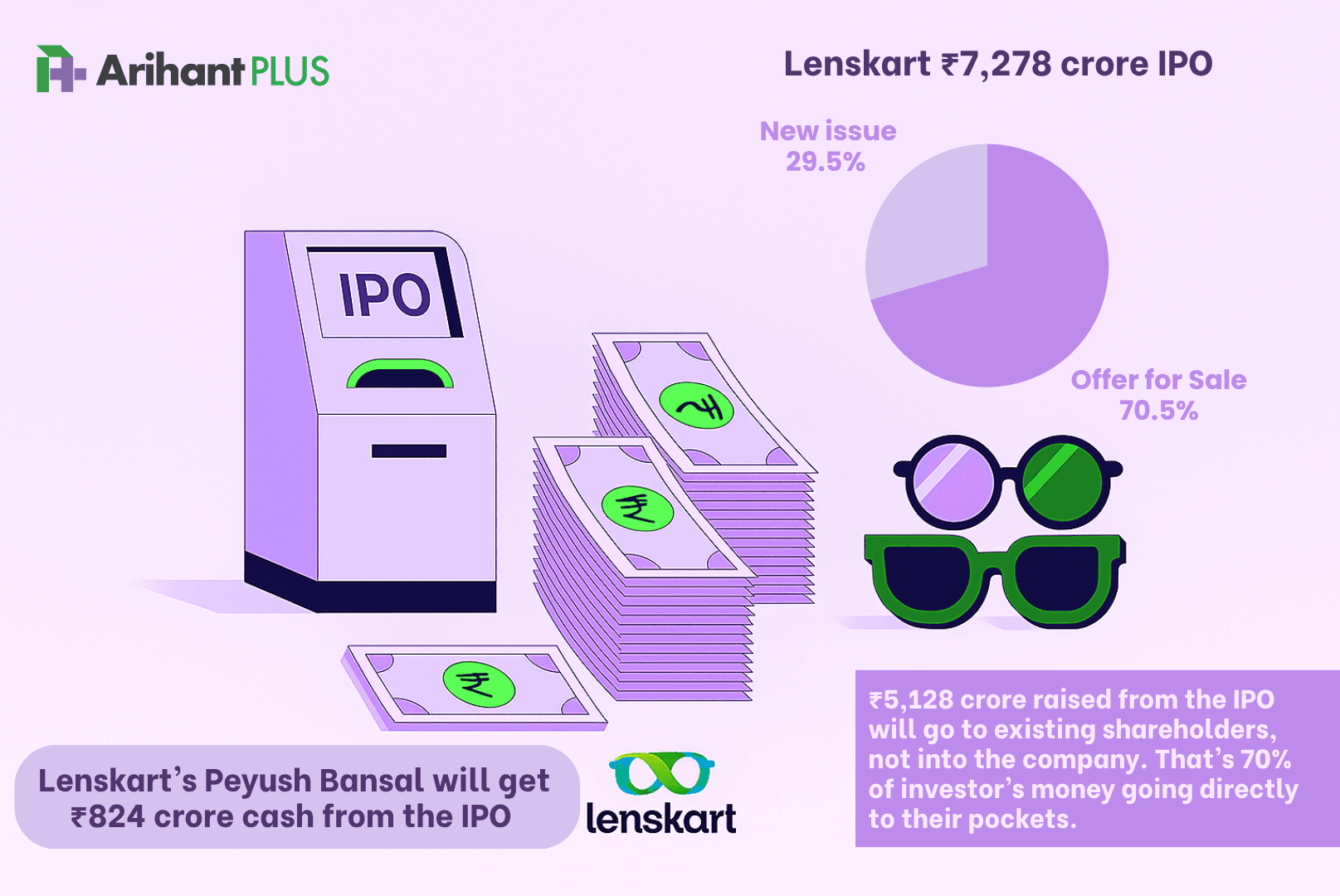

The Lenskart IPO is priced in the range of ₹382–₹402 per share, comprising a fresh issue of ₹2,150 crore and an offer for sale (OFS) worth ₹5,128.02 crore. The allotment will be finalized on November 6, and the stock is expected to be listed on the BSE and NSE on November 10, 2025.

