Aye Finance IPO Explained | RHP Insights, Price Band & Key Risks

By

Arihant Team

Aye Finance IPO targets India’s under-served MSME lending market. This article breaks down the RHP, price band, business model, asset quality trends, valuation vs peers, and the key risks investors should weigh before applying.

In This Article

- Introduction

- Issue Dates, Size and Structure | Aye Finance

- IPO Proceeds | Aye Finance IPO

- Aye Finance IPO | Business Model

- NPA and Asset Quality | Finance Aye IPO

- Financial Snapshot | Aye Finance IPO

- Investor Takeaway | Aye Finance IPO

- FAQs | Aye Finance IPO

Introduction

If you’ve been tracking NBFC IPOs, Aye Finance is an interesting one because it sits in a very specific pocket of lending, small-ticket loans to micro and small businesses (MSMEs). That’s a large and under-served market in India, but it’s also a segment where credit risk can move quickly when the economy slows.

So this IPO is best looked at through two lenses at the same time: growth opportunity and asset quality discipline.

Issue Dates, Size and Structure | Aye Finance

Aye Finance is based in New Delhi and operates across 18 states and 3 union territories. It lends through a mix of branch distribution and its supply chain finance platform, SwitchPe, and positions itself as a “phygital” lender, meaning it combines physical reach with tech-enabled underwriting and collections.

The offer is sized at ₹1,010 crore, split into:

Particulars | Amount |

Fresh issue | ₹710 crore |

Offer for sale | ₹300 crore |

The price band is ₹122-₹129 per share. At the upper end (₹129), the IPO implies a market capitalisation of ~₹3,183 crore.

Ahead of the IPO opening, Aye Finance raised ₹454.5 crore from anchor investors. It allotted 3.52 crore equity shares at ₹129 per share (upper band).

IPO Proceeds | Aye Finance IPO

Aye Finance says the fresh issue proceeds will be used to strengthen the capital base. That sounds generic, but for an NBFC it’s a very real growth lever.

A lender can’t keep expanding its loan book unless it has enough equity capital to support that growth and if asset quality worsens, extra capital becomes even more important because provisioning eats into profits and net worth.

So in simple terms, the fresh issue is meant to fund the next phase of loan book growth while giving the company a buffer if credit costs rise.

Aye Finance IPO | Business Model

Aye Finance lends primarily to micro-MSMEs. The challenge with this segment is that many borrowers don’t have neat audited statements, formal income proofs, or predictable cash flows. The company claims its underwriting advantage comes from evaluating borrowers using cash flow estimation and “business cluster” understanding using observable data points.

This is exactly where the business model becomes both exciting and risky. If underwriting is strong, you get scale in a big untapped market. If underwriting weakens while growth remains fast, stress typically shows up later as rising NPAs.

NPA and Asset Quality | Finance Aye IPO

Let’s pause here because NPA is the single most important term in an NBFC IPO. An NPA (Non-Performing Asset) is basically a loan where the borrower has stopped paying on time for a prolonged period. When NPAs rise, two things happen:

- the lender stops earning regular interest on that loan, and

- the lender has to set aside extra money (called provisions) to cover potential losses.

That means higher NPAs usually reduce profits, and if the trend persists, they can also slow loan growth because capital gets tied up managing bad assets.

For Aye Finance, the gross NPA ratio increased from 2.49% (Mar 2023) to 4.21% (Mar 2025). Another worrying aspect is the unsecured loans forming a large part of the book (~40% of AUM in recent periods).

