The #1 Mistake Indian ETF Investors Make: Ignoring Tracking Error

By

Arihant Team

ETFs offer diversification and simplicity, but choosing wisely is key. Beyond expense ratio and returns, tracking error matters most revealing how closely an ETF mirrors its benchmark, ensuring consistent, reliable, and predictable performance.

In This Article

- What is Tracking Error?

- Why Does Tracking Error Matter?

- What is Tracking Difference?

- Difference between Tracking Error & Tracking Difference

- How to Pick the Right ETF?

- Top 5 ETFs with the Lowest Tracking Error

- Conclusion

Picking the right ETF can feel overwhelming. We’ve all heard how exchange-traded funds (ETFs) are a smart, simple way to diversify your portfolios. They're like a pre-packaged basket of investments you can buy and sell like a single stock. ETFs aim to replicate the performance of their benchmark indices or underlying security, such as the NIFTY 50 or SENSEX (in case of Index ETFs) or gold (in case of gold ETFs).

It’s no wonder they’ve become increasingly popular among Indian investors, given their simplicity, diversification, and cost-effectiveness. But let’s be honest, with so many ETFs in the market – picking the right one can be daunting. Most investors focus on the expense ratio and past returns, and those are important. However, there’s a crucial, often overlooked factor, that can silently eat up your returns – Tracking Error. Understanding this single number can make a big difference in how closely your investment mirrors the actual index performance and, ultimately, how much you earn.

Let’s dive and learn about tracking error and how to use it to select the right ETF for you.

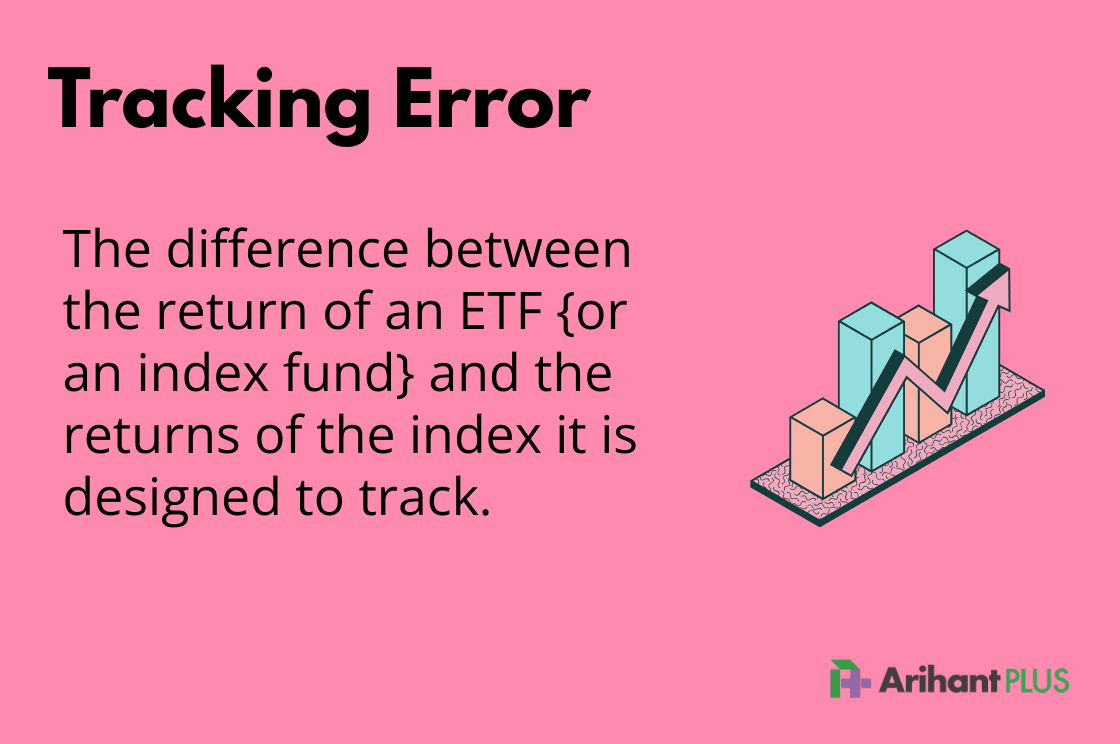

What is Tracking Error?

The goal of an ETF is to track a specific market index or asset (like gold). However, even the best ETFs, which are designed to perfectly copy a market index, will almost never have the exact same returns. There will always be a tiny difference. Tracking error is simply the number we use to measure that difference.

Tracking error is basically the “gap” between the performance of your ETF and its benchmark index (like the Nifty 50 or Sensex). Imagine you’re following your friend who’s driving to airport along a set path (the index). If you’re following the same route you’re doing great—but if you’re turning and taking a different route, sometimes ahead, sometimes behind, that’s tracking error.

Tracking error quantifies the volatility or variability of the difference between a fund's returns and its benchmark's returns over a specific period. In technical terms, it is the annualized standard deviation of the daily return differences between the fund and the benchmark.

A lower tracking error indicates that your ETF is closely following its benchmark, while a higher tracking error suggests greater deviation that can surprise you (in a good or a bad way) because it is not as closely tracking its index.

Why Does Tracking Error Matter?

The goal of an ETF is to track a specific index. Tracking error measures how well is your ETF doing its “task” - aka replicating the return of its target index. When you invest in an ETF, you are not paying the fund manager to pick winning stocks for you. You’re paying them to match the returns of its benchmark index.

