10 Things to Know About Sudeep Pharma IPO: Date, Price, GMP & Complete Review

By

Arihant Team

Sudeep Pharma IPO opened on 21 November 2025 with a price band of ₹563–₹593. The ₹895 crore IPO IPO is majorly an OFS with 11% fresh issue. The company has strong financials, maintains leadership in its niche and has high-quality loyal customer base.

In This Article

- Introduction

- Sudeep Pharma IPO: Dates, Price Band & Issue Details

- Sudeep Pharma IPO Objective

- About Sudeep Pharma – What Does the Company Do?

- Sudeep Pharma IPO GMP Today – Latest Market Sentiment

- Industry Outlook – Why This Sector Is Attracting Investors

- Sudeep Pharma Financials – How Strong Are They?

- Key Strengths – Why Investors Like This IPO

- Key Risks – What Should You Consider?

- Valuation & Peer Comparison

- Should You Apply for the Sudeep Pharma IPO? – Final Verdict

- Conclusion

- FAQs on Sudeep Pharma IPO

Introduction

India’s chemical and pharma-excipient landscape continue to see strong growth, and the next company gearing up to tap this momentum is Sudeep Pharma, a global supplier of high-quality mineral-based excipients, APIs, and specialty ingredients. As the company opens its ₹895 crore IPO, investors—especially those tracking specialty chemicals—are trying to understand whether this is an opportunity worth taking.

This detailed breakdown covers Sudeep Pharma IPO dates, price band, GMP, listing expectations, financials, strengths, risks, and our final verdict to help you make an informed decision.

Sudeep Pharma IPO: Dates, Price Band & Issue Details

Your 10-second snapshot of the IPO:

- IPO Dates: 21 Nov – 25 Nov 2025

- Price Band: ₹563 – ₹593

- Issue Size: ₹895 crore (OFS ₹800 crore & Fresh issue ₹95 crore)

- GMP Today: ₹109 (updated 21 Nov 2025, 10:57 AM)

- Listing: NSE, BSE

- Industry: Pharma Ingredients / Specialty Chemicals

Sudeep Pharma IPO Objective

The IPO primarily consists of an offer for sale (OFS) and a small portion towards fresh issue. Out of ₹895 crore raised through the IPO, 89% of the proceeds, i.e. ₹800 crore, will go to existing shareholders.

Out of the ₹95 crore fresh issue, ₹76 crore will go toward expanding capacity at the Nandesari plant, and the remaining amount will be used for general corporate purposes.

About Sudeep Pharma – What Does the Company Do?

Founded in 1989, Sudeep Pharma is a leading manufacturer of mineral-based excipients, APIs, and specialty ingredients used in:

- Pharmaceuticals

- Nutraceuticals

- Food and beverage fortification

- Animal nutrition

- Personal care

The company exports to 100+ countries, supplying critical ingredients to some of the world’s largest pharma and wellness brands.

Key Products:

- Calcium Phosphates

- Calcium Carbonates

- Mineral Blends

- Magnesium Derivatives

- Tailor-made fortification ingredients

Their niche focus gives them high entry barriers, backed by stringent compliance, global certifications, and long-term customer relationships.

