HFCL’s defence & telecom pivot gains momentum. Should you Invest?

By

Arihant Team

HFCL is quietly transforming from a telecom hardware maker into a high-margin fibre and defence technology player. With rising AI-driven optical fibre demand, a strong ₹11,125 crore order book, and upcoming electronic fuze approvals, the stock could see significant rerating potential over the next few years

In This Article

- Introduction

- HFCL – Whats the big deal?

- The AI-first world is pulling up fiber demand

- From commodity hardware to higher-value telecom solutions

- Defence: from lab to battlefield

- The bigger picture

- Outlook & valuation: where this leaves investors

- The final word: to invest or not to invest

Introduction

While India is busy tracking gold and silver prices, and thinking of riding the EV-driven copper boom; one commonly overlooked stock is quietly positioning itself to take advantage of AI-first world and military modernization. A stock which has a potential 110% upside from current levels.

But before we deep-dive and you decide to invest in this stock, please take a moment to join the Arihant Plus family. We promise to send you only research-backed and market relevant materials including some hidden gems like this stock.

Open a free account today

Invest in tomorrow with just one click

HFCL – Whats the big deal?

The mystery stock is HFCL — a name that doesn’t trend on social media, doesn’t show up in most headline portfolios, but may be sitting on one of the most interesting inflection points in Indian midcaps right now.

From the outside, HFCL looks like any plain vanilla tech company which makes optical fibre cables (OFC), telecom and defense equipment and provides turkey network solutions. However, beneath the surface, it is building the backbone of futuristic India’s using a 3- pronged approach

