NSDL IPO: A Deep Dive into India’s Digital Depository Giant

By

Arihant Team

India’s depository market has two giants—CDSL and NSDL. While CDSL is listed, NSDL debuts today with a ₹4,011.60 crore IPO, entirely offer for sale. A long-awaited opportunity for investors.

In This Article

- NSDL IPO Details

- About NSDL Company

- Industry Outlook

- NSDL Business

- Now here’s where it gets interesting

- How Does NSDL Actually Make Money?

- NSDL Financials

- NSDL IPO Valuation & Outlook by Arihant Reseach

- Final Thoughts: Should You Apply for the NSDL IPO?

There was a time when investing in stocks meant drowning in paperwork. Physical share certificates, stamp duties, endless signatures — and long delays. Lost or fake certificates weren’t uncommon, and transferring shares was a slow, messy affair. Chaos ruled, and trust in the system was shaky.

Then came 1996 — and NSDL changed everything. It introduced digital demat accounts, cutting out paperwork, fraud, and delays. Suddenly, buying and selling shares was smoother, faster, and more secure. It didn’t just make trading easier — it transformed the entire ecosystem.

Today, NSDL is India’s largest depository by market share and assets under custody — and it all started with one powerful idea: digitise trust.

To know more about how NSDL became a depository behemoth in 2.5 decades click here.

NSDL IPO Details

Fast forward to today, NSDL’s massive ₹4,011.60 crore IPO opens today, July 30, 2025 and bidding will continue till August 1, 2025. Before diving into the IPO details, keep in mind—this is entirely an Offer for Sale (OFS), meaning no fresh shares are being issued; existing shareholders are simply offloading a part of their stake. Here are key NSDL IPO details:

- IPO Price Band: ₹760 to ₹800 per share

- Lot Size:

- Retail Investors: 18 shares per lot (Minimum Investment: ₹13,680 to ₹14,400)

- sNII (Small Non-Institutional Investor): Min 14 lots or 252 shares (approx Investment: ₹2,01,600)

- bNII (Big Non-Institutional Investor): Min 70 lots or 1,260 shares (approx Investment: ₹10,08,000)

- Lead Manager: ICICI Securities Ltd.

- Allotment Date: 📆 August 4, 2025

- Listing Date: 📈 August 6, 2025 (BSE)

About NSDL Company

NSDL isn’t just any financial institution—it’s one of India’s most important market infrastructure players, registered with SEBI and serving a big chunk of the country’s financial ecosystem. After the Depositories Act came into play in 1996, NSDL led the charge in transforming how India handles securities by introducing dematerialisation—converting physical share certificates into digital format—in November that same year.

Fast forward to March 31, 2025, and NSDL stands tall as the largest depository in India—beating its peers when it comes to the number of companies it services, the volume of active financial instruments, and the total value of assets under its custody. In fact, NSDL leads the market share in demat settlement value. Even its physical presence is massive—with over 65,000 depository participant service centres across the country, compared to just under 19,000 by its closest competitor, CDSL.

Industry Outlook

Let’s talk about where the depository industry in India is headed—and the numbers paint an exciting picture. Over the past decade, demat accounts in India have been growing steadily, clocking a solid 21.94% CAGR from FY14 to FY25. That kind of growth shows just how much more aware and willing Indians have become to invest in the markets—whether it's for daily trading or long-term wealth building. As of March 31, 2025, there were a massive 19.24 crore demat accounts across the country.

But it’s not just about more accounts—it’s also about how people are investing. In recent years, we’ve seen the rise of new-age fintech or discount brokers. These guys have completely disrupted the traditional brokerage model by going digital, keeping costs low, and passing the savings on to customers. Thanks to their lean tech-driven operations, many of them offer zero or near-zero brokerage fees, making investing more accessible than ever. No surprise then, their market share jumped from just 5% in FY16 to a whopping 70% by FY25!

The broader depository market has also surged. Between FY17 and FY25, client accounts grew at around 27.4% CAGR. And while the pace may slow a bit, it’s still expected to grow at a healthy 11–12% CAGR till FY27.

Interestingly, this is just the beginning. The penetration of demat account India is still very low compared to the developed markets. Only ~3.4% of the entire population holds an active demat account, as of March 2025. That’s a tiny slice of a 1.44 billion population. The potential? Massive. As more people join the investing journey, demat accounts will rise, transactions will grow — and that’s more business for depositories. The real winners? Those who innovate with tech and keep costs low.

Even in terms of earnings, Indian depositories have done well. The standalone income hit ₹1,716 crore in FY25, growing at an impressive 22.4% CAGR since FY18. And if regulatory pricing stays stable, this could climb to ₹2100 – ₹2200 crore by FY27.

All in all, the future looks bright for India’s depository landscape—with more investors, smarter brokers, and solid growth ahead.

NSDL Business

NSDL’s business mainly runs on three key pillars:

- Depository Services – This is its core business. It earns money by charging companies and brokers for maintaining their shares, handling share transfers, managing IPOs, and other related services.