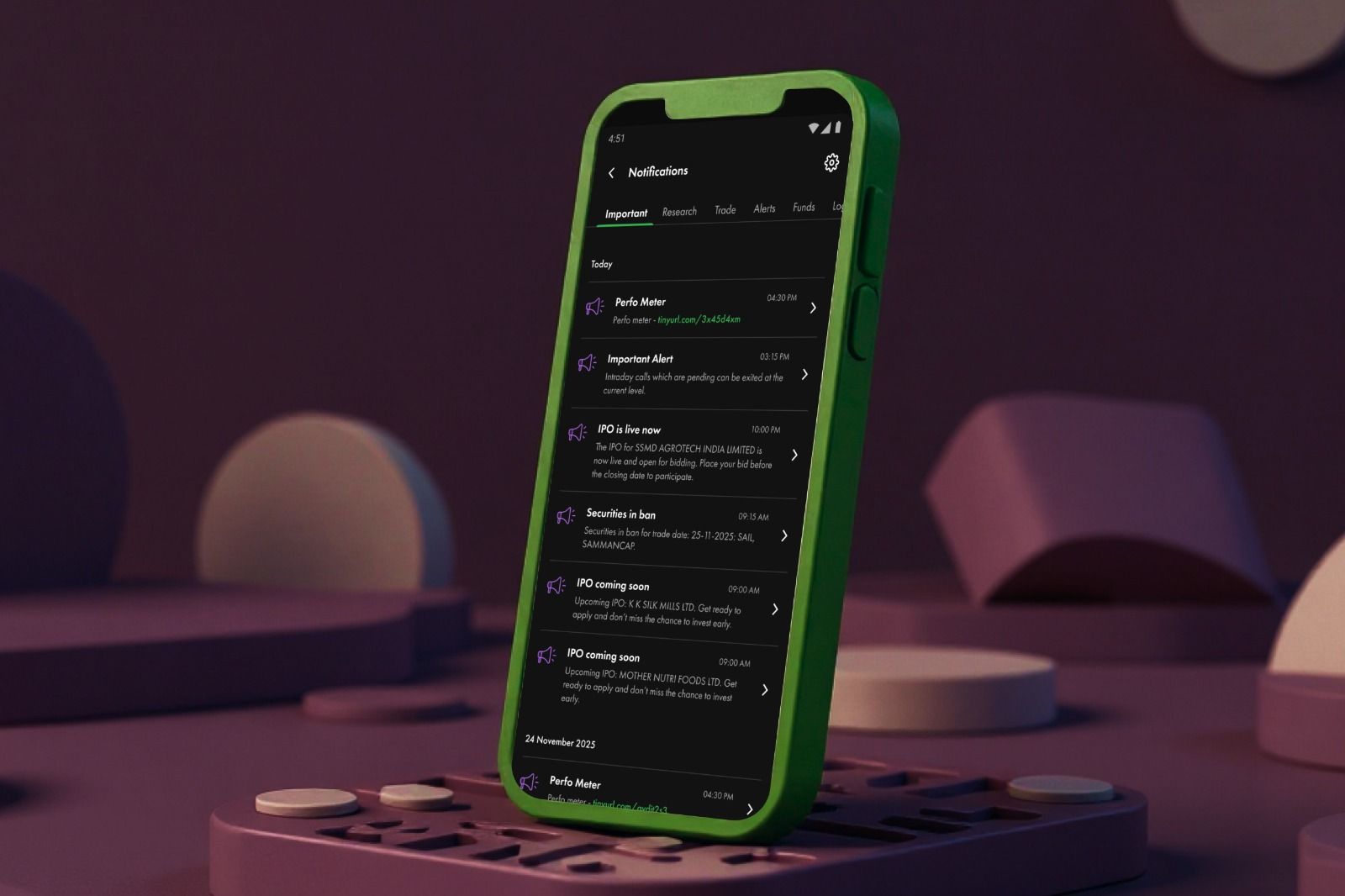

Sudeep Pharma IPO GMP Today – Latest Market Sentiment

The Sudeep Pharma IPO GMP currently stands around ₹111 per share (Source). This indicates healthy investor sentiment in the grey market, suggesting that Sudeep Pharma could list at a premium over its issue price.

With the IPO priced at ₹593 (upper band), the implied listing price becomes:

Estimated Listing Price = ₹593 + ₹111 = ₹704, that translated to an expected listing gain of 18.38%. But remember, GMP is just an indicator, not a promise! We recommend investors to not consider IPO as a lottery ticket, but understand the financials of the company before investing.

Disclaimer: Grey Market Premium (GMP) is not regulated or recommended by the stock exchanges or SEBI. ArihantPlus does not endorse or facilitate trading in the grey market. Investors are advised to conduct their own research or consult an expert before making any investment decisions.

Industry Outlook – Why This Sector Is Attracting Investors

India’s excipients and pharma ingredients industry is expanding rapidly. Moreover, India’s nutrition supplements market is currently around USD 43 billion and is expected to grow at an 8.1% CAGR between 2025 and 2030. A young population, rising incomes, and growing health awareness are driving this demand, especially for products that support immunity, weight management, and overall wellness as lifestyle-related illnesses increase.

Here is an overview of what makes this sector attractive:

- Growing demand for generics worldwide: India is the world’s 3rd-largest producer of pharma formulations.

- Rising nutraceutical consumption: Especially after COVID-19, global vitamin & mineral supplements demand is booming.

- China+1 Strategy: Global companies are shifting sourcing away from China, benefiting Indian producers.

