Where the Real Opportunities Lie in 2026: Investing in Uncertainty

As gold and global equities approach valuation extremes in 2026, the real investment opportunity is shifting toward India. With a strong capex cycle, resilient domestic demand, and improving midcap and smallcap fundamentals, India offers a compelling long-term growth story for strategic investors

In This Article

- Introduction

- Why Gold and Global Equities Are Riskier Now

- India: The Undervalued Opportunity

- Strategic Asset Positioning in 2026

- 2026 Market Outlook

- To sum up

Introduction

For the past year, gold, silver, and global equities delivered strong returns. Gold broke psychological levels on safe-haven demand, while developed markets surged on liquidity and optimism. But these rallies have largely priced in macro risks, leaving limited upside and increasing the risk of mean reversion. Investors chasing “yesterday’s winners” now face high valuations and diminishing returns.

At Arihant Capital, we believe the next wave of wealth creation lies closer to home: India’s underappreciated sectors and a brewing Capex super-cycle set to accelerate in FY27.

Open a free account today

Invest in tomorrow with just one click

Why Gold and Global Equities Are Riskier Now

Gold & Silver

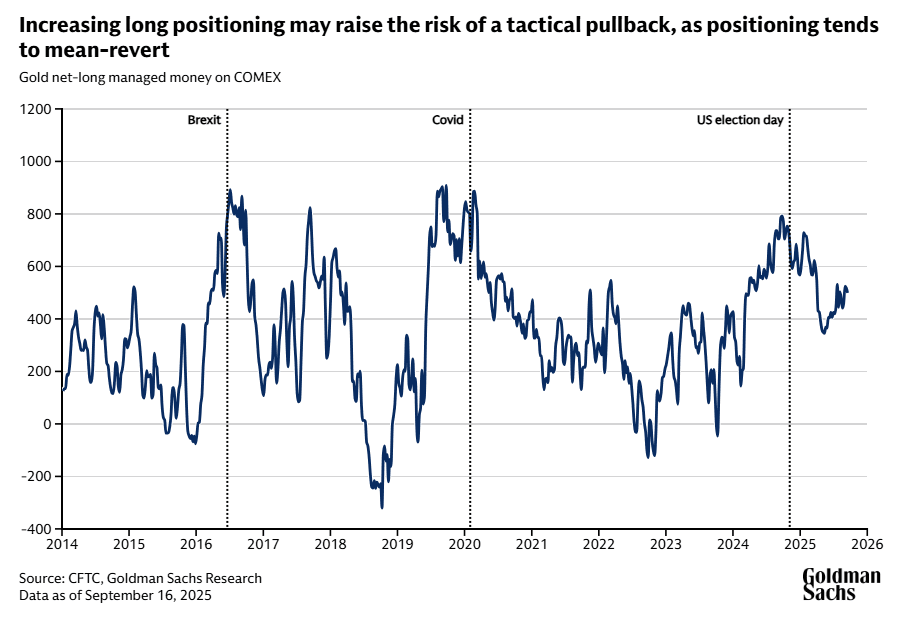

After a strong rally driven by macro uncertainty and positioning, precious metals are entering a phase where upside becomes incremental. Historically, gold exhibits mean reversion once speculative long positions get crowded, leading to periods of consolidation or pullbacks. As a result, near-term risk-reward looks less favorable unless a fresh macro shock emerges.

Global Equities

Developed markets are trading near historical highs. Valuations are stretched, and with moderating global growth and tightening financial conditions, the risk of corrections is elevated.

US stocks are near the top of their historical valuation range (90th percentile+). The world has piled into US stocks, pushing valuations close to extremes. Other regions haven’t run as hard and still sit closer to historical averages.

India: The Undervalued Opportunity

India’s markets underperformed while global indices rallied, creating an attractive entry point. Strong domestic growth, supportive policy, and capex momentum underpin India’s growth story.

India is projected to grow at ~6.5% in FY26 and ~6.7% in FY27, driven by domestic demand and investment activity.

We expect government capex to expand ~14% in FY27, accounting for ~3.3% of GDP. Private sector capex is also picking up, especially in manufacturing, infrastructure, and new-age sectors. With the budget 2026 coming up in few days, we will know where exactly the government is planning to spend to drive the economy.

Capex drives demand for capital goods, construction, industrial services, and employment, creating a multiplier effect across the economy. However, capex-led growth doesn’t benefit all companies equally. Mid and small caps are generally more domestic demand-oriented than large caps, which are often tied to global earnings and exports.