As one of India’s most successful direct-to-consumer (D2C) stories, Lenskart IPO has already caught investor attention with its strong fundamentals, expanding footprint, and fast-growing financials.

1. Vertical Integration

One of Lenskart’s biggest strengths lies in its vertically integrated business model. The company controls everything — from designing frames and manufacturing lenses to online sales, offline retail, and post-sale customer support. This level of control gives Lenskart several advantages:

- Pricing flexibility in a competitive market.

- Consistent quality across its global stores.

- Agility in launching new collections.

By managing its supply chain and product engineering in-house, Lenskart ensures quicker innovation cycles and steady margins — a rare feat in the retail space.

In short, vertical integration makes Lenskart a lean, efficient, and high-margin player — one of the key reasons investors are bullish about the Lenskart IPO.

2. Growing Eyewear Market: A Multi-Billion Opportunity

The global eyewear industry, valued at $177 billion in FY25, is expected to reach $217 billion by FY30, growing steadily at 4.1% CAGR, according to Lenskart’s DRHP.

Interestingly, prescription eyewear alone accounts for nearly 70% of the market. The Asia-Pacific region — especially India and Indonesia — is among the fastest-growing, with an annual growth rate projected between 10–14%, according to Redseer.

With over 2,700 stores (including 656 international stores) the company has a strong presence in India, Southeast Asia and UAE. This makes Lenskart perfectly positioned to ride this growth wave.

Its omnichannel strategy (physical and online) ensures it captures both premium and affordable customer segments — a huge competitive advantage in this expanding market.

3. Smart Business Model: Quick Payback and Loyal Customers

Lenskart’s business efficiency is impressive. Of the company-owned (CoCo) stores opened in the last two years, over 80% turned profitable within 10 months — one of the fastest payback periods in the retail industry.

Customer loyalty is another major moat. The company reported a 98.16% reorder rate in FY23, indicating that nearly every new customer returns for repeat purchases.

Some more staggering stats:

- 2,723 stores globally (2,067 in India).

- 99.4 lacs customers in India by FY25.

- 2.72 crore eyewear units sold in FY25 alone.

This combination of fast store profitability and customer stickiness makes Lenskart’s revenue model both scalable and sustainable — an ideal mix for long-term investors.

4. Focus on Design and Global Marketing Initiatives

Lenskart’s growth isn’t just about numbers — it’s about innovation and brand building.

With 18,000 employees from 25 nationalities, the company launched 105 new in-house designed collections in FY25. Many of these were collaborations with celebrities and brands like Karan Johar, Surya Kumar Yadav, and other influencers.

This focus on fashion-driven, lifestyle eyewear has elevated Lenskart from a utility product to a trend-led consumer brand, allowing it to command premium pricing and customer loyalty.

Moreover, Lenskart’s marketing campaigns consistently connect with the youth — blending tech, style, and accessibility — which ensures a powerful brand recall both in India and overseas.

5. Smart Global Expansion

Lenskart’s international expansion has been strategic, capital-efficient, and acquisition-led rather than driven by costly organic rollouts.

Since entering overseas markets in 2019, it has:

- Acquired Japan’s eyewear brand Owndays, adding 400 stores instantly.

- Invested in Metadome (US), an immersive visualization startup.

- Acquired 6Over6 (Israel), which develops AI-driven optical tech.

- Partnered with Le Petit Lunetier (France) for European entry.

- Formed Bao Feng Framekart (China), a joint venture to manufacture frames.

This “partner-first” strategy allowed Lenskart to quickly scale to 656 stores abroad, gaining instant access to local markets and customers — a big reason why analysts view its global growth model as smart and sustainable.