- Regulatory-led compliance focus: High-quality suppliers like Sudeep Pharma gain advantage as lower-grade producers get filtered out.

Overall, the specialty ingredient space is projected to grow at 10–12% CAGR over the next 5 years.

Sudeep Pharma Financials – How Strong Are They?

Sudeep Pharma has shown solid performance with growing revenues, healthy EBITDA margins due to higher specialty product contribution, and a strong FY25 RONW of 27.88%. It has maintained healthy return ratios (ROCE & ROE in mid-20s) and has low debt, indicating a strong balance sheet

Here is an overview of the company’s financials:

Financial year | Revenue | PAT (in crore) | EBITDA Margin | PAT Margin |

FY23 | ₹465 | ₹62.32 | 36% | 19% |

FY24 | ₹548 | ₹133.15 | 38% | 20% |

FY25 | ₹612 | ₹138.69 | 40% | 21% |

From a financial standpoint, the company looks robust and well-positioned for scaling.

Key Strengths – Why Investors Like This IPO

- Leadership in specialized mineral ingredients: Opportunity to invest in India’s growing healthcare industry. The company is operating in a niche that few players globally specialize in.

- High entry barriers: Regulations, audits, and certifications make it difficult for new entrants.

- Strong global client base: Long-term relationships across pharma, nutrition, and food companies. As of June 30, 2025, the company has served over 1,100 customers, including more than 40 blue-chip multinationals and 14 Fortune 500 companies.

- Expanding margins & improving product mix: Movement towards value-added blends and ingredients.

- Solid industry tailwinds: Healthcare, wellness, nutraceuticals — all fast-growing sectors.

Key Risks – What Should You Consider?

- High OFS component: Most proceeds go to selling shareholders, not growth.

- Regulatory dependency: Pharma suppliers face constant audits, global regulations, and compliance costs.

- Pricing pressure: Despite margins improving, raw material volatility remains a risk.

- Premium valuations: Compared to peers, valuations appear slightly aggressive.

Valuation & Peer Comparison

Although Sudeep is priced at a premium vs some peers, its margin profile and niche dominance justify higher valuations.

Company | Industry | P/E | EBITDA Margin |

Sudeep Pharma (IPO) | Pharma/Nutraceutical Ingredients | ~34x | 40% |

Anupam Rasayan | Specialty Chemicals | 36x | 25% |

Neogen Chemicals | Lithium-based Chemicals | 68x | 18% |

Fine Organics | Specialty Ingredients | 45x | 21% |

Should You Apply for the Sudeep Pharma IPO? – Final Verdict

Sudeep Pharma looks set for steady growth over the next few years. This is mainly because global demand for nutritional and mineral-based ingredients is rising, and the company already has a strong position in key products like phosphates and iron minerals. They also plan to expand capacity in FY26, which means they can produce more without major new costs — helping improve margins over time.

Right now, their factories are not running at full capacity, so as demand grows, they can scale up production efficiently. The company is also increasing its presence in highly regulated international markets and developing more specialized products, which should support gradual improvements in profits.

At the upper price band of ₹593, the IPO is valued at 48x its FY25 annualized earnings (EPS ₹12.3). The IPO includes both an Offer for Sale of ₹8,000 Mn and a Fresh Issue of ₹950 Mn.

Overall, we are giving this IPO a “Subscribe” recommendation. However, for conservative investors, given that the pricing is slightly aggressive, you can wait for listing and Q3 numbers for clarity and then decide about investing.

Conclusion

The Sudeep Pharma IPO comes at a time when India’s pharma ingredients and nutraceutical sectors are expanding rapidly. Strong financials, global customer presence, high entry barriers, and a growing market make this offering fundamentally appealing. Combined with an upbeat GMP trend and positive sauda values, the IPO appears well-positioned for healthy listing gains and solid long-term potential.

FAQs on Sudeep Pharma IPO

1. What is the Sudeep Pharma IPO GMP today?

The GMP of of the IPO is ₹111 as of Nov 21st 2025, 5pm.

2. What is the Sudeep Pharma IPO price band?

₹563 – ₹593.

3. What is the minimum investment?

The minimum investment to apply for Sudeep Pharma IPO is ₹14,825 for retail investors.

4. When will Sudeep Pharma be listed?

The IPO will list on 28 November 2025.

Related Topics