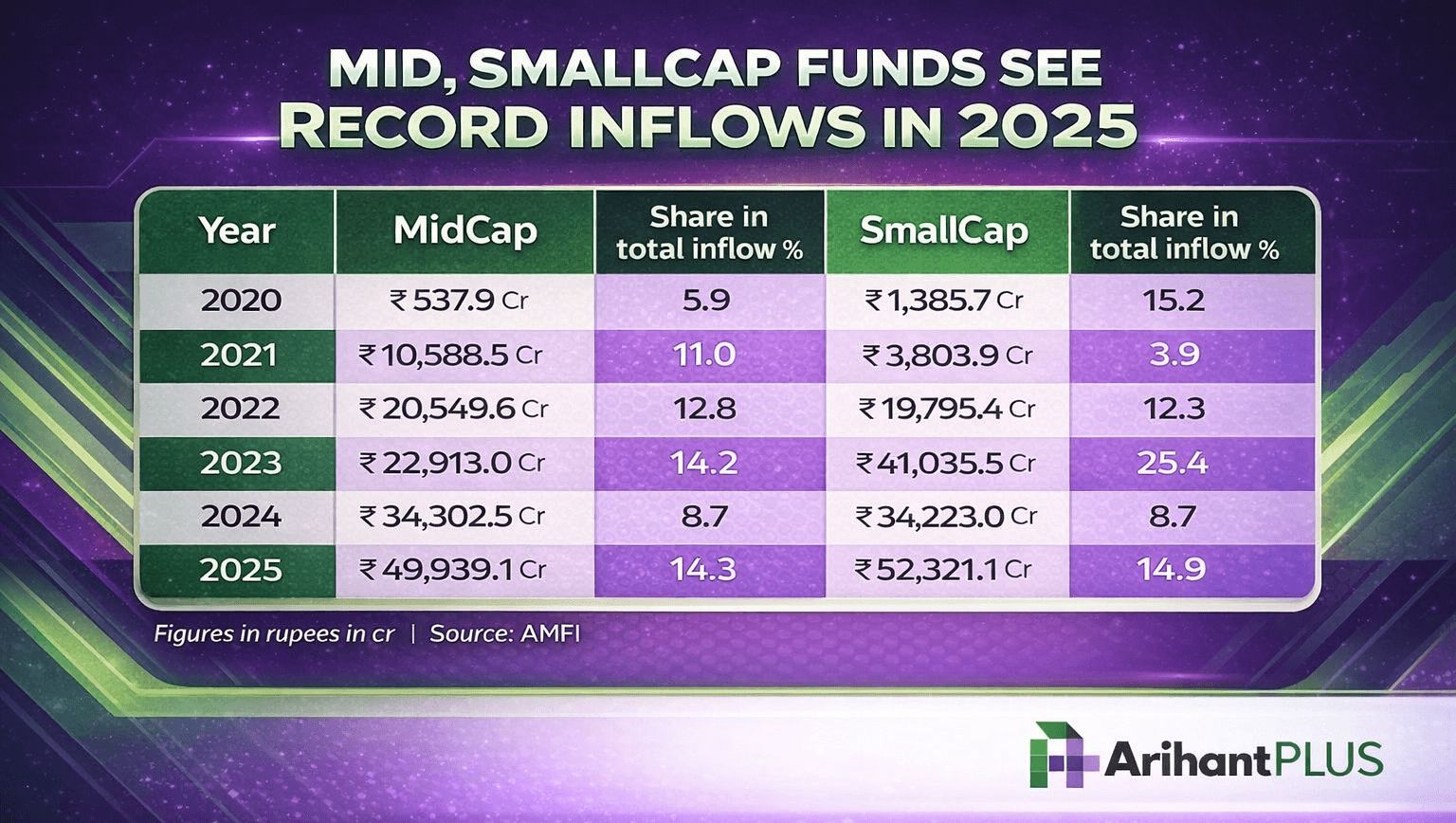

Despite near-term volatility, mutual fund category inflows into mid-cap & small-cap schemes hit record levels in 2025. As capex is set to boost demand, small & mid caps are well positioned to capture a disproportionate share of incremental revenue and margin expansion.

Strategic Asset Positioning in 2026

Gold and silver remain essential components of every portfolio, primarily for their hedging properties against uncertainties. However, their growth potential is limited, and they may have peaked in the current cycle. We recommend maintaining a balanced allocation without being overweight on these metals.

Indian equities remain attractive, particularly in sectors benefiting from capex, infrastructure, and domestic consumption.

Midcap and smallcap stocks can outperform during investment-driven growth cycles, but selectivity is key. Many of these stocks have rallied strongly in recent years, leading to overvaluation, so it’s important to focus on quality companies available at reasonable valuations with long-term growth potential.

2026 Market Outlook

It’s important to focus on analysis that are driven by valuation, positioning, and macro signals, not short-term noise. That’s what we always do at Arihant!

- January 2024: We identified value emerging in China equities (Hang Seng and China tech) at a time when sentiment was deeply pessimistic, positioning portfolios ahead of the subsequent recovery.

- August 2024: We advised partial profit-booking and higher cash allocation ahead of rising volatility, helping investors protect gains when market conditions turned unstable.

We avoid chasing what has already performed. Instead, as smart investors we should focus on structurally strong assets that are mispriced relative to their long term potential and also maintain our asset allocation and diversification.

To sum up

The next major opportunity is structural, not cyclical. India’s growth fundamentals, backed by Capex expansion and resilient domestic demand, offer a compelling case for portfolio reallocation.

Investors should pivot from overextended safe havens and global markets toward India-focused growth opportunities, especially midcaps and small caps set to benefit from FY27 investment momentum. At the same time, maintain disciplined diversification, avoid over-concentration in any single asset. Gold, for example, should remain in the portfolio at a modest 5–10% to provide a hedge against uncertainties.

Disclaimer: This content is for informational purposes only and does not constitute investment advice. Readers should consult a financial advisor before making any investment decisions.

Registered Analyst (RA): Abhishek Jain.

Related Topics