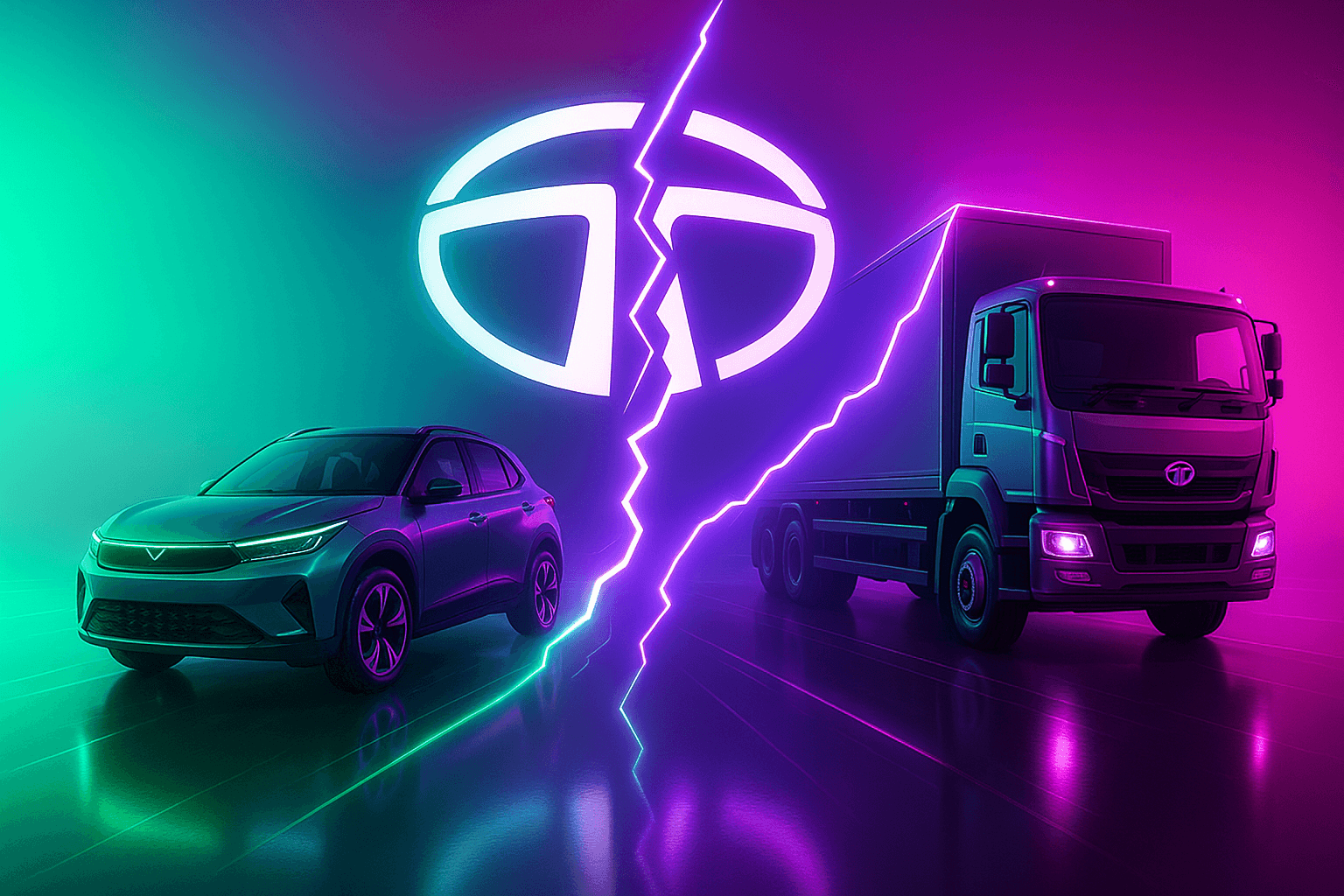

Tata Motors Demerger Gets NCLT Nod: What Shareholders Must Know

By

Arihant Team

Tata Motors demerger finally gets NCLT approval. It is splitting into two separate companies—one managing the commercial vehicles arm while other will take care of passenger vehicles. Record date is set at 14 Oct - the day to determine which shareholders will receive shares of TMLCV. This demerger will make it easier for investors to see the value of each business.

In This Article

- The Story

- Key facts & dates

- What happens to your shares?

- Why did Tata Motors decide to demerge?

- Bottom line

- FAQs

The Story

It’s official. Tata Motors’ long-awaited demerger has cleared the final hurdle. The National Company Law Tribunal (NCLT) has approved the split of Tata Motors into two separate listed entities to better capitalise on growth opportunities. Of the two new entities, one will handle the passenger vehicles arm that includes the electric vehicles (EVs) and the premium Jaguar Land Rover division and the other owning the commercial vehicles (CV) business aka trucks and buses.