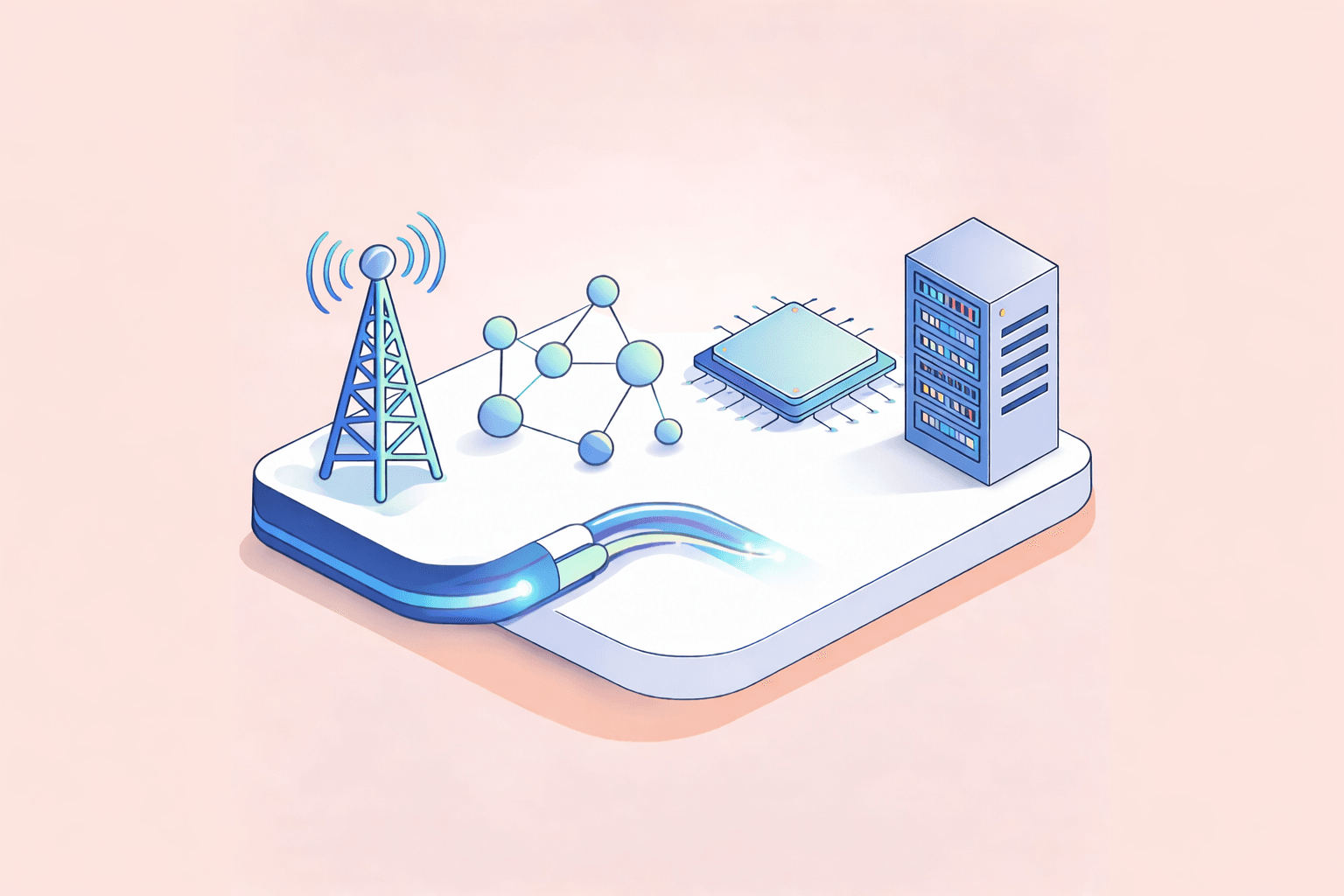

The AI-first world is pulling up fiber demand

Inventory pile-ups, pricing pressure, and commoditized products made the telecom sector feel like yesterday’s trade. The kind of industry investors stopped paying attention to. But beneath the surface, the narrative has quietly flipped.

The world is now building hyperscale data centres at breakneck speed — Think cloud giants, AI models, and massive data flows. And all of it runs on one unglamorous but absolutely essential backbone:

Optical Fibre

Now, this is where things get fun: AI-driven data centres don’t just need more fibre — they need high-fibre-count cables (3,456F and above). These are significantly harder to manufacture, supply is limited, and pricing sits at a premium.

Now that they have used up their inventory, global telecom operators are ordering again. That’s creating a powerful double engine of demand:

- Traditional OFC consumption is returning

- High-end, AI-led fibre demand is accelerating

Fibre prices have already jumped ~10% QoQ, with another ~10% hike likely in the near term.

And sensing the inflection point, the company is moving early — scaling capacity from 30.5 million f.km to 42.36 million f.km by June 2026, exactly as demand begins to heat up.

This is how “boring telecom hardware” turns into a structural growth story. If execution stays on track, HFCL’s Optical Fibre Cable (OFC) business alone could grow from ₹2,400 crores in FY26E to ₹3,400–3,500 crores by FY27E. Not bad for a segment many had considered written off.

From commodity hardware to higher-value telecom solutions

The company also strategically planned to increase their margin by changing focus from low-margin, commoditized telecom hardware and doubling down on higher-value solutions. Apart from this, a few things in the Indian telecom story are moving the scales for HFCL.

- Routers are quietly booming: The Indian Government had launched connectivity projects like BharatNet which are driving demand for routers. HFCL already has orders for ~1 lakh router units, translating to ₹700–800 crores in revenue.

- Tariff relief = export opportunity: The US has indicated a reduction in tariffs on Indian telecom equipment—from 50% to ~18% (formal rollout pending). If implemented, this could materially improve HFCL’s export competitiveness for Ultra-broadband routers (UBR) and Wi-Fi systems

- Betting on the right tech cycles: Instead of spreading itself thin, the company is investing in next-gen Wi-Fi 7 and avoiding expensive point-to-multipoint tech where global demand isn’t proven yet. The idea is simple: fewer products, higher value, better margins.

If this shift plays out as planned, margin expansion could be the real long-term payoff—not just revenue growth.

Defence: from lab to battlefield

Domestic demand for electronic fuzes

While HFCL is known for telecom, its most explosive potential lies in a small, high-tech device: the electronic fuze. An electronic fuze is the "brain" of modern ammunition (artillery shells, missiles), determining exactly when and how they detonate. Unlike traditional mechanical fuzes, these are high-precision, high-value electronics.