A higher tracking error means the ETF is not closely following the index – it can underperform (or overperform) silently eating up your returns or making your returns less predictable. It indicates inefficiencies in fund management, such as suboptimal replication strategies, higher transaction costs, leading to unexpected deviations from the benchmark's performance.

As an investor, it’s important for you to pick an ETF with a low tracking error. It ensures that your investment closely aligns with the benchmark, providing predictable returns.

What is Tracking Difference?

In the world of ETFs, tracking difference is also often used metric. But don’t confuse tracking error with tracking difference. They have a similar job yet are different in their measurement and interpretation.

Tracking Difference measures the absolute difference between a fund's return and its benchmark's return over a specific period. It indicates whether the fund has outperformed or underperformed the benchmark.

Example: If the NIFTY 50 Index returns 12% in a year and the corresponding Index Fund returns 11%, the Tracking Difference is -1%. This negative difference suggests that the fund underperformed its benchmark by 1%.

Unlike tracking error, which focuses on volatility, tracking difference provides a straightforward measure of performance deviation.

Difference between Tracking Error & Tracking Difference

Aspect | Tracking Difference | Tracking Error |

Definition | The absolute difference between a fund's return and its benchmark's return over a specific period. | The standard deviation of the difference between the fund's returns and the benchmark's returns over a specific period, indicating the volatility of this difference. |

Indicates | Measures whether the fund has outperformed or underperformed its benchmark. | Measures the consistency of the fund's performance relative to its benchmark. |

Measurement | Calculated as the difference between the fund's return and the benchmark's return over a set period. | Calculated as the standard deviation of the differences between the fund's and the benchmark's returns over multiple periods. |

Interpretation | A positive value indicates outperformance; a negative value indicates underperformance. | A lower value indicates a closer replication of benchmark’s performance, while a higher value indicates greater variability. |

Focus | Focuses on the magnitude of deviation from the benchmark. | Focuses on the variability of the deviation from the benchmark. |

Use case | Helps investors assess the extent to which a fund has met or deviated from its benchmark's performance. | Assists in evaluating the reliability and consistency of a fund's tracking relative to its benchmark. |

How to Pick the Right ETF?

Tracking Error: Look for ETFs with lower tracking errors for more consistency and predictability.

Expense Ratio: Lower fees leave more money in your pocket.

- AUM: A larger asset under management (AUM) often means better liquidity.

Top 5 ETFs with the Lowest Tracking Error

Scheme Name | AUM | TER (%) | Tracking Error (%) | 10-Year Tracking Difference (%) |

SBI BSE Sensex ETF | 1,23,200 | 0.04 | 0.03 | -0.08 |

HDFC Nifty ETF | 2,700 | 0.05 | 0.04 | -0.15 |

ICICI Prudential Nifty 50 ETF | 18,600 | 0.03 | 0.03 | -0.16 |

Kotak Nifty 50 ETF | 2,600 | 0.04 | 0.03 | -0.17 |

Nippon India ETF Nifty 50 Bees | 31,000 | 0.04 | 0.03 | -0.17 |

ETF Insights

SBI BSE Sensex ETF:

Launched in March 2013, the SBI BSE Sensex ETF tracks the performance of the BSE Sensex. It boasts one of the lowest tracking differences in the industry, ensuring exceptional consistency with its benchmark.

- Launch Date: March 8, 2013

- Benchmark: BSE Sensex

- Minimum Investment: ₹5,000

- AUM: ₹1,17,254 Cr

This ETF is a solid choice for investors seeking steady performance aligned with the Sensex.

HDFC Nifty ETF:

Launched in July 2011, the HDFC Nifty ETF tracks the performance of the NIFTY 50 TRI index. It stands out for its efficient expense management, making it a robust choice for investors seeking NIFTY 50 exposure.

- Launch Date: July 22, 2011

- Benchmark: NIFTY 50 TRI

- Minimum Investment: ₹5,000

This ETF offers an affordable and reliable way to invest in India’s top 50 companies.

AUM: ₹4,664.38 Cr

ICICI Prudential Nifty 50 ETF:

Launched in March 2013, the ICICI Prudential Nifty 50 ETF tracks the performance of the NIFTY 50 TRI index. Known for its high liquidity and low costs, it provides excellent tracking accuracy for investors.

- Launch Date: March 20, 2013

- Benchmark: NIFTY 50 TRI

- Minimum Investment: ₹5,000

- AUM: ₹31,378.05 cr

Kotak Nifty 50 ETF:

Launched in February 2010, the Kotak Nifty 50 ETF is known for its consistency and reliability in tracking the NIFTY 50 TRI index.

- Launch Date: February 2, 2010

- Benchmark: NIFTY 50 TRI

- Minimum Investment: ₹5,000

- AUM: ₹ 3,255 Cr

Nippon India ETF Nifty 50 Bees:

Launched in December 2001, the Nippon India ETF Nifty 50 Bees is one of the earliest ETFs in India and has a strong reputation for reliability and scale.

- Launch Date: December 28, 2001

- Benchmark: NIFTY 50 TRI

- CAGR Since Inception: 15.10%

- Minimum Investment: ₹10,000

- AUM: ₹48,923 cr

AUM data as of 31 July 2025

Conclusion

ETFs are great tools for passive investors, but picking the right one requires a little homework. You should focus on ETFs with low tracking error and tracking difference for the best long-term performance, in addition to expense ratio and AUM of the fund. Tracking error will measure the variability of returns and tracking difference will directly measure the performance gap. By doing this, you’ll ensure your investments stay on track, just like your financial goals!

Related Topics