Invest smarter, invest better with Arihant Plus

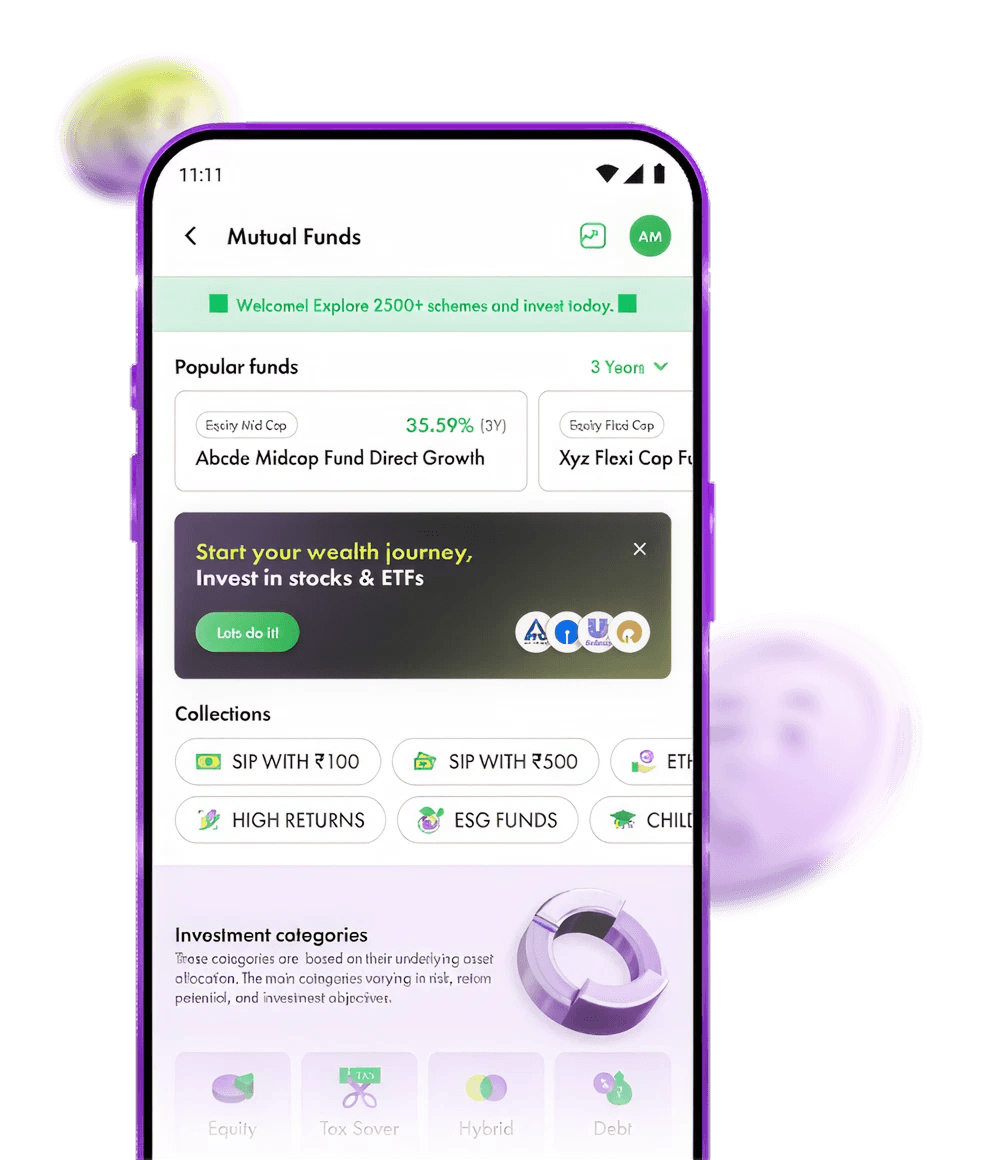

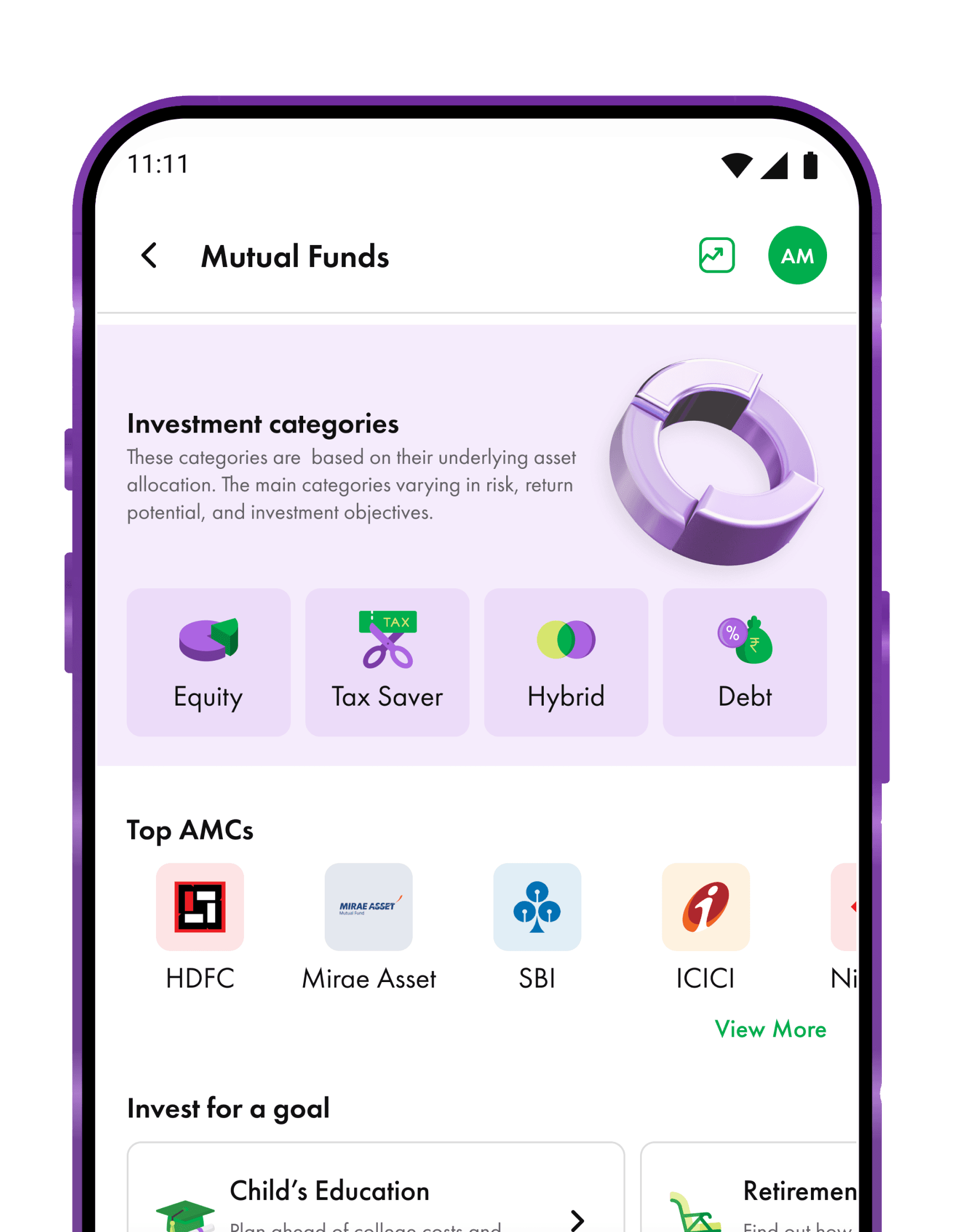

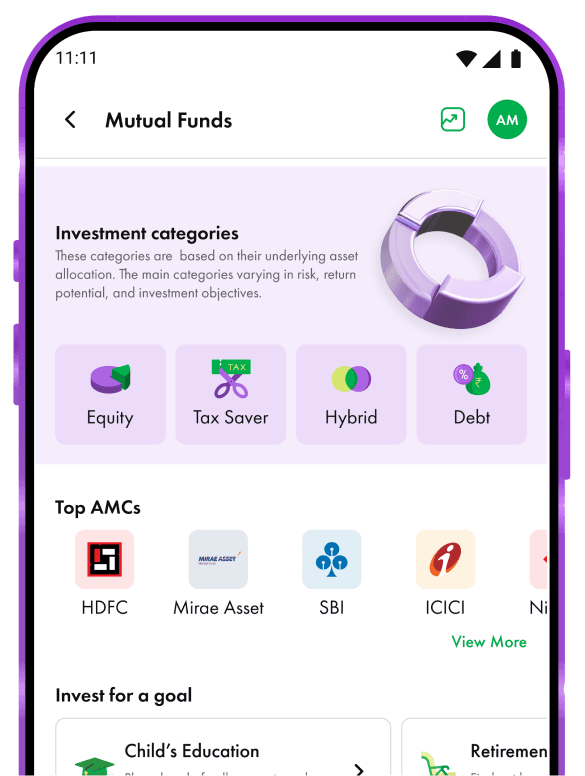

5000+ Mutual Funds, Find the Right One on ArihantPlus

Explore by Category

01

Better Than Fixed Deposits

02

Index Funds

03

All-Size Companies

04

High-Risk, High-Returns

05

Large-Cap Funds

06

High-Quality Debt Funds

07

Save Tax, Invest Smart

08

Gold Investments

Curated for You

01

High Return

02

My First Crore

03

Long-term Portfolio

04

SIP with ₹500

05

ESG & Ethical Funds

Download the app and discover more.

Invest in tomorrow with just one click

3 Simple Steps

Investing in mutual funds is quick, easy, and hassle-free. Follow these three steps to begin your journey today.

01

Open Your Free Account

Complete your digital KYC in minutes and get started instantly.

02

Choose Your Mutual Fund

Explore top-performing funds and pick the right one for you.

03

Invest Your Way

Start an SIP from or invest a lump sum amount as low as ₹100.

Turn Dreams into Reality with Goal-Based Investing

Secure your future with ArihantPlus— link your mutual funds to your life goals, monitor progress, and stay on track with ease.

Two Smart Ways to Invest

Whether you prefer consistency with SIP or a one-time Lumpsum investment, we make it simple and seamless.

Investing in SIP

- Invest small amounts regularly for long-term growth.

- Benefit from rupee cost averaging and market fluctuations.

- Automate investments for hassle-free wealth building.