The opportunity here is massive because HFCL has achieved indigenous intellectual property (IP)—they aren't just assembling these; they own the technology. The product is currently in advanced testing phases, with the critical final trial scheduled for April 2026. Post-approval, HFCL is targeting to capture about 20% of the total market demand. This shifts the company from a general contractor to a strategic defence partner with high barriers to entry.

From R&D to revenues

The electronic fuze is just the spearhead of HFCL’s defence arsenal. They have already secured orders for thermal weapon sights and electro-optic systems that help soldiers see in the dark. Beyond that, they have entered the UAV (drone) space with specialized thermal cameras and are developing advanced radars capable of drone detection and even foliage penetration (seeing through deep forests). The defence pipeline is robust, including participation in major programs like the BMP upgrade.

The bigger picture

Let us zoom out and see how the company is positioned vis-à-vis the economy. In the most recent budget, Finance Minister, Mrs Nirmala Sitharaman announced a 15.3% increase in defence spending to ₹7.8 lakh crore making it the single biggest recipient of budget resources with focus being on modernization. They have also mandated that about 75% of capital investments have to be procured from Indian manufacturers. This is a good omen for a company who is already shortlisted as one of five parties nationwide for BMP upgradation program. Add to this, the company’s strong defence-tech moat, the result:

The defence vertical alone may grow to ₹500 crore in revenue by financial year 27.

Fun fact: Castles were built on moats to protect them from invaders. Similarly, a company’s moat is its competitive edge which gives the company an edge against competition and protects its market share.

Similarly, telecom was treated as critical national infrastructure and got an incremental 38% budget. The budget focuses on finalising the BharatNet project to provide high-speed fiber broadband to villages, treating telecom as critical national infrastructure. The budget also introduced a tax holiday for data centres until 2047 and customs duty rationalisation to reduce rollout friction for network infrastructure.

The company’s fibre wing benefits from the data centre capex while its other products are moving up the value chain.

Outlook & valuation: where this leaves investors

HFCL’s order book of ₹11,125 crores (which is about 2.7 times its FY25 revenue) offers strong medium-term visibility. And importantly, this isn’t just legacy telecom demand. The global rollout of hyperscale data centres and AI networks is structurally shifting demand toward higher-fiber-count, higher-realisation, low-latency cables—a sweet spot where HFCL is already positioned.

On defence, the upcoming electronic fuze trials in April 2026 are a key trigger. Post approvals, the company is targeting 1 lakh fuzes, roughly 20% of domestic demand, alongside a growing pipeline in electro-optics, radars, and UAV-linked systems.

Strategically, HFCL is also changing how it makes money—moving away from low-margin EPC work toward higher-margin OFC, defence, and solution-led businesses. That shift could lift EBITDA margins to 18–20% over the medium term.

Individually, each segment looks promising. Together, they point to a company quietly repositioning itself—from volume-driven hardware to technology-led, margin-accretive businesses. Sometimes, the most interesting turnarounds don’t shout. They just show up in the numbers— one quarter at a time.

Balance sheet risks are easing too. The recent ₹550 cr QIP has helped repay debt, which should lower interest costs and support profitability.

