How to Analyse a Stock in 2026: Fundamental + Technical Checklist

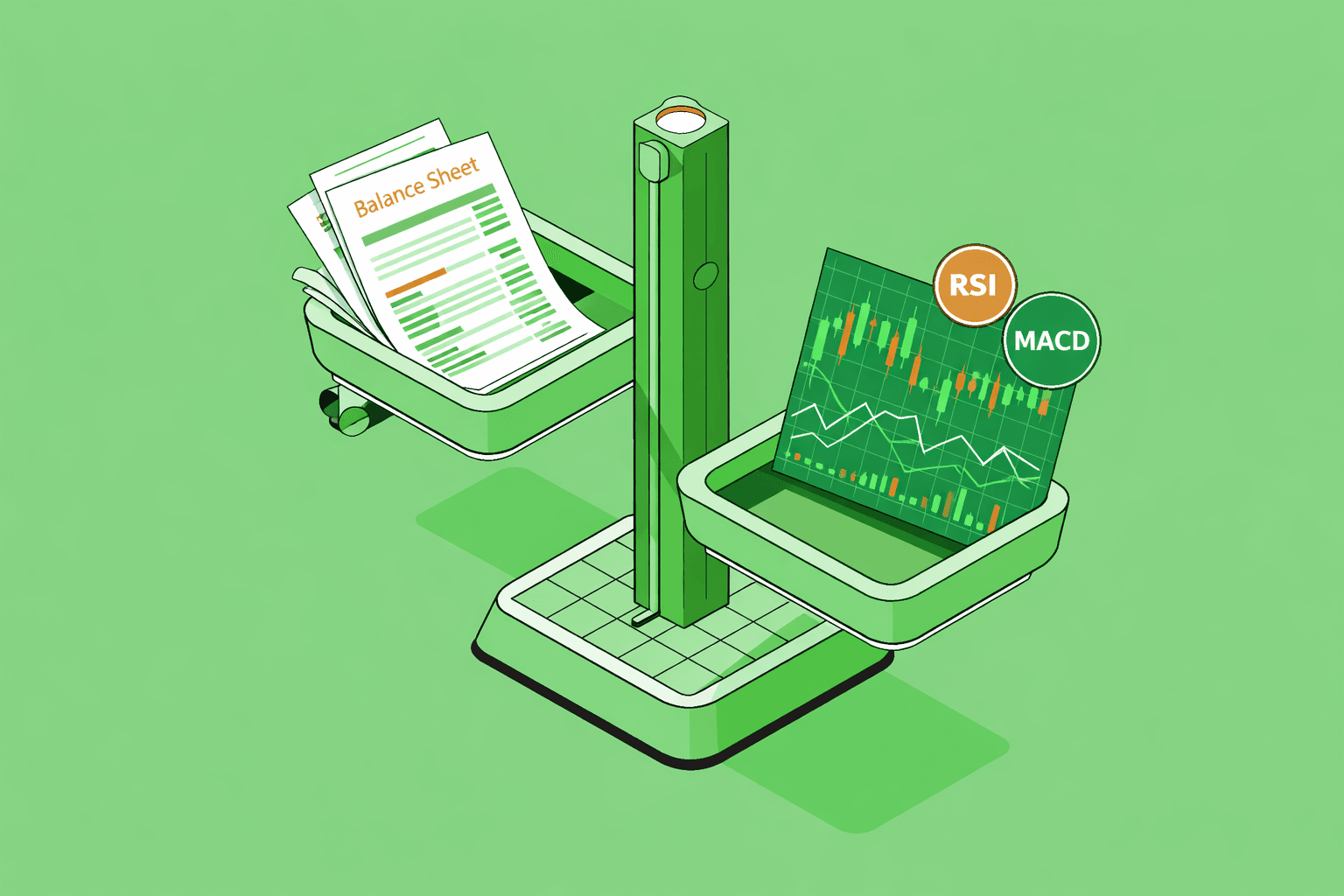

Fundamental and technical analysis are two indispensable tools in analysing a stock. Fundamental analysis focuses on the company’s business model, financial health, and management. Technical analysis involves studying the company’s price movements, chart patterns, and using technical indicators. Using the combination of two can help investors make smart decisions.

