Gaudium IVF IPO 2026 | Should You Invest?

By

Arihant Team

The Gaudium IVF IPO 2026 offers investors exposure to India’s fast-growing fertility treatment market. The company shows strong margins and rising IVF cycle volumes, but risks include revenue concentration, capital-intensive expansion, and dependence on medical talent. Suitable for long-term healthcare investors.

In This Article

- Introduction

- Business Model and Structure

- IPO Structure and Issue Details

- IPO Objectives: How will Gaudium IVF use IPO funds?

- Financial Snapshot of Gaudium IVF

- Revenue Concentration & Geographic Exposure

- Gaudium IVF IPO key risks for investors

- Investor Takeaway | Should You Invest in Gaudium IVF IPO?

- FAQs | Gaudium IVF IPO

Introduction

India’s lifestyle has changed faster than its biology.

Careers are starting earlier. Marriages are happening later. Stress levels are higher. And when couples finally decide they’re ready for children, fertility doesn’t always cooperate.

This gap between modern living and natural timelines is steadily expanding the assisted reproductive technology (ART) market in India.

Gaudium IVF operates squarely within this shift. Incorporated in 2015 and headquartered in Delhi NCR, the company runs IVF centres across India and is now coming to the market with a fresh issue and an offer for sale with its ₹165 crore IPO.

As this heads to the market, you’d wonder if this is an apply or avoid IPO.

At first glance, this looks like a straightforward healthcare growth story. But once you go deeper into the DRHP, the picture becomes more layered.

Onto peeling those layers now.