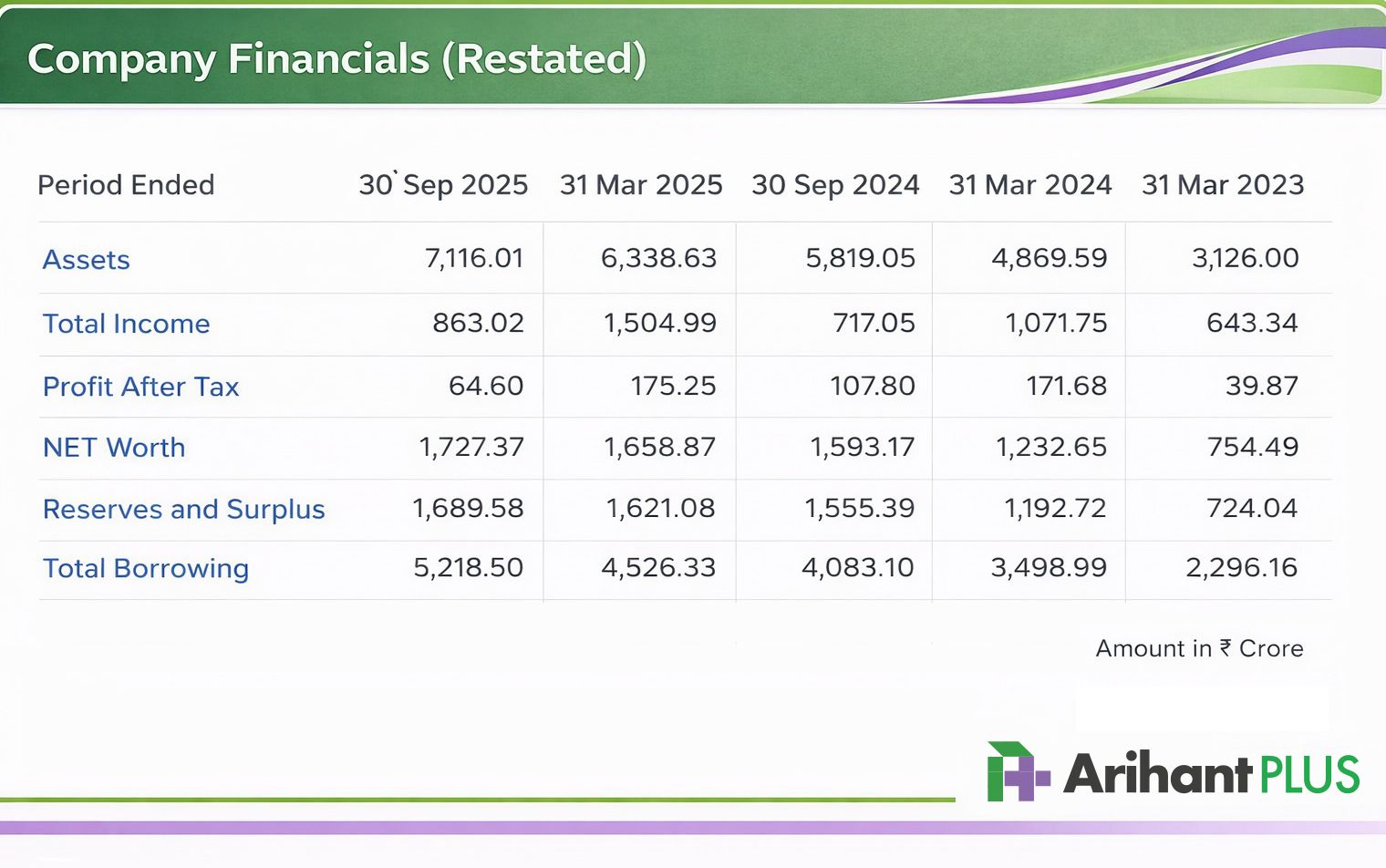

Financial Snapshot | Aye Finance IPO

Aye Finance’s reported financials show improving profitability and scale. On an annualised basis:

Investor Takeaway | Aye Finance IPO

Aye Finance offers exposure to a large MSME lending market with strong growth, but performance depends on maintaining asset quality alongside expansion. If NPAs stabilize, returns and valuations could improve.

FAQs | Aye Finance IPO

1. What are the IPO dates for the Aye Finance IPO?

The IPO opens on February 9, 2026 and closes on February 11, 2026. Anchor investor allocation was completed ahead of the issue opening, and the shares are proposed to be listed shortly after allotment.

2. What is the Aye Finance IPO price band?

The company has fixed a price band of ₹122 to ₹129 per share for the IPO.

3. What is the lot size of the Aye Finance IPO?

Investors can apply for shares in the minimum lot size specified in the prospectus and in multiples thereafter (final lot details are confirmed in the IPO application forms).

4. Who should consider applying for the Aye Finance IPO?

Investors looking for exposure to the MSME lending and NBFC sector with a high-growth opportunity may find the IPO interesting. However, they should be comfortable with risks related to asset quality, unsecured lending exposure, and economic slowdowns affecting small businesses.

5. Is Aye Finance IPO a fresh issue or OFS?

The IPO includes fresh Issue of ₹710 crore and offer for sale of ₹300 crore.

This means part of the proceeds will go toward strengthening the company’s capital base, while the OFS portion will go to existing shareholders selling their stake.

Related Topics