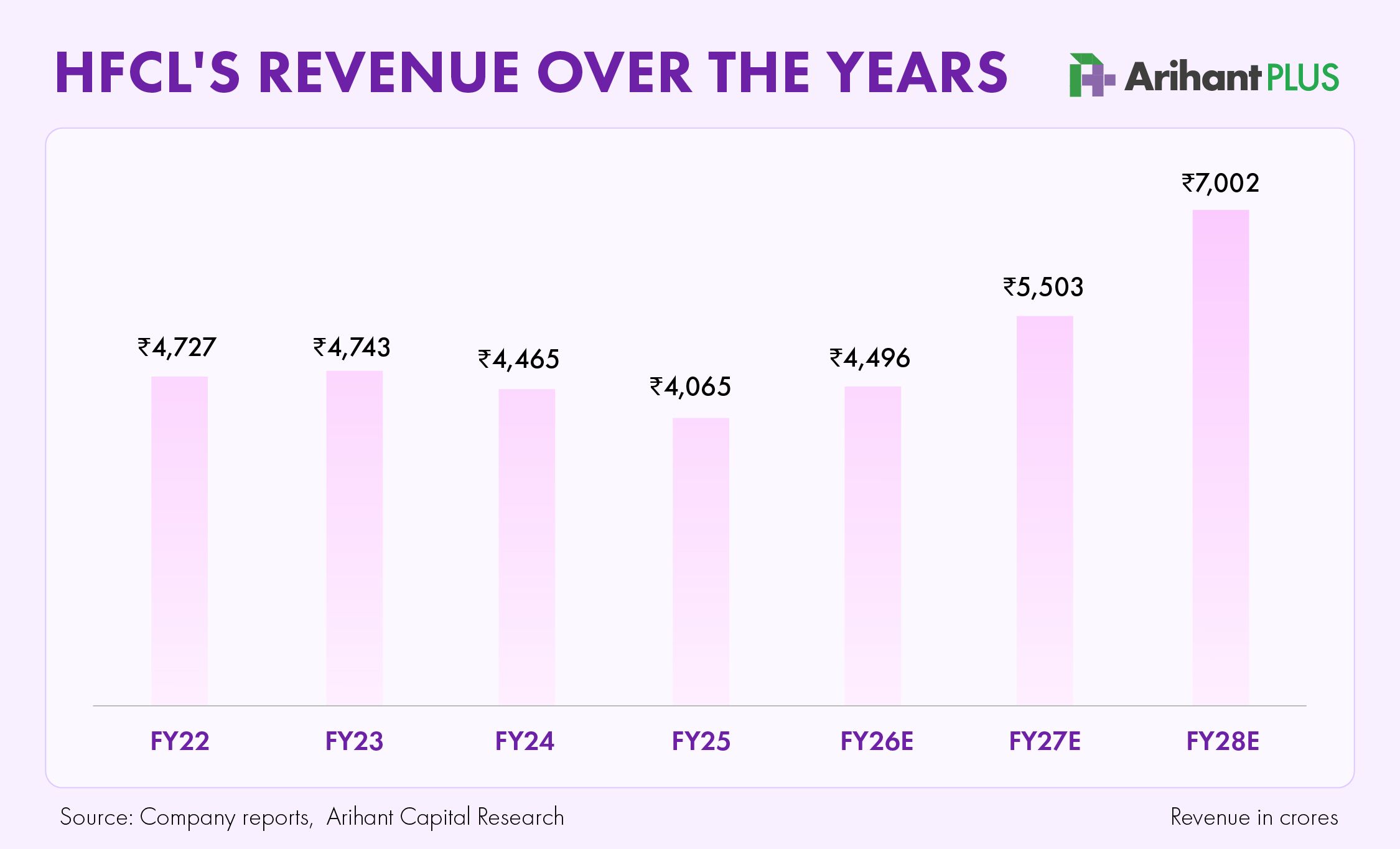

Put it all together, and the numbers start to reflect the transformation. The revenues which had taken a dip in FY24 and FY25 are now moving up steadily. In Q3FY26, revenues increased by 19.6% year-on-year (YOY). Between FY25 and FY28, revenue is expected to grow with a roughly 20% CAGR, the EBITDA may grow at about 36%. While profits (PAT) are projected to skyrocket at a 59% CAGR. Furthermore, the company's efficiency is set to improve drastically, with return on equity (RoE) expected to jump from 4.3% (FY25) to 12.5% (FY28E).