For shareholders, this marks the beginning of a new phase where both businesses will run independently, with their own balance sheets, boards, and growth strategies.

Key facts & dates

Before we get into the nitty gritty of the demerger, let’s take a look at some important information:

Effective Date: The demerger will officially come into effect from October 1, 2025. The demerger received board’s approval in March 2024 and NCLT approval on 26th September 2025.

Record Date: Tuesday, October 14, 2025 is set as the record date for the demerger of its commercial vehicles entity.

Completion Timeline: Tata Motors plans to complete all operational formalities by the second quarter of FY26.

Entity Structure:

- Tata Motors, the existing entity, will retain the passenger vehicles and JLR business (passenger cars, electric vehicles, Jaguar Land Rover).

- The commercial vehicle business and related investments will move into a new company (initially called TML Commercial Vehicles Limited), which may later be renamed.

- Both the companies will be renamed

- Tata Motors, the existing entity, will retain the passenger vehicles and JLR business (passenger cars, electric vehicles, Jaguar Land Rover).

Share Split Ratio (Swap Ratio): Share entitlement ratio is set at 1:1, which means for every 1 share of Tata Motors you hold, you will receive 1 share in the new CV company.

- Separate Listings: Post demerger, both entities (CV side & PV + JLR side) will be listed individually on NSE and BSE.

What happens to your shares?

Let’s understand this with an example. Assume you own 100 shares of Tata Motors, currently trading at ₹650, which means the value of your holding is ₹65,000 (100 × ₹650).

- After the demerger, you will continue to own 100 shares of Tata Motors.

- On top of that, you’ll also get 100 more shares of the newly listed entity.

Now, the market will re-price these separately.

- Suppose after the split, the PV + JLR stock trades at ₹500 per share, and the CV stock trades at ₹150 per share.

- Total value = (100 × ₹500) + (100 × ₹150) = ₹65,000.

So basically, you will now hold shares in two separate companies — one for PV + JLR, another for CV. And the value of your overall investment will remain the same, even after the split.

Why did Tata Motors decide to demerge?

Passenger vehicles and commercial vehicles are two completely different segments.

- Passenger Vehicles + JLR → Growth driven by EVs, global expansion, and premium positioning.

- Commercial Vehicles → Stable, cyclical, closely tied to India’s infrastructure and logistics growth.

By splitting the two businesses — the cash-generating cyclical commercial vehicles business unit and the very fast-growing but capital-heavy passenger vehicles and Jaguar Land Rover business division—shareholders can consider each business on its own.

Through the demerger, Tata Motors ensures each business gets the management focus and fundraising ability it needs, without being overshadowed by the other. "The proposed demerger will bring greater strategic clarity and agility, enabling a more focused approach to execution and value creation, delivering superior experiences for customers, rewarding careers for employees, and long-term returns for shareholders," Mr. Natarajan Chandrasekaran, Tata Motors Chairman said in their FY25 annual report.

This step eliminates the so-called “conglomerate discount”, by which markets value one company lower just because they hold very different businesses within the same roof.

Bottom line

The demerger isn’t about breaking apart; it’s about unlocking clarity and choice for investors. Tata Motors has separated its growth story into two entities—EVs and luxuries on one side, trucks and buses on the other.

And as history shows, Indian demergers create value. Will Tata Motors? That will depend on how each of the new companies will perform. However, now this will allow shareholders the choice to invest in the growth story they prefer – one of passenger vehicles or the commercial vehicles, or maybe both. So if you’re holding Tata Motors, you’re not just riding the past—you’re now on board for two sharply-focused journeys.

What’s your play—passenger, commercial, or both?

FAQs

When did the demerger take effect?

The Tata Motors demerger became effective on October 1, 2025 after the company received NCLT approval. On this date, the commercial vehicle and passenger behicle businesses of the company were officially separated into different entities.

What is the record date for Tata Motors demerger?

The company has fixed Tuesday, October 14, 2025 as the record date for Tata Motors demerger. This means if you are holding shares of Tata Motors on the Oct 14, you will be eligible to receive new shares of TML Commercial Vehicles (TMLCV) once it is listed on BSE and NSE, subject to regulatory approvals.

What will happen to my Tata Motors shares after demerger?

If you are holding Tata Motors shares on the 14th of October (set as the record date of demerger), you will receive 1 fully paid-up share of TMLCV (face value ₹2 each) for every 1 share held in Tata Motors. These shares will be listed on BSE and NSE, subject to regulatory approvals.

So if you are holding 100 shares on 14 October, after the demerger you will have 100 shares each of Tata Motors Ltd (the EV and passenger vehicle arm) and you will receive additional 100 shares of TMLCV (commercial vehicles arm).

Will Tata Motors stock rise after the demerger?

A demerger is not a guarantee that the stock price of Tata Motors will rise. That will depend on how each of the new companies will perform.

Last updated: 3 Oct 2025

Related Topics