Tuesday is the New Thursday: NSE & BSE Expiry Shift from Sep 2025

By

Arihant Team

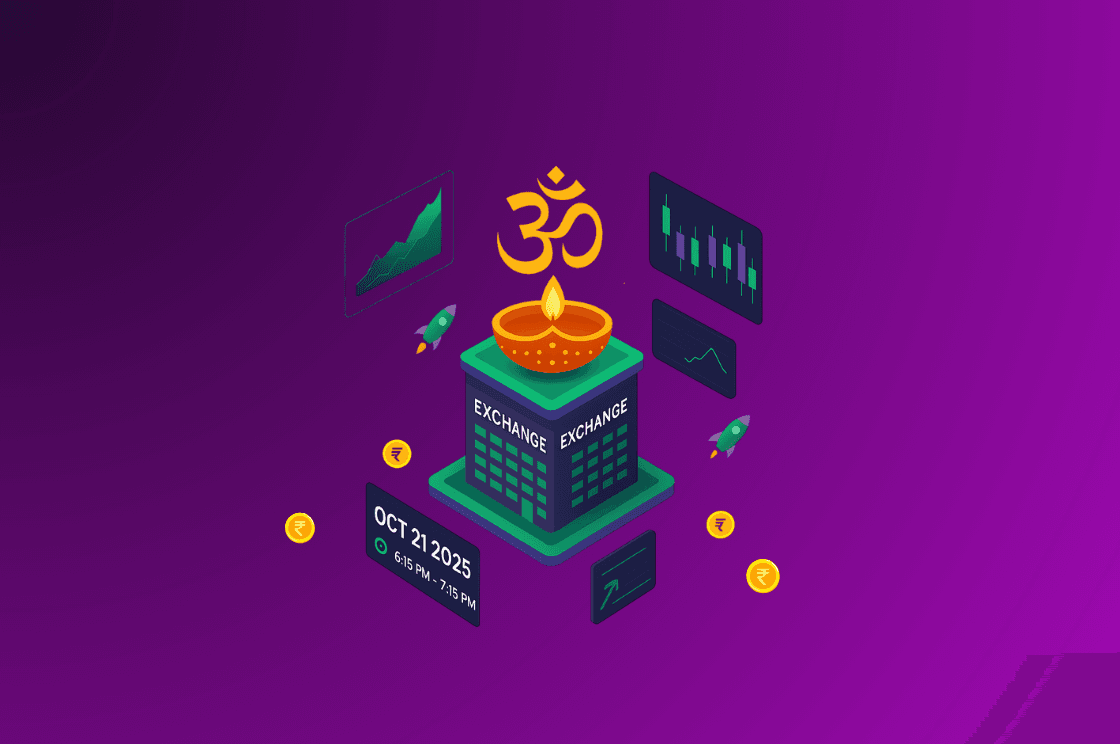

SEBI revises expiry from September 1, 2025: NSE contracts on Tuesdays, BSE on Thursdays. This ends a 25-year Thursday tradition, reshaping trading strategies, risk management, weekend decay, and arbitrage opportunities.

In This Article

- Why the Change in NSE, BSE Expiry days?

- The Biggest Structural Change in Expiry Days

- Implementation Timeline

- What This Means for Traders

- Market-Wide Implications

- The Bigger Picture

- Final Thoughts

For 25 long years, one thing was constant in the Indian stock market, Thursday meant expiry day. Ask any trader, and they would tell you, Thursday is when the real action happens, when volatility shoots up, when strategies either shine or collapse.

But now, history is about to change.

From September 1, 2025, Nifty and Bank Nifty will no longer expire on Thursdays. Instead, they’ll expire on Tuesdays. Yes, you read that right, after 25 years, Tuesday is the new Thursday for Nifty traders.

And that’s not all. Thanks to SEBI’s new rule, all equity futures and options contracts in India will now expire only on two days Tuesday and Thursday. The entire derivatives market calendar has been reset.

Why the Change in NSE, BSE Expiry days?

On May 26, 2025, SEBI released a circular standardizing expiry day across exchanges. Until now, each exchange could choose its own expiry schedule. That meant multiple expiries on different days, creating constant speculation and bursts of volatility.

SEBI’s logic is simple: streamline expiry, reduce unnecessary chaos, and bring more discipline to the market.

So, here’s the big swap:

- All NSE contracts will now expire on Tuesdays, and all BSE contracts will now expire on Thursdays.