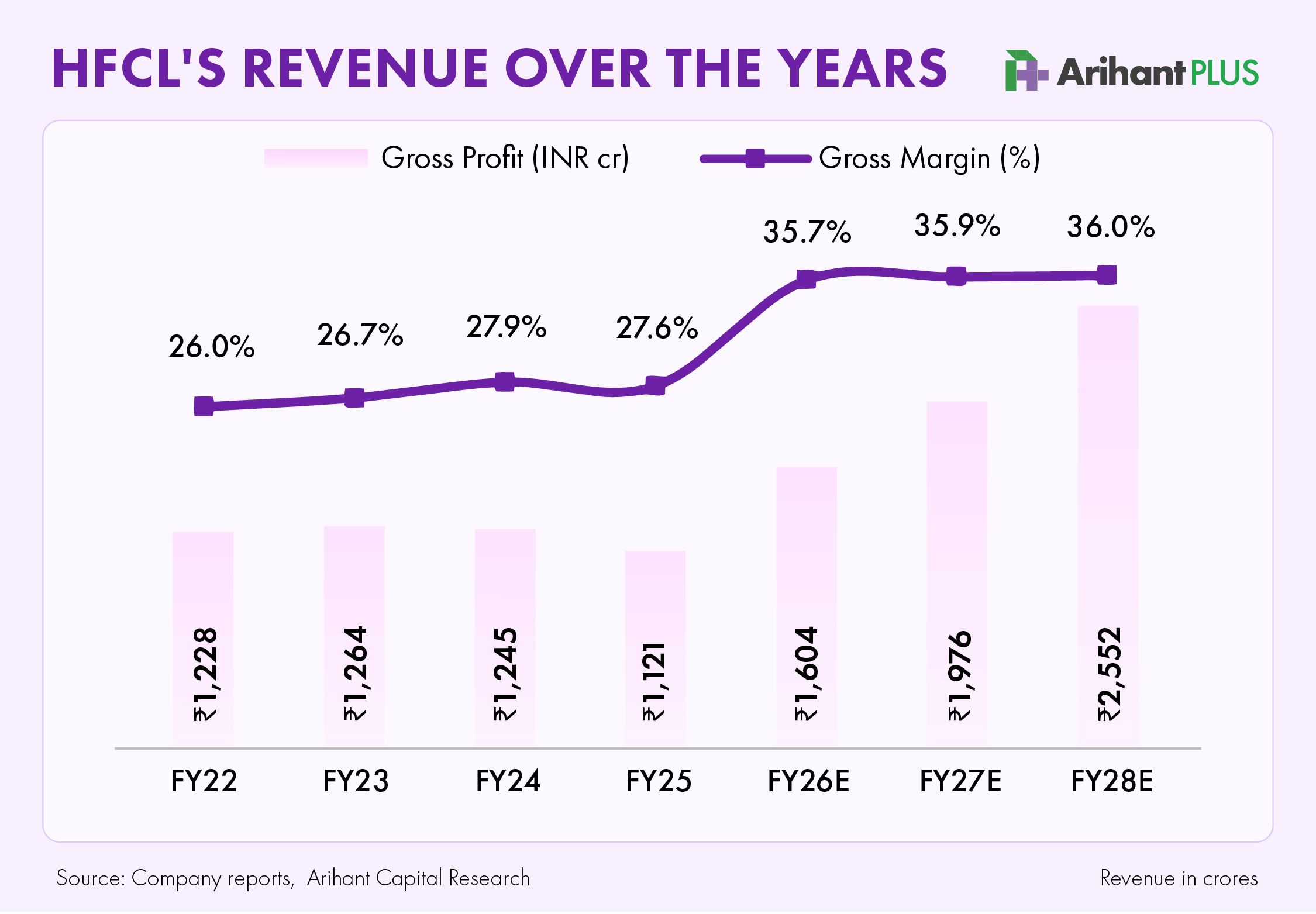

Gross margins which stood at 26% in FY22 have gradually started showing an improvement. It stood at 37.9% in Q3FY26 an increase of 703 bps YoY. Softening raw material cost and focusing on higher margin products and solutions are the key factors driving this change.

The final word: to invest or not to invest

At the current price of ₹69*(check the current market price by clicking the link) , the stock is valued well below its medium-term potential. On a sum-of-the-parts basis, the target price of ₹146 implies ~111% upside.

Quiet execution, structural tailwinds, and improving returns—HFCL may finally be entering its rerating phase.

Ready to take advantage of this opportunity, open your Arihant Plus app and invest in HFCL. Not on Arihant Plus yet? Don’t miss out! Download the app today and start investing.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Readers should consult a financial advisor before making any investment decisions.

Registered Analyst (RA): Abhishek Jain.

Balasubramanian A

Related Topics