In This Article

- Introduction

- What is fundamental analysis?

- Fundamental Analysis Checklist

- What is technical analysis?

- Technical Analysis Checklist

- Fundamental vs Technical Analysis

- Conclusion

- FAQs

Introduction

If you track the stock markets even a little, you might have come across stocks that have stood the test of time and generated returns despite market volatilities. You might have also seen stocks rise with blazing speed and fall even quicker.

This often leads to questions like, ‘How can I know if a company is worth investing in?’ or ‘Should I do fundamental analysis or technical analysis?’ In 2026, one cannot rely on just one way of analysing stock. You need to use both to understand how the market works and thinks. Here’s a fundamental and technical analysis checklist that you can actually use. Fundamental analysis can help you spot companies that are fairly valued, financially healthy, and have a high scope of growth. Meanwhile, technical analysis can help you know when to enter and exit a stock. You enjoy better risk management, timing, and value when you combine both approaches.

Open a free account today

Invest in tomorrow with just one click

- Fundamental analysis involves studying the company’s financial health, business model, and management quality.

- Technical analysis is related to the price movements, market trend, and momentum.

- Both methods help you research and predict future trends in stock prices.

- The main objective of fundamental analysis is to determine the valuation of a company.

- Revenue growth, profitability, margins, business model, company leadership, and governance are key components of fundamental analysis.

- Price trends, candlestick patterns, key price levels, and technical indicators are the core tools used in technical analysis.

What is fundamental analysis?

If you’re going to purchase apples, you are definitely going to pick them up and check if they're not rotten, right? Similarly, before you invest in a company, it is crucial to conduct a fundamental analysis of the company. This involves studying and analysing a company’s business model, financial health, market position, management quality, and leadership to determine its intrinsic value.

The main objective of fundamental analysis is to understand the business in great detail and determine the intrinsic value of the shares, as opposed to market trends or its historical price.

Fundamental Analysis Checklist

Here are some key things to look out for while conducting fundamental analysis of a stock:

Business Model and Industry Analysis

When you invest in a company, it is important to study and understand its business model, growth prospects, and the competitive landscape of the specific industry the company operates. You should know how the company generates revenue. It is also crucial to study its market size, scope of growth,its competitive advantage, and competitors. This can help you identify potential strengths and weaknesses of a company.

Financial Strength

One of the key areas of fundamental analysis is gauging a company’s financial health. Financial statements are the medical reports of a company. So fundamental analysis basically starts with examining a company’s financial statements including the profit & loss statement, balance sheet and cash flow statement. You study the company’s assets, debt, cash reserves, revenue growth, its expenses, how much money it is making through the company’s net profit, EBITDA, its capability in paying off its liabilities and other fundamental metrics and also compare them with its peers. Tracking these parameters can help you get an idea about the financial strength and stability of the company.

Valuation Ratios

Fundamental analysis helps you figure out the fair valuation of a company. Ratios such as the price-to-earnings (P/E), price-to-book (P/B), return on equity (ROE), or enterprise value-to-EBITDA (EV/EBITDA) can help you estimate the valuation of a company and compare it to competitors and the industry average.

Leadership & Management Quality

A company’s growth and success depend on the people running it - aka its management and leadership. As an investor, it’s a good idea to do a background check on the senior executives and managers of the company to understand them. Their experience, track record, and qualifications can tell you a lot.

Fundamental analysis also considers factors such as fair practices, corporate governance, and environment, social, and governance (ESG) that will ensure the company is future-ready.

What is technical analysis?

Imagine you want to go to a restaurant, but it's always crowded, and you might not have a pleasant experience. So you go online to check the restaurant trends to find out the hours when the restaurant is not as busy and perhaps even when it may offer a happy hour discount. Now you know the best time to eat at that restaurant. Technical analysis is similar. It tells you the ‘when’ and ‘where’ of the stock price.