Open a free account today

Invest in tomorrow with just one click

Business Model and Structure

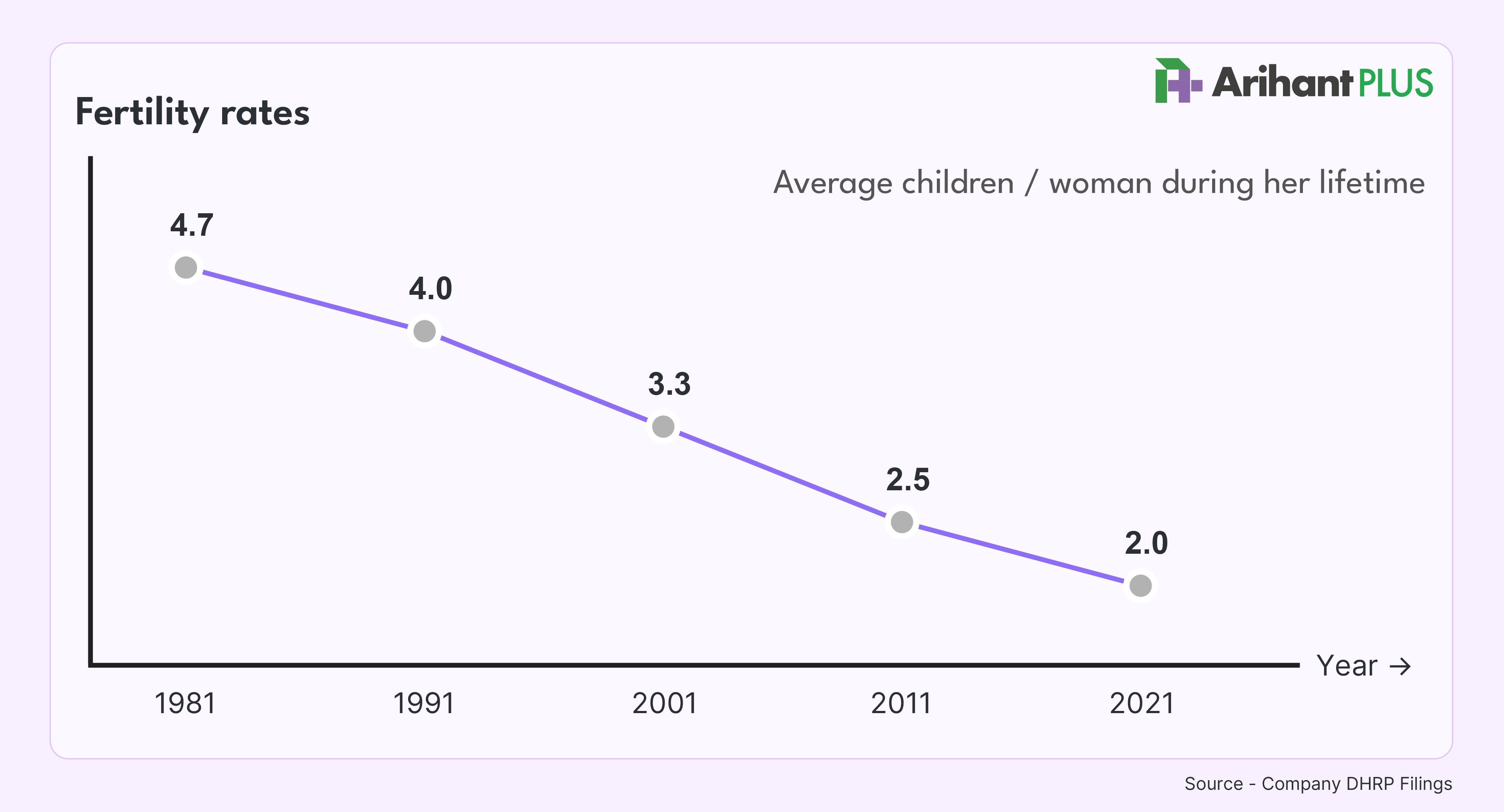

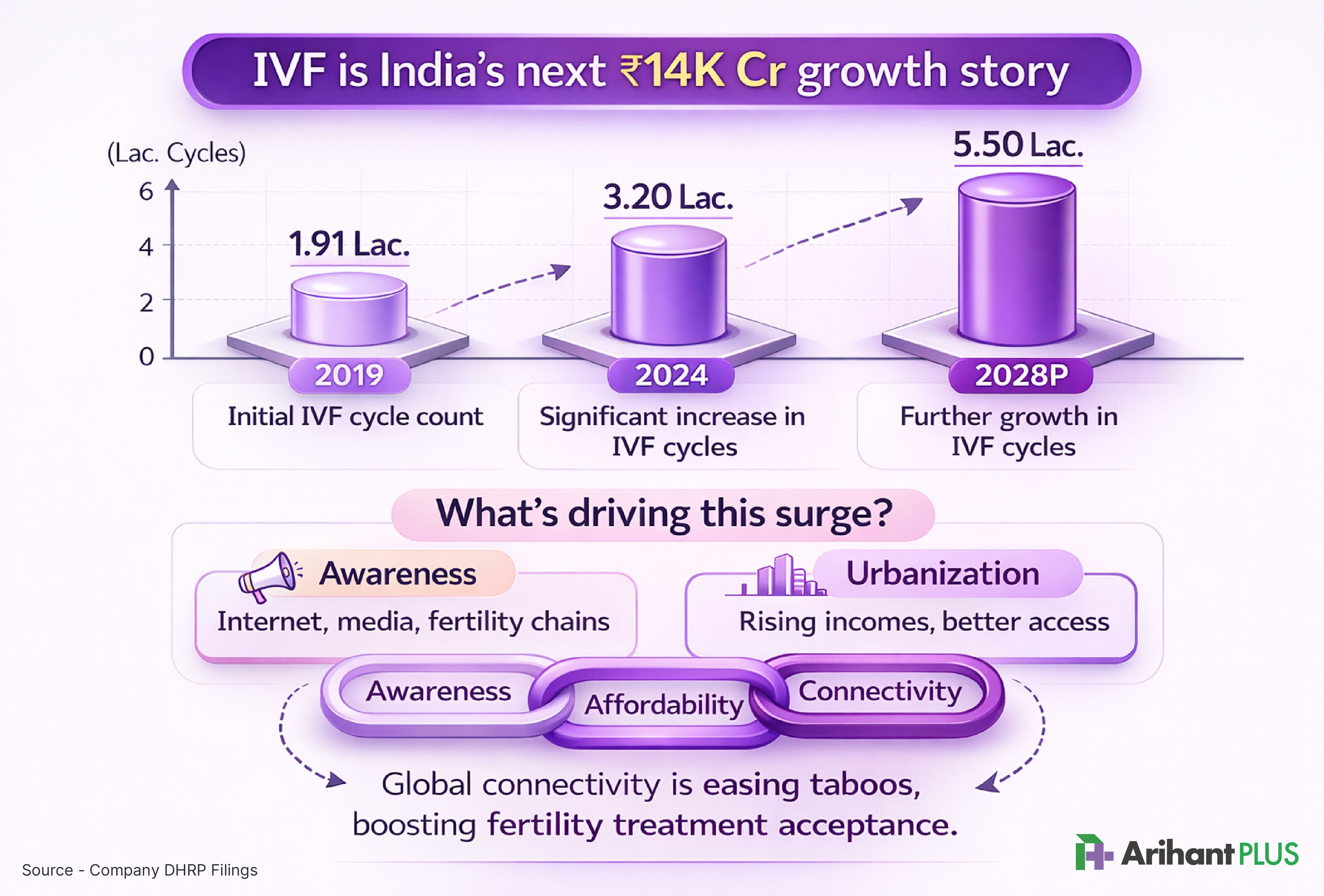

India is going through a quiet fertility shift. The country’s fertility rate has fallen sharply.

