Revolutionise Options Trading with ArihantPlus

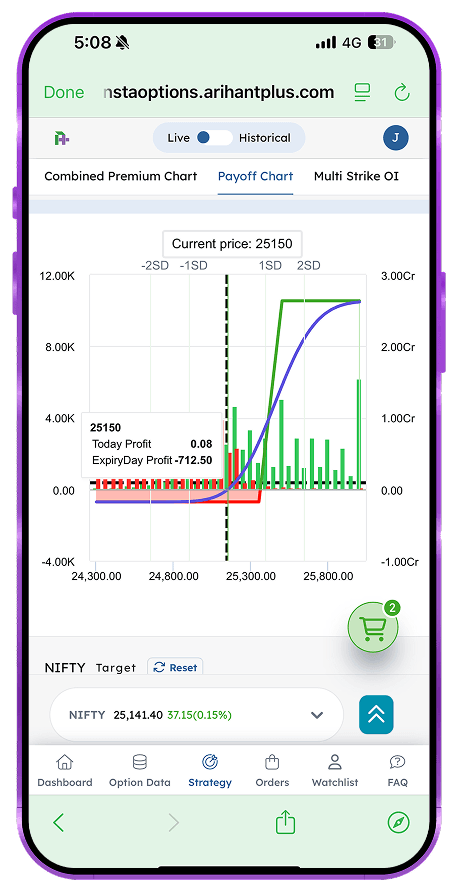

Powerful tools for options trading with Insta Options

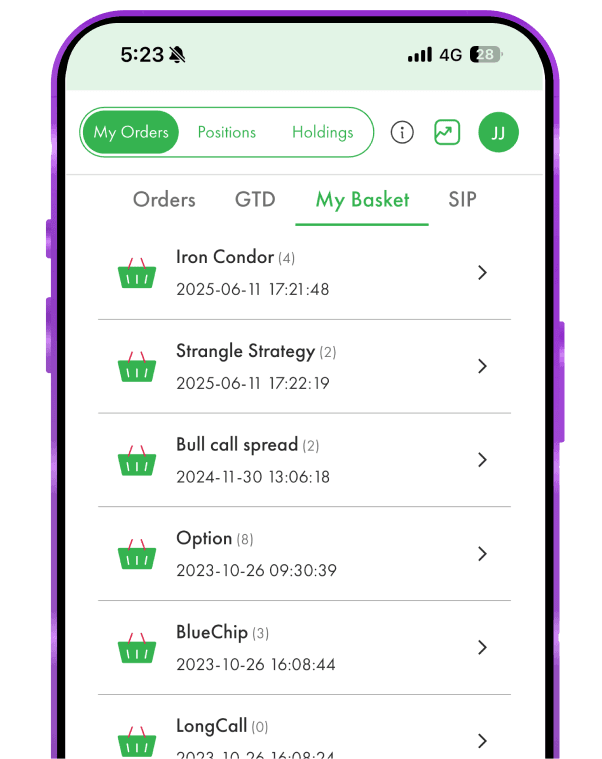

Custom strategy finder with payoff graph

Plan, build, analyse and execute strategies using smart strategy finder with max profit, loss & breakeven levels.