Technical analysis is basically the art of studying charts and past price movements of a stock through candlestick patterns and other key quantitative data. Through technical analysis, you can identify key price levels and get insights about the stock price’s momentum, trend, and strength so you can make smarter buying or selling decisions.

Technical analysis is built on three simple ideas:

- The market price already reflects all available information.

- Stock prices tend to move in trends.

- Price patterns often repeat over time.

Based on this thinking, technical analysts study charts and past price movements to decide the best time to buy or sell, usually for short-term trades.

While fundamental analysis is more focused on the company’s business model and financial strength, technical analysis is primarily focused on market behaviour and timing. Think of it as learning to “read” the market’s mood. The idea is that history tends to repeat itself, and by observing past price action, traders can make more informed decisions about when to buy or sell. For example, an investor can use technical analysis to identify a key level to enter a stock. It can also help spot key support and resistance areas.

Technical Analysis Checklist

There are several key points that can help you in the technical analysis of a stock:

Chart Patterns

At the heart of technical analysis is charting. Charts convert raw price data into visual stories. For example, a quick glance at a candlestick chart can show whether the stock has been rising, falling, or moving sideways, helping you in the decision-making process. You can recognise chart patterns on price charts. When you study how prices reacted in the past, you can predict possible future movements. Candlestick chart patterns such as morning star, double top, or cup & handle can be useful in spotting potential price breakouts or trend reversals.

Market Structure and Trend

Technical analysis primarily revolves around the price of a stock. It is important that you understand the market structure and trend before making a decision. The price of a stock can be in an up trend, a down trend, or sideways. The overall market mood can influence the stock price you are analysing.

Support and Resistance Levels

While conducting technical analysis of a stock, you should identify key levels of support & resistance. Levels from which the price has bounced back act as support levels. A support level is like a floor at which the price of a security is expected to pause or stop falling.

A resistance level is a price point where a stock usually stops rising, and you may see sellers step in. A resistance level is a ceiling at which the price may see heightened selling pressure and potentially see a downward reversal. Support and resistance levels can help you decide entry and exit points.

Technical Indicators

Technical analysis utilises several tools and indicators that can help gauge the momentum, trend, and volatility. Indicators and tools such as moving averages, relative strength index (RSI), moving average convergence divergence (MACD), Fibonacci retracement, or Bollinger Bands are commonly used in technical analysis. Every technical analysts has their own preferred indicators, which they use to gauge price movements and profit from it.

Fundamental vs Technical Analysis

Conclusion

Markets today can be highly volatile and unpredictable. If you rely on just one method, you might miss key signals. Using the combination of fundamental and technical analysis can help you get detailed insights about a stock and make suitable and informed decisions.

Fundamental analysis will help you understand a company’s true strength by studying its revenue, profit, management quality, and long-term growth potential. At the same time, technical analysis will complement this by examining price, volume, trends, and patterns to identify the right time to enter or exit a stock. Together, they help you pick strong companies and invest in them at the right moments, hence reducing risk.

However, it’s important to understand that while a company may hit all the checkmarks, you can’t predict a stock’s price with 100% accuracy. Hence, you should always manage your risk effectively and keep strict stop-loss orders in place.

FAQs

Is fundamental analysis useful for short-term investments?

Yes, fundamental analysis can be useful even for short-term investments, as it can help you spot companies that are financially strong and stable, mitigating your risk.

Can you use fundamental analysis & technical analysis together?

Yes, using fundamental analysis along with technical analysis can help you study the company’s financial strength and also identify the price trend of the stock.

What makes a company fundamentally strong?

A strong fundamental company has stable and consistent growth in revenue, healthy profit margins, transparent governance, and strong leadership.

What are some common tools for technical analysis?

Technical analysis can be done through technical indicators and tools such as RSI, MACD, Bollinger Bands, moving averages, and volume.

Related Topics