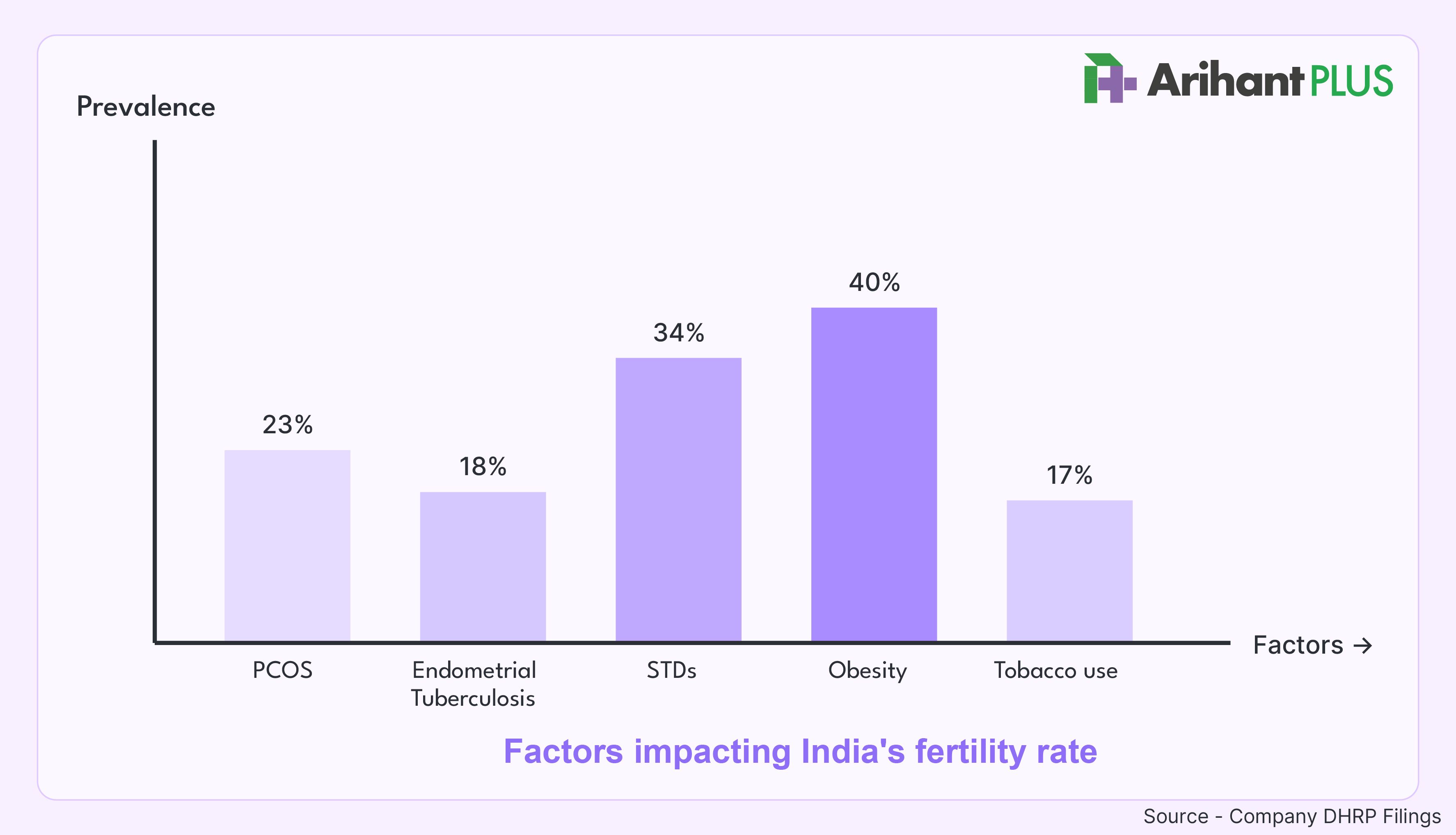

At the same time, infertility-linked health issues are rising. Around 23% of women face PCOS, obesity prevalence is as high as 40%, and factors like STDs, endometrial tuberculosis and tobacco use are further impacting reproductive health.

