Nifty 50 Performance Since Last Muhurat Trading: Nifty Top 10 Performers

By

Arihant Team

From Muhurat trading 2024 to 2025, Nifty’s top performers showcased India’s growth story, steady demand, strong earnings, and broad-based market momentum kept investor sentiment upbeat throughout Samvat 2081–2082

In This Article

- Introduction

- Which stocks gave the highest returns between Muhurat Trading 2024 and 2025?

- How did Bharat Electronics (BEL) emerge as the defence sector hero?

- How did Maruti Suzuki sustain investor confidence with 30% returns?

- Why did Bharti Airtel, JSW Steel, and Apollo Hospitals perform steadily?

- What trends can investors take away from since the 2024 muhurat trading session?

- What can investors expect in the next Samvat year?

- Wrapping Up

Introduction

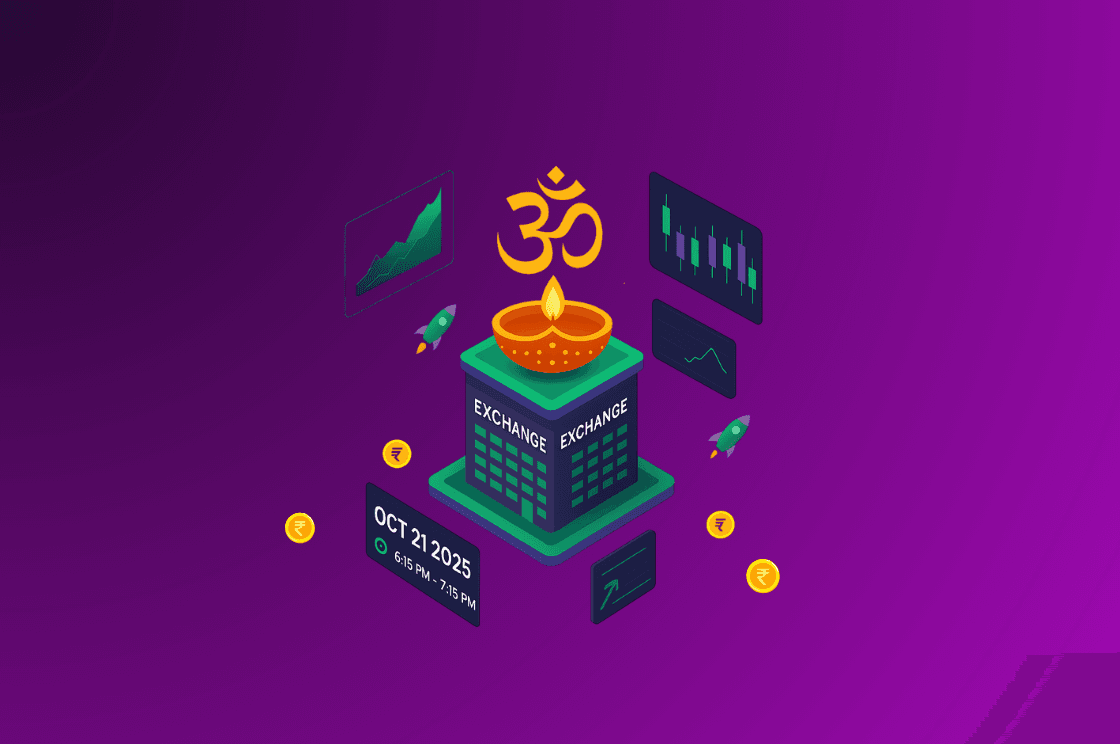

Diwali isn’t just about lights and celebrations for the stock market; it’s also about new beginnings and prosperity. Every year, the NSE and BSE hold a special one-hour session called Muhurat Trading, marking the start of the new Samvat year based on the Hindu calendar. This Diwali 2025, the special ‘muhurat trading’ session is scheduled on Tuesday, October 21, between 1:45 pm and 2:45 pm.