- Banking Services – Yes, NSDL also has a banking arm! It runs a payments bank called NSDL Payments Bank Ltd (NPBL), which started in 2018.

- Database Services – Through NSDL Database Management Ltd (NDML), it handles things like KYC verification, managing insurance records, and even the National Skills Registry.

Now here’s where it gets interesting

While CDSL has slowly grabbed market share from NSDL over the years, NSDL still holds the lion’s share when it comes to the total value of assets. As of March 2025, NSDL held a massive ₹464 trillion worth of securities in demat accounts—that’s almost six times more than CDSL’s ₹71 trillion.

But here’s the twist—CDSL has more demat accounts. Why? You can blame COVID for that.

When the pandemic hit in 2020, retail investors rushed into the stock market. Discount brokers became popular, and most of them chose CDSL as their go-to depository. Why? Because CDSL had lower transaction costs, easier tech integration (APIs), and quicker account opening.

The result? NSDL’s market share (by value of securities settled) fell from 81% in FY20 to 66% in FY25. Meanwhile, CDSL climbed up to 33%.

So yes, NSDL still holds more valuable assets, but CDSL has captured the retail investor base in a big way. Even NSDL admits this shift, saying they've lost market share because of the rise of fintech brokers.

How Does NSDL Actually Make Money?

NSDL seems like a rock-solid, diversified business. It’s been around for nearly three decades, manages trillions in assets, and operates in a tightly regulated duopoly. Sounds unbeatable, right? But if you look under the hood, the business model has evolved quite a bit since the 1996s.

In FY25, only 43% of NSDL’s total revenue came from its core depository services—you know, the business it’s best known for. Surprisingly, the largest chunk—about 50%—came from its banking arm, NSDL Payments Bank (NPBL). Another 6.3% came from NDML, which handles KYC and database services.

Now you might think, “Hey, that’s some solid diversification!” But hold on.

Because while banking pulls in half the revenue, it contributes just around 1% to overall profits. That’s right—barely anything. On the other hand, the depository business, despite generating less than half the revenue, delivers a whopping 91% of NSDL’s profits. NDML makes up the remaining 6-7%.

So, despite all the buzz about NSDL branching out, it’s still the depository services that are driving the real value of the business. The other segments add volume, but not much value—at least for now.

NSDL Financials

So, how’s NSDL doing financially? Pretty solid, actually. Over the last two years, NSDL has shown consistent growth. In FY24, it clocked ₹1,365 crores in revenue with a net profit of ₹275 crores. The momentum continued in FY25, with revenue jumping to ₹1,535 crores and profit rising to ₹343 crores. That kind of steady performance highlights NSDL’s strong business model and its vital role in powering India’s capital markets.

Strengths of NSDL

- Pioneering Leadership: NSDL holds the distinction of being India’s first and leading depository, playing a foundational role in shaping the country’s digital securities ecosystem.

- Technology at the Core: With a strong focus on technology-led innovation, NSDL continues to develop modern, efficient, and scalable solutions that serve a wide range of market participants.

- Robust Systems & Security: The company boasts a solid IT backbone, complemented by strong risk management and cybersecurity frameworks, ensuring the safety and reliability of the depository system.

- Stable & Recurring Revenues: NSDL enjoys a stable revenue stream, with a good portion coming from recurring income sources—adding predictability to its financial performance.

- Diversified Portfolio: It manages multiple asset classes under demat accounts and operates across diverse business verticals, reducing reliance on any single segment.

- Experienced Leadership: The company is guided by a seasoned senior management team with deep domain expertise and proven track records.

Risks Associated with NSDL

- Changing Investor Trends: A shift in investor preferences or behaviors could potentially reduce the demand for NSDL’s services.

- Innovation Pressure: Failure to expand or upgrade offerings through innovation or keep pace with evolving tech could impact its competitiveness and growth.

- Market Dependency: Since NSDL’s revenue is linked to trading volumes and market activity, a slowdown in the securities market could directly affect its financials.

- IT System Risks: Heavy reliance on complex IT infrastructure makes it vulnerable to potential disruptions, cyber threats, or regulatory issues.

- Regulatory Compliance: Any non-compliance with SEBI or other regulatory norms may lead to legal consequences, penalties, or reputational damage.

- Tough Competition: The company operates in a highly regulated and competitive space, and failure to stay ahead of rivals may impact market share and profitability.

- Reliance on Depository Participants (DPs): NSDL’s growth and service delivery depend significantly on its DP network, making it a key risk factor.

- Subsidiary Risk Exposure: Any regulatory non-compliance or issues arising from its subsidiaries can spill over to NSDL, impacting its reputation and operations.