Gaudium operates a focused fertility services business centred on IVF treatment.

In Vitro Fertilization (IVF) is a medical procedure where eggs and sperm are fertilised in a laboratory and the resulting embryo is implanted into the uterus to achieve pregnancy. Patients typically pay per treatment cycle, and this forms the core revenue model.

Over 90% of Gaudium’s revenue comes from IVF treatments, making it a single segment, volume driven business. Revenue growth depends largely on the number of cycles performed and the average revenue per patient.

The company follows a hub-and-spoke model, where larger hub centres house advanced embryology labs and perform complex procedures, while smaller spoke centres focus on consultations and diagnostics. This structure allows expansion without duplicating high-cost lab infrastructure in every location.

The opportunity backdrop is strong.

India’s IVF market was estimated at around ₹70,000 crore in CY23 and is expected to grow to nearly ₹1.7 lakh crore by CY29, driven by delayed parenthood, rising infertility rates and increasing awareness of assisted reproductive treatments.

India relatively does less IVF procedures than countries like China, Brazil & Thailand but has one of the largest target populations and lower costs, highlighting the substantial untapped demand potential for fertility services in the country.

While the company also operates a 15-bed mother-and-child hospital facility and earns minor pharmacy revenue, IVF remains the dominant driver.

IPO Structure and Issue Details

Here are the key details of Gaudium IVF IPO:

- IPO Size: ₹165 crores

- IPO Opens: February 20, 2026

- IPO Closes: February 24, 2026

- Price Band: ₹75 - 79 per share

- Face value: ₹5

- Minimum investment: ₹14,931

- Lot Size: 189 shares

- Expected Allotment: February 25, 2026

- Credit of Shares: February 26, 2026

- Proposed Listing: February 27, 2026 on BSE and NSE

Gaudium IVF’s IPO is a book-built issue comprising a total of 2,08,86,200 equity shares, consisting of a mix of fresh issue and offer for sale.

- Fresh Issue: ₹90 crores (54.55%)

- Offer for Sale (OFS): ₹75 crores (45.45%)

Since the issue includes both a fresh issue and an OFS component, proceeds from the fresh issue will be used to fund expansion of IVF centres, working capital requirements and investment into its subsidiary, while proceeds from the OFS will go to the selling shareholders.

IPO Objectives: How will Gaudium IVF use IPO funds?

The IPO size is ₹165 crore, comprising a fresh issue of about ₹90 crore and an offer-for-sale of about ₹75 crore, which means 45% money raised from the IPO will go in the pocket of existing shareholders.

The fresh issue proceeds are primarily aimed at expanding the company’s clinical footprint and supporting new growth initiatives. The allocation of funds is as follows:

- Capital expenditure for setting up new IVF centres

- Funding the working capital requirements of these new centres

- Investment into its wholly owned subsidiary, EKK Global Private Limited, for launching mother-and-child wellness and nutraceutical products, marking a diversification beyond core IVF services

- The remaining amount will be utilized for general corporate purposes and issue-related expenses

Overall, the proceeds are largely growth driven, with the bulk directed toward expanding IVF capacity while allocating a smaller portion toward adjacent healthcare product opportunities.

Financial Snapshot of Gaudium IVF

Gaudium has delivered steady growth over the last three fiscals, supported by higher IVF cycle volumes and improving centre utilisation.

- Revenue from operations increased from ₹4,423.69 lakhs in Fiscal 2023 and ₹5,348.46 lakhs in Fiscal 2024. For the six months ended September 30, 2024, revenue stood at ₹3,169.12 lakhs.

- Operating leverage is visible in margins. EBITDA rose from ₹1,342.14 lakhs in Fiscal 2022 to ₹2,582.19 lakhs in Fiscal 2024, with EBITDA margin expanding from 36.75% to 48.28% over the same period.

- Profit after tax increased to ₹1,660.12 lakhs in FY2024, translating into a PAT margin of 30.89%.

- Operationally, the number of IVF cycles performed grew from 2,736 in Fiscal 2022 to 3,711 in Fiscal 2024, while Average Revenue Per Patient improved from ₹3.06 lakhs to ₹3.70 lakhs. This suggests both volume growth and stable pricing.

- However, return ratios have moderated during expansion, with ROCE at 18.13% as of September 2024, indicating that new centre investments are still ramping up.

Importantly, this is a human capital-driven business.

As of September 2024, the company had 15 doctors and 4 embryologists across 7 centres. In fertility services, clinical expertise directly impacts outcomes and patient inflow, making talent retention just as critical as financial performance.