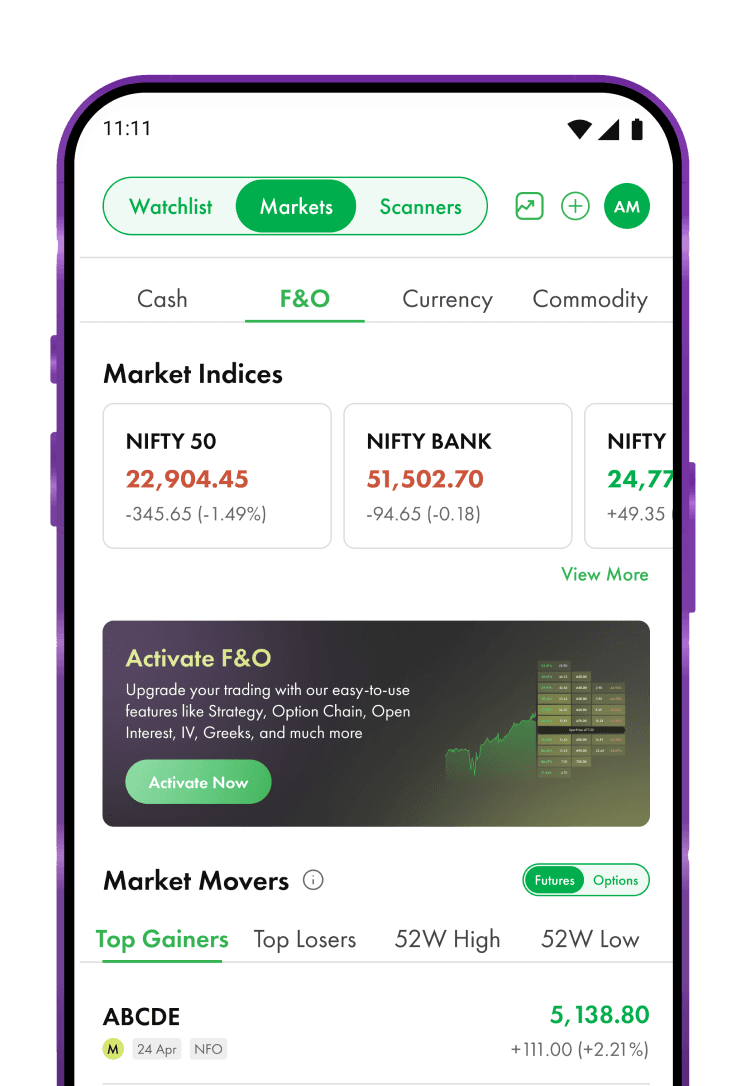

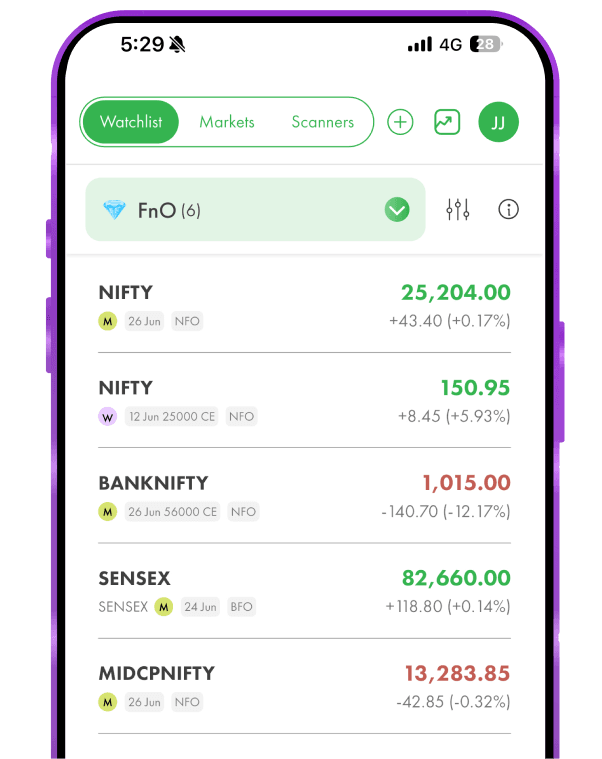

Powerful F&O trading experience with ArihantPlus

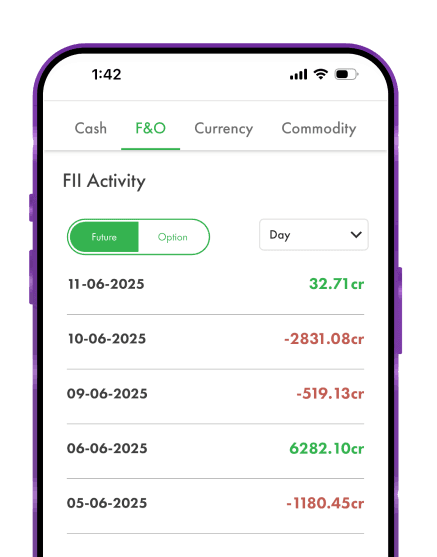

Other Features

With ArihantPlus you get more

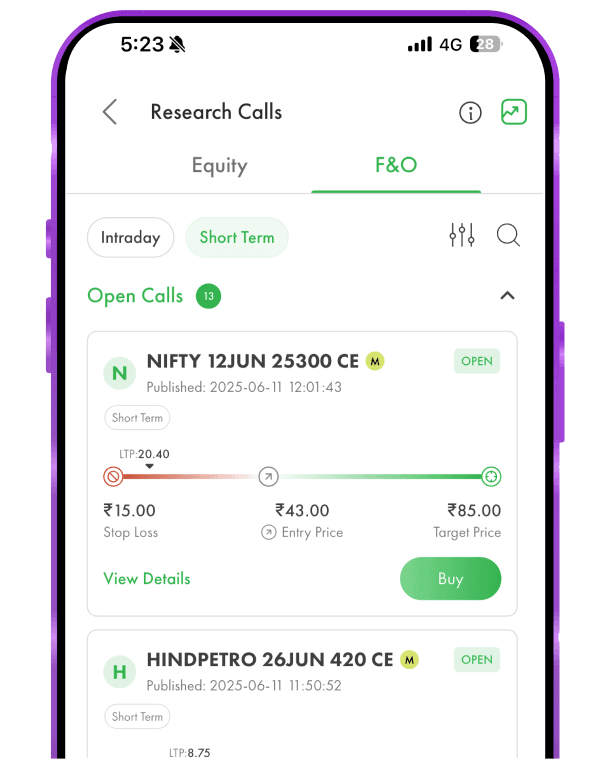

Research backed expertise

Technical calls and strategy from award-winning analysts with 33+ yrs of experience in risk management and fast execution