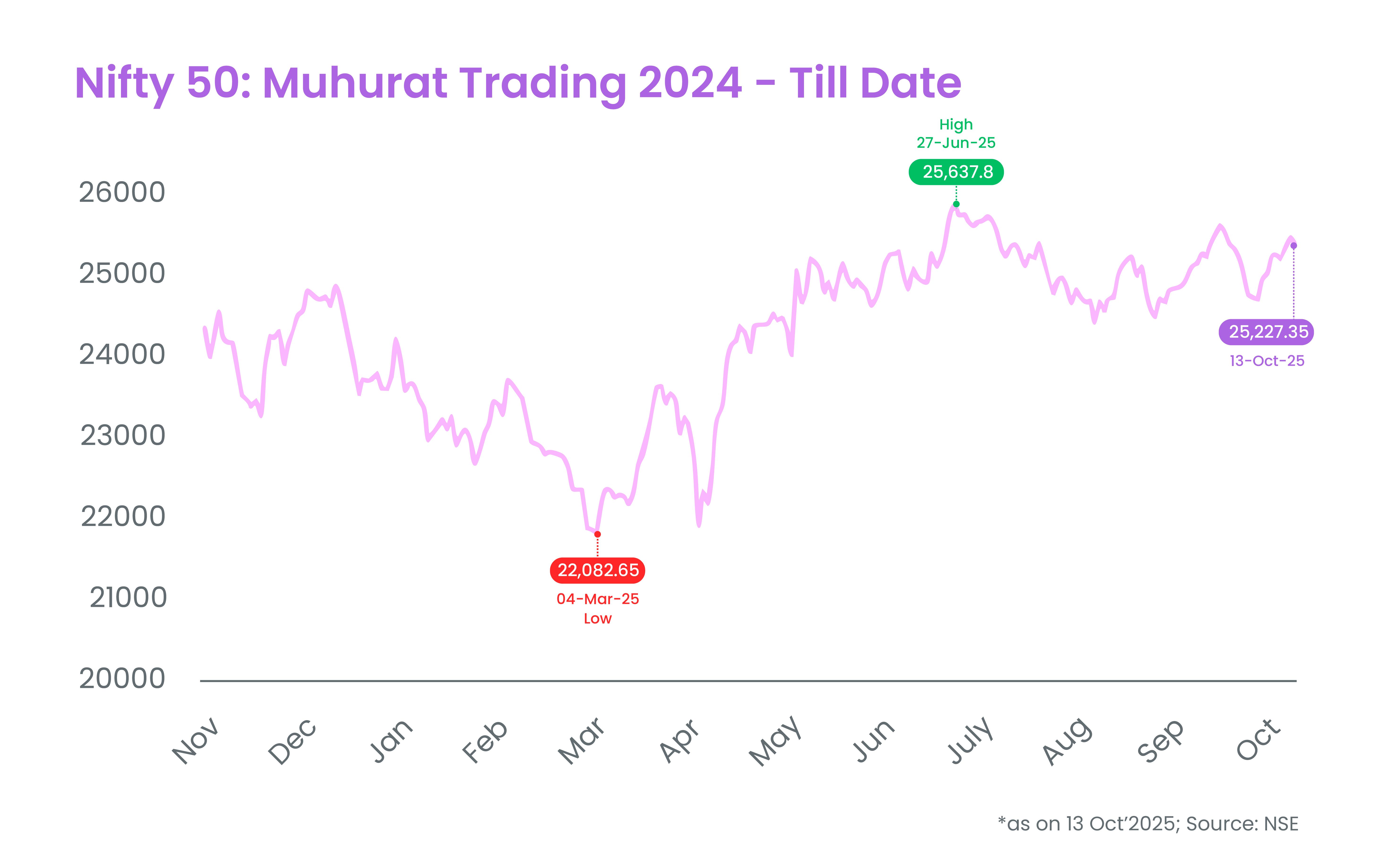

Between Muhurat Trading 2024 and Muhurat Trading 2025 (Samvat 2081–2082) Nifty 50 remained flat, underperforming other asset classes like gold and silver. From November 1, 2024 to October 13, 2025, the Nifty 50 index delivered an annualized return of approximately 4.01% (whereas gold jumped 54% and silver 57% in the same period). During the Samvat year, the index hit its lowest level of 22,082.65 on March 4, 2025, while its highest point was 25,637.80 on June 27, 2025.

On the global front, Indian equities underperformed other markets like China, Hong Kong, Taiwan, South Korea and Brazil by a wide margin this year. However, despite a lackluster performance of Indian equities some sectors performed well including automobile, defence, finance, and telecom sectors.

Foreign portfolio investors (FPIs) have been net sellers of Indian equities to the tune of ₹1.6 lakh crore in the ongoing Samvat year so far. According to NSDL data, FPIs were net sellers of Indian stocks in seven out of eleven months since the last muhurat trading session.

Let’s dive into who were the top performers of Nifty 50 since the last Muhurat Trading session till date and what drove their impressive returns.

Which stocks gave the highest returns between Muhurat Trading 2024 and 2025?

Here’s the list of Nifty’s top 10 performers in the Samvat year 2081–2082, ranked by their year-to-date returns:

Stock Name (Nifty50) | Year-to-date returns |

Eicher Motors | 44.73% |

Bajaj Finance | 44.13% |

Bharat Electronics | 43.38% |

Maruti Suzuki | 30.17% |

Eternal (Zomato) | 24.37% |

HDFC Bank | 15.76% |

Bharti Airtel | 15.3% |

JSW Steel | 15.05% |

Kotak Mahindra Bank | 12.59% |

Apollo Hospitals | 8.27% |

Source: Investing.com, Data on October 13, 2025

From automobile and telecom to banking and healthcare, stocks from various sectors contributed to the market rally since the last muhurat trading session.

Why did Eicher Motors top the list with over 44% returns?

Among the Nifty 50 stocks, Eicher Motors, the maker of Royal Enfield, stole the show with a massive 44.73% return since the last Samvat year.

The company benefited from a surge in demand for premium motorcycles, both in India and overseas. The successful launch of new models, combined with a strong export push and margin expansion, boosted investor sentiment.

