Diwali Muhurat Trading: Can Nifty’s 7-Year Winning Streak Continue?

By

Arihant Team

Nifty 50 has closed positive in seven straight Muhurat Trading sessions since 2017. As Diwali 2025 nears, investors wonder, can the festive momentum and bullish streak continue this year?

In This Article

- Introduction

- How has the Nifty 50 performed during Diwali’s Muhurat Trading?

- Did Nifty50 ever fall during Muhurat Trading?

- Why does muhurat trading matter for investors?

- Lessonss from past sessions

- What can we expect from 2025 muhurat session?

- Final Thoughts

Introduction

Every year, Diwali brings not just lights, sweets, and celebrations but also a special hour for stock market enthusiasts: Muhurat Trading. The stock market opens for a special one-hour trading session, on the Diwali day, for traders and investors to make auspicious trades during the muhurat hour. It marks an auspicious beginning of the new Samvat year, based on the Hindu calendar. Traders and investors believe that buying shares or ETFs during this hour brings good luck and prosperity. Many families even make token purchases, their “first trade” of the new year, to mark a fresh start.

Over time, this symbolic ritual has turned into one of the most watched market events of the year. But how has the Nifty 50 actually performed during this golden hour in the last decade? Let’s find out.

How has the Nifty 50 performed during Diwali’s Muhurat Trading?