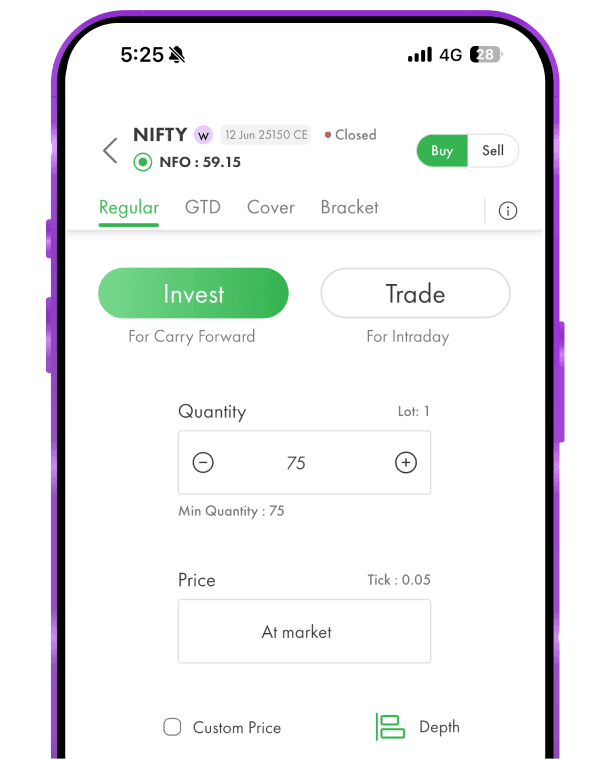

All order types

Trade F&O with basket, bracket, cover orders plus order slicing!

Complete Experience

Packed with research, charts, MTF, advanced orders, alerts, market data and much more

Manage or exit all positions

Modify, cancel or exit all positions in one tap.

33+ yrs of expertise

Risk management, reliable platform, fast execution with multiple-award winning broker.

Low fees. High reward.

Unmatched services for unbeatable prices

Join 2.5+ Lakh Investors Who Trust Us

F&O stands for Futures and Options, which are derivative instruments that derive their value from underlying assets like stocks, indices, commodities, or currencies. These are used for hedging, speculation, or arbitrage.

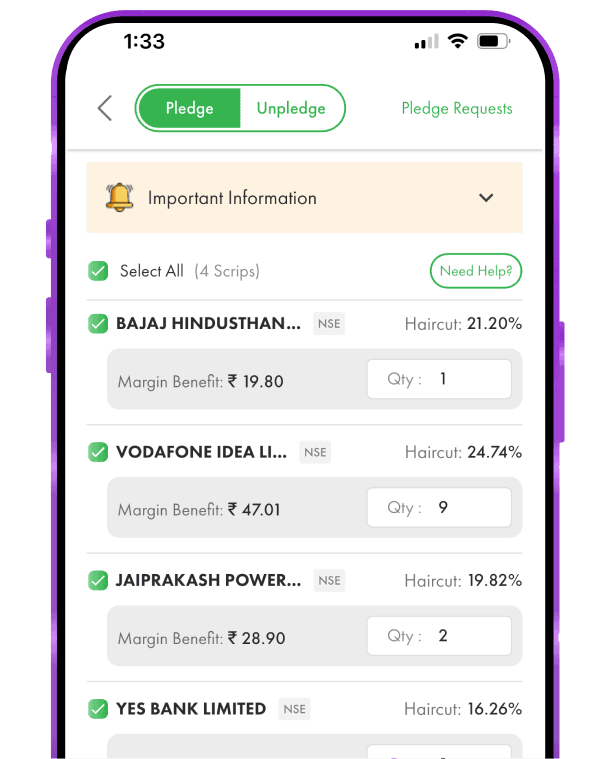

Margins vary based on:

- Type of contract (Index/Stock Futures or Options)

- Volatility of the instrument

SEBI and exchange norms

You can check live margin requirements using our F&O Margin Calculator.

You can view the Advanced Option Chain with OI, IV, and Greeks directly on the ArihantPlus platform in the Stock Quote section.

Yes. ArihantPlus allows you to slice large F&O orders into smaller chunks to:

- Avoid slippage

- Get better execution

- Stay within risk/margin limits

Yes, you can write (sell) options using margin provided you meet the exchange-required SPAN + Exposure margin. However, selling options carries unlimited risk, so it's advisable to hedge your position or use defined-risk strategies.