Investing in Lumpsum

- Invest a large amount in one go

- Ideal for those with surplus funds and long-term vision.

- Take advantage of market opportunities instantly.

Investing in Mutual Funds Made Simple, Just for You

Arihant Digest

Join 2.5+ Lakh Investors Who Trust Us

Mutual funds are one of the best ways to start your investment journey because it allows you to start with as low as ₹500 and your money is managed by the top experts in the investment industry at nominal cost.

To start investing in mutual funds, you simply need to get your KYC done that requires you to fill in the KYC application and upload your pan card, identity proof (like driver’s license or Aadhar card), and address proof (like your passport or driver’s license). Yes its that simple.

If you already have a trading account with Arihant, you don’t need anything. You can buy and sell mutual funds with your same trading account using existing funds in your account.

A Systematic Investment Plan, commonly known as the SIP, helps you invest a fixed amount in a mutual fund scheme at regular intervals.

Investment in mutual funds can happen in two ways – the lump sum method and SIP. In the case of the lump sum method, investors pay a large sum upfront and purchase units of mutual funds in one go. On the other hand, SIP involves regular payments at fixed time intervals helping you make staggered investment. The biggest advantage of investment via SIP is that one does not need to time his/her investment.

You can set up a SIP through ArihantPlus app in both mutual funds and stocks. To make a SIP investment, download the ArihantPlus app, login, choose the mutual fund scheme you'd like to invest, select SIP investment option, enter the amount you want to invest along with the period of investment (monthly or weekly), set up autopay so the money can directly be debited from your bank account on your chosen day automatically and voila, you're set on the path to your financial freedom!

Mutual funds are regulated by SEBI (Securities and Exchange Board of India) and managed by professional fund managers, making them a secure investment option. However, like all investments, they carry some level of risk based on market fluctuations. Choosing the right fund based on your risk appetite and investment goals can help you manage risks effectively.

Yes, NRIs and FPIs can also invest in mutual funds. Necessary details in this respect are given in the offer documents of the schemes.

An open-ended fund is one that is available for subscription all through the year. These do not have a fixed maturity.

These funds buy and sell units on a continuous basis and, hence, allow investors to enter and exit as per their convenience.

Since the units of open ended funds are not traded on the stock exchange, there is no limit on the number of units that the fund can issue. Investors can buy (purchase) or sell (redeem) units from the fund house on any working day at the existing Net Asset Value or NAV of the scheme.

The NAV is determined by the performance of the underlying securities of the fund. These schemes do not have a maturity period.