Overall, recent financials show strong margin expansion, but sustaining these levels will depend on centre utilisation and stability of medical teams as the network scales.

Revenue Concentration & Geographic Exposure

Gaudium’s revenue profile is far more concentrated than a diversified hospital chain.

Over 90% of total revenue consistently comes from IVF treatments. In Fiscal 2024, IVF contributed 90.70% of revenue from operations, while hospital services accounted for 6.94% and pharmacy sales just 2.36%. For the six months ended September 30, 2024, IVF contribution rose further to 91.35%.

This means the business is highly dependent on fertility cycle volumes and patient inflow. Unlike multi-specialty healthcare providers, there is limited revenue diversification to cushion slowdowns in core IVF demand.

Geographically, operations are entirely India-focused under a hub-and-spoke model. While the company has a collaboration in London for patient guidance, revenue generation remains domestic. Additionally, the company operates all its centres on leased premises, which introduces location-level operational sensitivity.

The concentration is not necessarily negative; it keeps the model focused but it does mean performance is closely tied to IVF demand, centre utilisation and stability across a limited operating footprint.

Gaudium IVF IPO key risks for investors

Gaudium’s risks arise from the nature of the fertility business itself and from its ongoing expansion phase.

- Revenue concentration: Over 90% of income coming from IVF treatments, as outlined above. Any slowdown in fertility cycle volumes, competitive pressure in pricing, or reputational setback affecting patient inflow could materially impact performance.

- Capital Intensive: Capital intensity is significant. Each new IVF centre requires ₹4–5 crore of upfront investment. If new centres fail to ramp up utilisation within expected timelines, return on capital may remain under pressure despite revenue growth.

- Volatile Cash Flow: Cash flow volatility is another consideration. The company has reported negative operating cash flows in certain periods and consistently negative investing cash flows due to expansion. Sustained growth will require disciplined capital allocation and improving operating cash conversion.

- Human Capital Dependency: As of September 2024, the company operated with 15 doctors and 4 embryologists across 7 centres. Fertility outcomes depend heavily on medical expertise, and historically elevated attrition levels indicate that talent retention is a real operational risk.

- Lease Dependence: All centres operate on leased premises. Any inability to renew leases or disputes with landlords could disrupt operations and affect patient confidence in a reputation-sensitive business.

- Regulatory Risk: Regulatory oversight under India’s assisted reproductive technology framework continues to evolve. Changes in compliance requirements or stricter enforcement could increase costs or delay expansion.

- Execution Risk: The company also plans to diversify into FMCG products through its subsidiary. While adjacent to the core business, this introduces execution risk in a completely different operating segment.

- Technological Obsolescence: Finally, rapid technological advancements in reproductive medicine mean the company must continually upgrade equipment and processes. Failure to adapt to evolving IVF technologies could impact competitiveness and clinical success rates.

Investor Takeaway | Should You Invest in Gaudium IVF IPO?

Gaudium IVF gives investors a way to participate in India’s expanding fertility market; a space driven by delayed parenthood, rising infertility rates and growing awareness of assisted reproductive treatments. The company has delivered steady revenue growth and healthy margins, supported by strong IVF cycle volumes.

That said, this is a capital intensive healthcare business. New centres require meaningful investment, returns depend on utilisation, and clinical talent plays a central role in sustaining credibility.

The demand story is visible. The execution story is still unfolding.

FAQs | Gaudium IVF IPO

1. What are the Gaudium IVF IPO dates?

The IPO opens on February 20, 2026 and closes on February 24, 2026. The basis of allotment is expected on February 25, 2026, and the shares are proposed to list on February 27, 2026 on BSE and NSE.

2. What is the price band of the Gaudium IVF IPO?

The price band will be announced closer to the issue opening. Investors should refer to the final RHP and exchange filings for the confirmed pricing details.

3. What is the lot size of the Gaudium IVF IPO?

The minimum lot size is 189 shares, which means the minimum investment needed to apply for the IPO is ₹14,931.

4. Who should consider applying for the Gaudium IVF IPO?

Investors looking for exposure to India’s growing fertility and IVF market may find the IPO relevant. However, they should consider the capital-intensive nature of the business, centre utilisation risks and execution challenges before investing.

5. Is Gaudium IVF IPO a fresh issue or OFS?

IPO includes both components: fresh issue of 1,13,92,500 equity shares and offer for sale (OFS) of 94,93,700 equity shares. This means a portion of the funds will go toward business expansion, while the OFS proceeds will go to the selling shareholders.

Related Topics