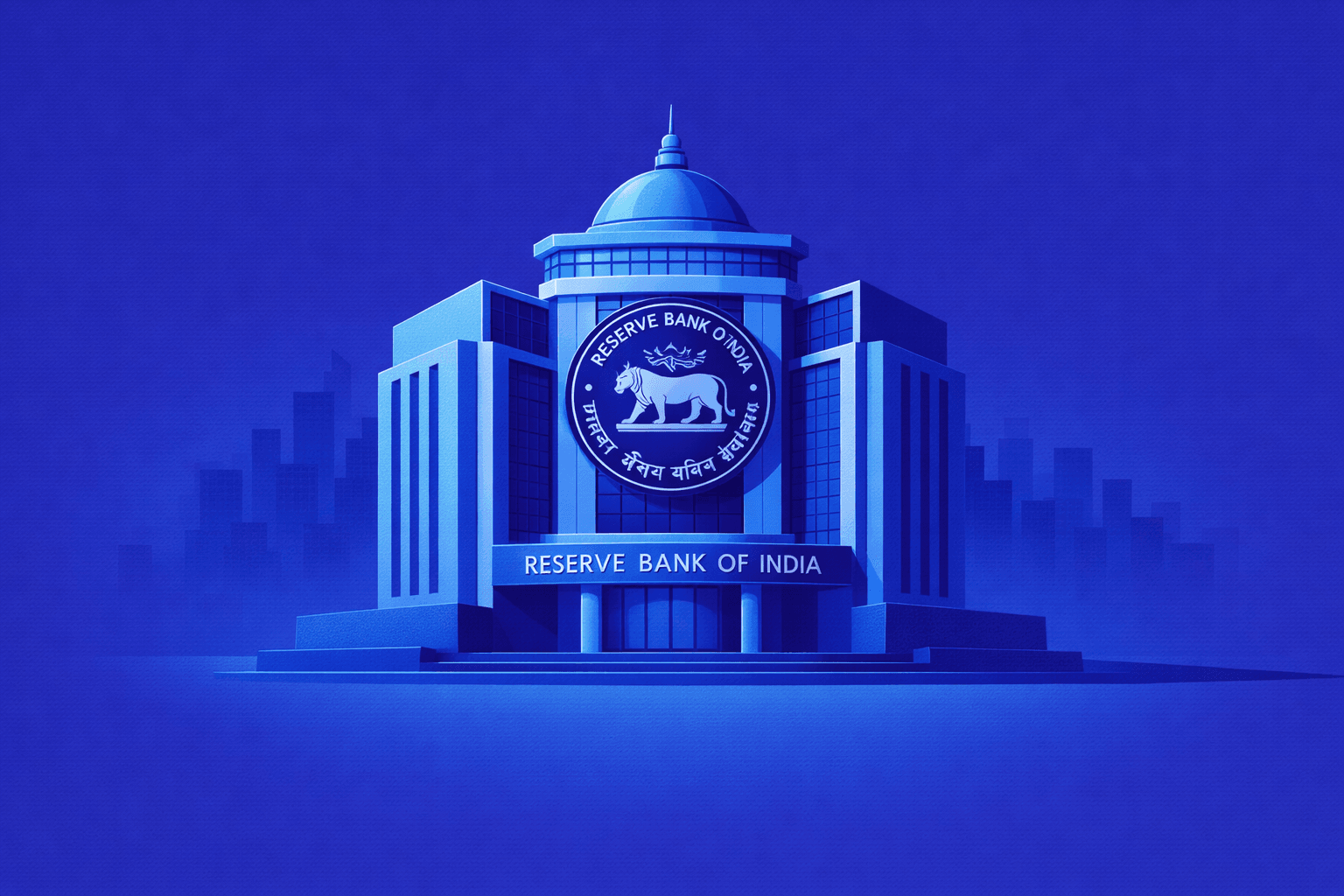

RBI Repo Rate Unchanged: Impact on EMI, FD & Stock Market

By

Arihant Team

RBI has kept the repo rate unchanged at 5.25%, signalling economic stability. EMIs remain steady, FD investors enjoy higher real returns for now, and equity markets may shift focus to earnings, growth outlook, and sector-wise fundamentals.

In This Article

- Introduction

- If you invest in equities

- If you already have a home or car loan

- If you’re thinking of taking a loan

- If you’re an FD investor or retiree

- Macro Outlook: Growth & Inflation

- Wrapping Up

Introduction

The Reserve Bank of India Monetary Policy Committee (MPC) wrapped up its meeting today, February 6, 2026, and decided to keep things unchanged, holding the repo rate steady at 5.25%.

For context, the MPC is the six-member panel that decides India’s key interest rates, with the job of balancing inflation and economic growth.

Right now, that balance looks fairly comfortable. Inflation is sitting within RBI’s 2%-6% target band, while growth remains strong, with GDP expected to be around 7.4% this year. With prices under control and the economy holding up well, the committee saw little reason to tweak rates at this stage.

On the surface, that sounds like a non-event. But when a rate cycle pauses after a series of cuts, it tells us something important about where things may head next and that directly affects borrowers, savers, and investors.

Open a free account today

Invest in tomorrow with just one click

If you invest in equities

The policy decision was largely anticipated by investors. A status-quo stance tends to be market-friendly when inflation is under control, it suggests stability rather than stress in the economy.

Markets are now likely to focus more on corporate earnings, macro data, and budget announcements rather than interest-rate surprises.

Sectoral Effects

- Interest-rate sensitive sectors like Real Estate, Automobiles, and Banking may not see an immediate rally that comes with a rate cut.

But the stability in rates can support long-term investment planning and capital expenditure decisions.

If you already have a home or car loan

Your EMI will stay the same for now because the RBI hasn’t cut rates. Over the past year, the central bank has already reduced rates by 1.25%, and many floating-rate borrowers have already benefited from that.

With rates on hold, banks may take longer to pass on any future cuts. So rather than waiting for another policy move, this is a practical time to review your loan. If your current rate is higher than what other lenders are offering, refinancing or renegotiating could lower your interest cost.

The pause also reduces the chance of rates rising suddenly, which helps with better monthly cash-flow planning.

If you’re thinking of taking a loan

Borrowing costs are now predictable.

That helps you decide based on property prices, income stability, and long-term affordability, instead of trying to time RBI moves.

If you’re an FD investor or retiree

FD rates usually fall after repo cuts, not before. Since RBI has paused the rate cut, banks don’t have urgency to reduce deposit rates right away.

So you currently have:

- Still-elevated FD rates

- Falling inflation

- Stable interest rate outlook

That combination improves real returns (returns after inflation).

Locking in medium tenure FDs now could work in your favor before the next easing phase resumes!

Macro Outlook: Growth & Inflation

Although the RBI kept rates steady, the committee also updated its growth and inflation projections signalling confidence in the economy:

- GDP: RBI revised up its GDP growth forecast for the fiscal year to 7.4%.

This suggests the economy is strengthening, with steady demand and investment activity. - Inflation: Inflation is expected to moderate and stay within the target range of 2% (lower bound) and 6% (upper bound).

This gives RBI room to remain cautious, avoiding premature rate cuts while still supporting growth.

Wrapping Up

The RBI didn’t cut rates..and for borrowers that means no surprise EMI drops this month. While FD investors get a little more time to enjoy current deposit rates before they eventually slide. With GDP growth seen at 7.4% and inflation within the target band, markets are likely to rely on actual earnings and economic performance rather than on interest rate moves.

Related Topics