This means all NSE contracts along stock’s futures and options will expire on Tuesdays. Meanwhile, BSE’s Sensex and stock derivatives will follow Thursday expiries.

The Biggest Structural Change in Expiry Days

Let’s break this down:

Revised Contract Expiry Schedule – NSE effective from 1st September 2025

Derivatives | Particulars | Current Expiry Day | Revised Expiry Day |

Index | NIFTY monthly, quarterly and half yearly contracts | Last Thursday of expiry month | Last Tuesday of expiry month |

| NIFTY weekly contracts | Thursday of the week | Tuesday of the week |

| BANKNIFTY monthly & quarterly contracts | Last Thursday of expiry month | Last Tuesday of expiry month |

| FINNIFTY, MIDCPNIFTY and NIFTYNXT50 monthly contracts | Last Thursday of expiry month | Last Tuesday of expiry month |

Stocks | All Monthly contracts | Last Thursday of expiry month | Last Tuesday of expiry month |

Revised Contract Expiry Schedule – BSE effective from 1st September 2025

Index/ Stock Derivatives | Contract Type | Existing Day | Revised Day |

SENSEX | Weekly Expiry | Tuesday of expiry week | Thursday of expiry week |

| Monthly Expiry | Last Tuesday of expiry month | Last Thursday of expiry month |

BANKEX | Monthly Expiry | Last Tuesday | Last Thursday |

SENSEX 50 | Monthly Expiry | Last Tuesday | Last Thursday |

Single Stock | Monthly Expiry | Last Tuesday | Last Thursday |

Implementation Timeline

The transition will happen smoothly:

- August 28, 2025: After market close, expiry dates of live contracts will automatically be adjusted.

- August 29, 2025: New contract cycle begins; brokers and apps will update their systems.

- September 1, 2025: All new contracts will directly follow the Tuesday–Thursday schedule.

Important: contracts expiring before August 31 will stick to their old expiry dates.

So, if you’re using apps like ArihantPlus, don’t worry, your contracts will automatically reflect the changes.

What This Means for Traders

Now comes the interesting part of how this change impacts trading behavior.

1. Theta Decay Gets Sharper

Option values naturally melt as expiry approaches. With Tuesday expiry, weekend time decay (Saturday + Sunday) will hit option buyers harder. If you’re holding options from Friday to Monday, your premium will shrink faster.

- Good news for sellers: More time decay = more premium erosion.

- Tougher for buyers: Less chance of recovering losses after the weekend.

2. Gamma Exposure Intensifies

As expiry nears, price swings get sharper. With Tuesday expiry, Monday and Tuesday will see wild volatility. Market makers and institutions will need to adjust their hedging and gamma scalping strategies.

3. Friday Closing Becomes Critical

Earlier, traders had time till mid-week to adjust. Now, Friday decisions matter more because the weekend will eat into your option premiums.

Market-Wide Implications

This isn’t just about retail traders, it affects everyone.

- FIIs (Foreign Institutional Investors):

Their trading systems will need reprogramming to align with the Tuesday cycle, which may clash with global expiry calendars.

- Mutual Funds & Insurance Companies:

They’ll have to tighten risk management since the adjustment window has shrunk.

- Retail Traders:

The weekend decay will hit hardest. Holding positions overnight on Friday will be riskier than before.

- Market Makers & Brokers:

Liquidity supply and spreads will change. Bid-ask spreads may widen on Tuesdays, especially near closing hours.

- NSE vs BSE Arbitrage:

With different expiry days, arbitrage opportunities open up between the two exchanges. But remember BSE’s derivatives liquidity is still lower than NSE, so the scope might be limited.

The Bigger Picture

This move is designed to reduce unnecessary volatility that often spiked on random weekdays, while distributing trading activity more evenly across the week. At the same time, it will push traders to adopt a more disciplined approach instead of relying on scattered expiry opportunities. In many ways, it’s the market’s way of compelling everyone, whether big institutions or small retail traders, to level up their strategies and operate with sharper precision.

Final Thoughts

After nearly 25 years, the expiry culture of Indian derivatives is getting a complete makeover. Starting September 1, 2025, NSE contracts will expire on Tuesdays and BSE contracts on Thursdays, marking not just a minor adjustment but a fundamental restructuring of the market.

For traders, this shift means it’s time to recalibrate strategies, tighten risk management, and embrace Tuesday as the new expiry reality. Because in the stock market, one golden rule always applies adapt to change, or the market will make you adapt.

Related Topics