NSDL IPO Valuation & Outlook by Arihant Reseach

NSDL’s entrenched market leadership and scale in depository services position it to sustain robust, recurring fee income even as trading volumes ebb and flow. Its diversified revenue mix—anchored by the rapid growth of NSDL Payments Bank and the steady contributions of NDML—helps smooth earnings across market cycles. Regulatory moats under SEBI’s framework and the duopolistic nature of India’s depository market underpin durable competitive advantages.

As India’s digital and financial inclusion agenda accelerates, NSDL is well-positioned to leverage its broad participant network and advanced platforms to grow its wallet share in digital banking, KYC, insurance repositories, and e-governance solutions. At the upper price band of ₹800, the issue is valued at a P/E ratio of 46.63x based on FY25 EPS of ₹17.16.

We recommend a “Subscribe for listing gains” on this issue. Read the full report here

Final Thoughts: Should You Apply for the NSDL IPO?

The NSDL IPO offers a rare chance to invest in India’s most trusted financial infrastructure firm. With 25+ years of legacy, NSDL has been key to dematerialising shares and ensuring secure, seamless transactions. Despite rising competition, it still leads in terms of total asset value under custody.

As more Indians—driven by digital awareness and financial literacy—open demat accounts, NSDL is poised to benefit from the rising demand for equity, mutual funds, IPO participation, and digital investing infrastructure.

However, it’s important to note that this IPO is a pure Offer for Sale (OFS)—which means the proceeds won’t go to the company, but to existing shareholders. So while NSDL’s fundamentals are strong, the absence of fresh capital infusion and increasing competition in the digital era are things to keep an eye on.

That said, with its stable recurring revenue, strong market presence, and vital role in the financial ecosystem, NSDL’s IPO could be a solid bet for investors looking to add a core financial infrastructure stock to their portfolio.

As always, make sure to assess your risk appetite and consult your financial advisor before investing.

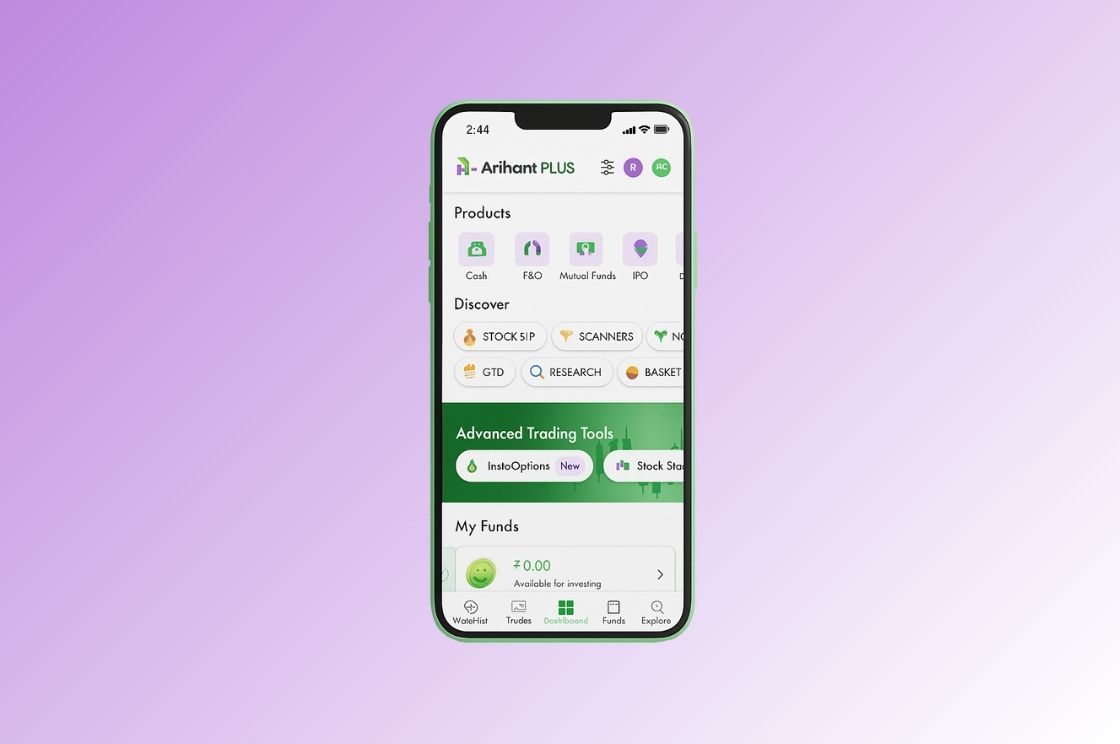

How to Apply for NSDL IPO?

Step 1: Log in to your ArihantPlus app to access IPO investments. Next, select the current IPO section.

Step 2: Specify IPO details - Enter the number of lots and the price you wish to apply for.

Step 3: Enter UPI ID - After entering your UPI ID, click submit. This will place your bid with the exchange.

Step 4: Mandate Notification - Your UPI app will receive a mandate notification to block funds.

Step 5: Approve Request - Your funds will be blocked once you approve the mandate request on your UPI.

Related Topics