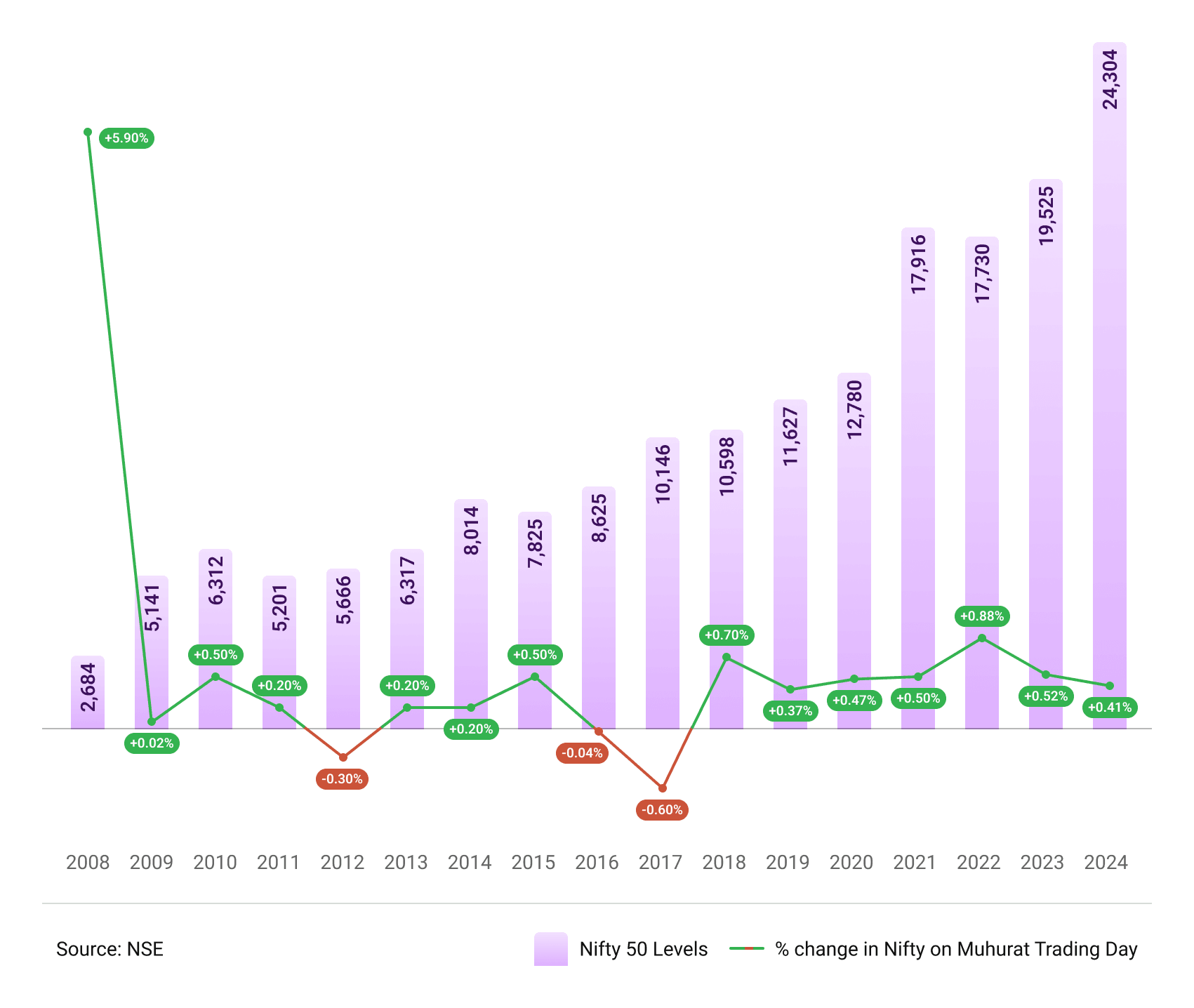

When we look at the last ten-year muhurat trading session performance, from 2015 to 2024, Nifty 50 has mostly ended on a positive note. Out of 10 years, the index has closed in green in 8 sessions, reflecting the overall festive optimism that usually drives the market higher. 2008 was the best performance of Nifty 50 during the muhurat trading session when the index jumped almost 6%, its best in recent history. Interestingly, Nifty has delivered an impressive 14.76% CAGR returns since 2008.

If we observe the last three years 2022, 2023, and 2024, Nifty clocked returns of 0.88%, 0.52%, and 0.41% respectively.

Interestingly, this period also coincided with strong domestic flows, rising retail participation, festive offers from brokers and improved investor sentiment. The participation of new-age investors and digital platforms has further boosted the popularity of this one-hour session.

Moreover, sectors like banking, FMCG, and automobiles tend to perform better during the Muhurat session, as festive demand and positive consumer outlook often drive these stocks higher.

Here’s a quick look at the year-wise performance of Nifty 50 during Muhurat Trading: Clearly, the trend shows a strong positive bias, with Nifty 50 gaining in most years, even though the percentage change is modest.

What is the average return during Muhurat Trading?

If we average the performance across the last 11 years, Nifty 50 has delivered around 0.4% gains during the Muhurat session.

While that may not seem significant, it is critical to note that Muhurat Trading is only for one hour and is more of a sentimental than a speculative play. Typically, traders will do something like make new investments, symbolic trade or booking symbolic profit rather than making aggressive trades with respect to ‘inviting’ prosperity during the auspicious muhurat of Diwali.

Did Nifty50 ever fall during Muhurat Trading?

Yes, even Diwali does not insulate the markets from volatility. Nifty 50 has produced some red candles a couple of times in the last decade in 2016 (–0.14%) and 2017 (–0.63%).

These are the years that remind us that although the festive spirit raises expectations for a positive sentiment on the muhurat trading session, fundamentals still govern the stock market. Broader variables such as global cues, political events, or corporate earnings can move the market in either direction, even on an auspicious day.

However, that those declines were marginal, suggests the investor inclination exists to mostly remain positive or at least refrain from selling heavy during this symbolic trade.

Why does muhurat trading matter for investors?

For most market participants, Muhurat Trading is not about short-term profit, but about starting the new Samvat year on a positive note. It blends the emotion of tradition with the logic of investing.

Here’s why this session matters:

- Sentiment booster: It often sets the tone for how investors feel entering the new year.

- Fresh positioning: Many traders take new positions or square off old ones to start afresh.

- Symbolic wealth creation: Long-term investors buy blue-chip stocks to mark the beginning of their financial journey for the new year.

- Low volatility window: With limited participation and high optimism, the session usually stays calm and positive.

Lessonss from past sessions

Looking back at the data, a few key takeaways stand out from previous muhurat trading sessions:

- Positivity prevails: Nifty has closed positive in 9 out of the last 11 years — that’s a success rate of over 80%.

- Moderate gains: The average movement hovers around 0.4%–0.6%, showing it’s more of a feel-good session.

- Avoid over-trading: Since volumes are lower, large positions can be risky. It’s better to trade small and focus on quality names.

- Good time to rebalance: Many investors use this occasion to clean up their portfolio or add long-term holdings.

In essence, muhurat trading is more symbolic than strategic. It’s a perfect occasion to mark intent and optimism, not to chase short-term returns.

What can we expect from 2025 muhurat session?

If history is any guide, the odds remain in favour of a positive close. But as always, the broader market context will play a big role, and global economic cues, interest rate trends, and earnings outlook could all influence short-term direction.

However, the spirit of muhurat trading will likely stay unchanged, optimism, faith, and the joy of new beginnings. For many, it’s not just about returns; it’s about reaffirming confidence in the long-term India growth story.

Final Thoughts

The last decade of Muhurat Trading shows that Nifty 50 loves to celebrate Diwali in green. With an average gain of around half a percent and only two negative years, the trend clearly favours bulls.

Muhurat Trading is a reminder that equity, as an asset class, is a powerful tool for long-term wealth creation. Instead of focusing on day-to-day volatility, this day encourages you to make a purposeful, symbolic investment in quality stocks or ETFs. So, whether you buy your first stock or simply watch the market glow for that one hour, Muhurat Trading is the perfect symbol of wealth, hope, and new beginnings in the Indian financial calendar.

Related Topics