6. Profit Turnaround But High Valuation

From FY23 to FY25, Lenskart’s revenue grew from ₹3,788 crore to ₹6,653 crore, clocking a solid 32.5% annual growth.

The company also achieved a remarkable turnaround — from a loss of ₹63.76 crore in FY23 to its first-ever profit of ₹297.34 crore in FY25, and profit margins improving to 4.47%. Lenskart’s past financial performance appears to have been mixed. While the reported FY25 profit looks strong, a significant part of it is driven by a one-time, non-cash accounting gain of Rs 167 crore related to the Owndays acquisition. Adjusting for this, profitability appears closer to break-even or marginally positive. However, in Q1FY26, the company maintained profitability at ₹61 crore.

At ₹402 per share, Lenskart's IPO commands a PE of 238x, based on a EPS of INR 1.71 per share and valued at 8.2 times its book value. This unusually high price raises questions about whether the shares offer good value right now?

In simple words, here's the real financial data:

- Lenskart's actual loss history (FY23: ₹64cr loss, FY24: ₹10cr loss, FY25: ₹297cr profit).

- A profit breakdown showing ₹167cr was from Owndays revaluation + ₹73cr from mutual funds

- Real operational profit was only ₹130 crore

- 234x P/E ratio at ₹70,000 crore valuation

Here’s a quick snapshot

Financial Metric | FY23 | FY24 | FY25 |

Revenue from Operations | ₹3,788 Cr | ₹5,609 Cr | ₹6,653 Cr |

PAT (Profit/Loss) | -₹63.76 Cr | -₹10.15 Cr | ₹297.34 Cr |

Profit Margin | -1.68% | -0.18% | 4.47% |

RoCE | -0.48% | 7.40% | 13.84% |

Its gross margins also expanded from 63.88% in FY23 to 67.92% in FY25, driven by in-house manufacturing and better cost efficiency.

7. Higher Other Income: Not from Business

Lenskart clocked its first profit in FY25 and it is important to note that this profitability is largely driven by other income – not from selling eyewear or expanding its store. Here’s the story.

In mid-2022, Lenskart bought the Japanese eyewear company, Owndays. The payment was structured: Lenskart paid some cash upfront, and the rest was promised later, depending on Owndays hitting specific performance goals.

In FY25, Lenskart reviewed this future payment and determined they would pay less than initially expected. This favorable change resulted in a financial gain of ₹167 crore, which was recorded as profit (other income) for the year. It was, in essence, a one time gain due to a change in the accounting value of future payments for the acquisition of Owndays.

Additionally, the company also made gains on the redemption of mutual funds worth ₹72.6 crore, up from ₹64 crore in FY25. Although it was partially offset by a decrease in interest income from fixed deposits.

8. Promoters Offloading Stake

Lenskart currently has a low promoter holding at just 19.9%. The IPO is a 70.46% offer-for-sale (OFS). Since the promoter group is one of the main sellers in this public offering, their stake is expected to drop further to 17.5% after the issue is complete. In addition to the promoters, several large institutional investors are also selling their shares via OFS, including major names like SoftBank, Temasek, Schroders Capital, Kedaara Capital, and Alpha Wave Ventures.

Final Takeaway

From its vertically integrated business model to its tech-driven retail innovation, Lenskart IPO reflects a company that’s not just selling glasses, but redefining how a new-age retail brand can scale globally.

With robust growth, a profitable turnaround, and a clear expansion roadmap, Lenskart Solutions stands out as one of the most promising IPOs of 2025. However, a major part of FY25 profit was due to non-business related other income. That said, Lenskart’s underlying performance remains robust with steady topline growth, a dominant retail network of over 2,500 stores, and a strong omni-channel model. The broader eyewear market in India is expected to triple by 2032, supported by rising screen time, an ageing population, and growing fashion consciousness. With its expanding store base, brand acquisitions like Owndays and Meller, and leadership in the organized eyewear space, Lenskart’s long-term growth story remains intact — though investors should note that near-term valuations already factor in much of this optimism.

Related Topics