Fractal Analytics IPO 2026: RHP, Price Band, Risks & Verdict

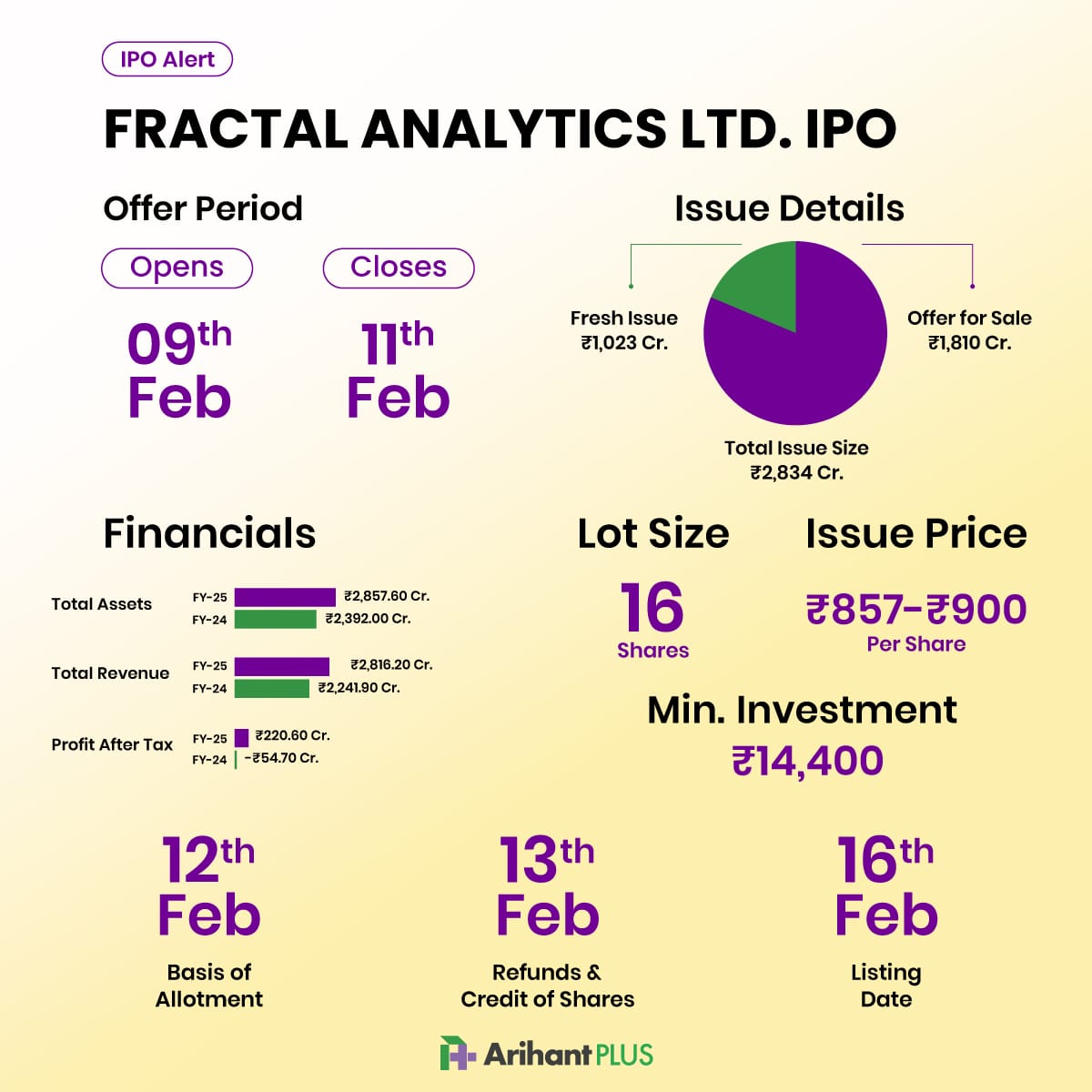

Fractal Analytics IPO opens on Feb 9, 2026 with a price band of ₹857–900 per share. Backed by strong revenue growth and global enterprise clients, the IPO offers exposure to the AI services space, with added upside from its evolving product-led strategy along with key risks to watch.

In This Article

- Introduction

- Business Model and Structure

- IPO Structure and Issue Details

- IPO Proceeds | Fractal IPO

- Financial Snapshot | Fractal IPO

- Client and Geographic Concentration | Fractal IPO

- Key Investor Risks | Fractal IPO

- Investor Takeaway | Fractal Analytics IPO

- FAQs | Fractal Analytics IPO

Introduction

Fractal Analytics is getting ready to hit the stock market with a ₹2,833.9 crore IPO on 9th February 2026. Started back in 2000 in Mumbai, the company helps some of the world’s biggest businesses use artificial intelligence to make smarter day-to-day decisions.

It sits behind the scenes, using data and AI to help large organisations figure out things like what to price, where to cut risk, how to manage supply chains, or how to understand customers better.

The company has set the price band of the IPO at ₹857 - ₹900 per share and its a completely fresh issue, which means all the money raised through the IPO will be utilized for business growth, including a part towards debt repayment. Should you apply for Fractal Analytics IPO? Let’s dive and learn.

Business Model and Structure

Fractal operates through two primary business engines, each carrying different financial and valuation implications.

Fractal.ai is the core services and platforms segment. In FY25, this segment generated ₹27,037 million in revenue, accounting for the bulk of the company’s operation.