Eicher also rode on India’s rising middle-class aspirations — where owning a Royal Enfield remains a lifestyle statement. With consistent growth in volumes and profitability, it’s no surprise that Eicher turned out to be the Nifty50’s star performer.

How did Bharat Electronics (BEL) emerge as the defence sector hero?

At a close second, Bharat Electronics (BEL) delivered an impressive 43.38% return. This rally was fueled by India’s growing focus on defence indigenization and the government’s Make-in-India initiatives.

BEL’s strong order book, solid financials, and its positioning as a trusted PSU in the defence space made it a go-to stock for long-term investors. The company’s diversification into electronic warfare, radars, and communication systems has also widened its revenue base.

BEL clearly emerged as the poster child of India’s defence growth story in Samvat 2081–2082.

What helped Bajaj Finance maintain its growth momentum?

Bajaj Finance, one of India's leading NBFCs, achieved a robust 44.13% gain during the annual period.

Despite a tough macro environment, Bajaj Finance continued to expand its digital ecosystem while maintaining exceptional asset quality. By focusing on retail lending and small business lending amid a strong customer base and databased credit models, Bajaj Finance maintained a competitive lead.

Investors recognized the company’s uninterrupted profitable performance and innovation-driven business model to be a primary reason for the company being one of the preferred stocks in Nifty50 for financial companies.

How did Maruti Suzuki sustain investor confidence with 30% returns?

Maruti Suzuki, India's foremost automaker, saw 30.17% returns on the back of higher sales in the SUV and hatchback segments, continued supply chain normalcy, and strong margins.

Moreover, by introducing models in the hybrid and CNG space, Maruti not only addressed the rising consumer demand in these areas but benefitted from being future ready for their EV transition. Overall, its consistent operating performance, and leadership position in the passenger vehicle market, ensured stable compounding and returns for investors in this Samvat year.

What Drove Gains in Eternal (Zomato), HDFC Bank & Kotak Bank?

Eternal (or Zomato) surged 24.37% since the last Muhurat Trading session, reflecting investor confidence in its strong fundamentals and consistent growth. Zomato recorded a staggering 50.14% jump in its net profit to ₹527 crores in financial year 2025, from last year.

Additionally, HDFC Bank (15.76%) and Kotak Mahindra Bank (12.59%) regained their respective momentum post their merger consolidation and improved credit growth. Both private sector lenders benefitted from rising deposits, stable NIMs (net interest margins) and improved loan quality attributes. Their strong performance continues to highlight how financials remained the bedrock of stability within markets, in the face of global/international volatility or change.

Why did Bharti Airtel, JSW Steel, and Apollo Hospitals perform steadily?

- Bharti Airtel (15.3%): The telecom giant continued to grow its ARPU (Average Revenue Per User) and benefitted from the expansion of 5G. Its Africa business continued to show solid earnings and remains a long term institutional investor favorite.

- JSW Steel (15.05%): Backed by strong domestic infrastructure demand and stable steel prices, JSW Steel showed healthy performance while reporting prices pressured from global commodity pressures.

- Apollo Hospitals (8.27%): The leader in healthcare had continued momentum for both physical hospital operations and its digital health platform Apollo 24/7. Growth in healthcare engagement and Tier-II city growth added more momentum to Apollo's modest growth.

These companies represent resilience and sectoral strength, even in a year marked by global uncertainty.

What trends can investors take away from since the 2024 muhurat trading session?

Looking at these top performers, a few clear trends emerge:

- The rally was led by auto and financials, driven by healthy domestic demand and strong credit growth.

- The defence and PSU stocks outperformed, reflecting policy support and investor confidence in government-backed companies.

- Diversification proved beneficial with stability in sectors like telecom, steel, and healthcare amid market volatility.

- Quality matters – companies with high visibility of consistent earnings, strong governance, and growth lift themselves above the rest.

In short, India’s growth story stayed intact, and the best-run companies continued to deliver impressive returns.

What can investors expect in the next Samvat year?

Whereas Samvat 2081–2082 was characterized by consolidation and selective rallies, it is possible that the year to come will be characterized by sector rotation and new leadership.

With inflation moderating and international interest rates easing, look for traditional-growth sectors like IT, consumption, and infrastructure to come to the fore. It is even still likely that the frontrunners in the auto, defence, and financial sectors can continue to thrive long into the future, given India's economic fundamentals.

Investors should take a quality-oriented approach based on earnings, momentum, and qualitative thematic sector positions instead of chasing performance and high multiples.

Wrapping Up

India’s growth story remains strong despite the tailwinds. The global factors, uncertainties over Trump’s tariffs.

From market leaders like Eicher Motors to steady performers like Apollo Hospitals, Muhurat Trading 2024–2025 reflected India’s balanced market growth. Strong domestic demand, policy tailwinds, and quality leadership fueled this rally. As Samvat 2082 begins, investors must stay focused on fundamentals, disciplined allocation, and long-term wealth creation.

Related Topics