On the services side, Fractal helps companies actually use AI in their day-to-day operations. It works on AI consulting, upgrading analytics systems, and building decision tools that sit directly inside how clients run their business. Most of the revenue here comes from projects and long-term engagements, but once Fractal gets deeply integrated into a client’s decision systems, those relationships tend to be quite sticky and repeat in nature.

Then there’s Fractal Alpha, which is the company’s push into building its own AI products and intellectual property. This segment brought in about ₹644 million in revenue in FY25 and is growing fast, but it’s still small compared to the services business. It also posted a segment loss of ₹283 million in FY25, mainly because the company is spending heavily on building products, improving technology, and expanding sales efforts.

Put simply, Fractal today still earns most of its money from AI services, but it is actively investing to become more of a product and platform company over time. That shift is a big part of the long-term story investors are being asked to believe in.

IPO Structure and Issue Details

Fractal’s IPO is a book-built issue of ₹2,833.9 crore, comprising:

- Fresh Issue: ₹1,023.5 crore

- Offer for Sale (OFS): ₹1,810.4 crore

Key Dates and Pricing:

- IPO Opens: February 9

- IPO Closes: February 11

- Anchor Investor Bidding: February 6

- Price Band: ₹857 - ₹900 per share

- Lot Size: 16 shares and multiples thereafter

- Expected Allotment: February 12

- Proposed Listing: February 16 on Indian stock exchanges

Since the issue includes a sizable OFS component, a portion of the proceeds will go to existing shareholders, while the fresh capital will support growth and expansion.

IPO Proceeds | Fractal IPO

The ₹1,023.5 crore fresh issue is earmarked primarily for growth and capability expansion:

- Investment in Fractal USA (including debt repayment): ₹264.9 crore

- Purchase of laptops and tech infrastructure: ₹57.1 crore

- New office premises in India: ₹121.1 crore

- R&D and Sales & Marketing for Fractal Alpha: ₹355.1 crore

- Inorganic growth, strategic initiatives & general corporate purposes: ₹225.3 crore

A significant share is directed toward Fractal Alpha, underlining management’s intent to scale its IP-led AI product portfolio.

Financial Snapshot | Fractal IPO

Fractal has shown steady top-line growth with improving operating metrics.

- FY25 Revenue from Operations: ₹27,654 million, up from ₹21,963 million in FY24, reflecting 25.9% YoY growth.

- FY25 Profit for the Year: ₹2,206 million, compared to a loss of ₹547 million in FY24.

- Adjusted EBITDA (FY25): ₹4,821 million, with an Adjusted EBITDA margin of 17.4%.

- Cash Flow from Operations (FY25): ₹3,970 million, a sharp improvement over prior years.

However, profitability remains uneven across segments, with Fractal Alpha still in an investment phase.

Client and Geographic Concentration | Fractal IPO

Fractal’s revenue profile reflects deep enterprise relationships but also concentration risks. a

- Top 10 clients contributed 53.8% of revenue in FY25

- Top 20 clients contributed 69.6% of revenue

Geographically, exposure is skewed toward developed markets:

- Americas contributed 66.5% of Fractal.ai segment revenue in FY25

This creates sensitivity to spending cycles in a handful of large enterprises and regions.

Key Investor Risks | Fractal IPO

Fractal’s IPO risks stem from both its current structure and its future transition.

- Client concentration risk is significant, given over half of revenues come from just 10 clients. Any reduction in spending from a key account could materially impact financials.

- US market dependence means performance is tied to North American enterprise technology budgets, which can fluctuate with economic cycles.

- Profitability pressure remains, particularly as Fractal Alpha reported a ₹283 million segment loss in FY25 and will continue to require investment.

- Execution risk in scaling products is central to the long-term story. If product revenues do not scale as expected, Fractal may continue to be valued primarily as a services company.

- Regulatory and AI governance risks are rising globally, especially in sectors like BFSI and healthcare where Fractal operates. Compliance costs and deployment cycles could increase.

- Cybersecurity and AI model risk is inherent in decision-critical AI systems, where failures could lead to reputational or financial damage.

- Talent dependency is high, with 5,254 employees as of FY25, many in specialised AI roles. Hiring and retention pressures could impact margins.

Investor Takeaway | Fractal Analytics IPO

Fractal Analytics gives investors a chance to participate in a focused enterprise AI growth story. The company is riding strong revenue momentum, generating healthier operating cash flows, and is deeply embedded in the systems of large global clients which gives its business a certain level of stability and visibility.

At the same time, it’s important to remember that Fractal is still evolving. Today, it is primarily an AI services company, but it’s working toward becoming a more scalable, product- and IP-led platform business. That transition could unlock higher margins and better valuations over time, but it also means the company is in an investment phase and still proving out this next stage of its model.

FAQs | Fractal Analytics IPO

1.What are the Fractal Analytics IPO dates?

The IPO opens on February 9, 2026 and closes on February 11, 2026. Anchor investor bidding takes place on February 6, while the proposed listing date is February 16, 2026.

2. What is the Fractal Analytics IPO price band?

The company has fixed a price band of ₹857 to ₹900 per share for the IPO.

3. What is the lot size of the Fractal Analytics IPO?

Investors can apply for a minimum lot of 16 shares and in multiples of 16 thereafter.

4. Who should consider applying for the Fractal Analytics IPO?

Investors looking for exposure to the enterprise AI and analytics sector with a long-term growth story may find the IPO interesting, but should consider risks related to client concentration and product execution.

5. Is Fractal Analytics IPO a fresh issue or OFS?

The IPO includes both:

- Fresh Issue: ₹1,023.5 crore

- OFS: ₹1,810.4 crore

So, part of the proceeds will go to the company and part to existing shareholders.

Related Topics