Gold & Silver Rally Amid US–Venezuela Conflict: What Should Investors Do?

By

Arihant Team

Rising US–Venezuela tensions triggered a sharp rally in gold and silver as investors moved to safe-haven assets. This article explains what’s driving the surge, how to read key signals like the Gold–Silver Ratio, and how investors should position their portfolios without chasing headlines

In This Article

- Introduction

- The rally in numbers: Sharp move in 48 hours

- Why are gold and silver rising?

- Gold in 2026: Absorbing fear, not chasing it

- Silver: No longer gold’s “Little Brother”

- So should I invest in silver now? The Gold–Silver ratio (GSR): What it’s signalling now

- Institutional positioning: The quietly bullish factor

- Should you buy gold and silver now?

- Bottom line

Introduction

When geopolitical tensions erupt, financial markets rarely stay composed. History shows that uncertainty—whether political, economic, or military—pushes investors to reassess risk and seek safety.

In early January 2026, reports that the United States had captured Venezuelan President Nicolás Maduro triggered exactly that response. Global equities turned volatile, risk appetite faded, and capital rotated swiftly toward traditional safe-haven assets.

This time, the beneficiaries were unmistakable: gold and silver.

Within just 48 hours, precious metal prices in India (and around the world) surged sharply, reflecting how quickly investor psychology can shift during geopolitical shocks. The speed and magnitude of the move caught many investors off guard—raising an important question:

Is this rally a genuine long-term opportunity, or a short-term reaction that could reverse just as quickly?

The rally in numbers: Sharp move in 48 hours

Prices of precious metas have surged since the US's military control over Venezuela. Since Maduro's capture by the US military, gold surged almost 4% while silver rallied ~14%.

Let’s look at how the prices of gold and silver moved right after the Venezuela issue:

Date | USD/oz | INR 24K 10gm |

30 Jan 2025 | $4345.7 | ₹1,31,950 |

31 Jan 2025 | $4339.6 | ₹1,31,624 |

1 Jan 2026 | $4321.5 | ₹1,31,033 |

2 Jan 2026 | $4329.0 | ₹1,31,337 |

3 Jan 2026 | $4328.6 | ₹1,34,780 |

04 Jan 2026 | $4328.6 | ₹1,34,780 |

5 Jan 2026 | $4373.7 | ₹1,36,170 |

6 Jan 2026 | $4441.2 | ₹1,36,660 |

7 Jan 2026 | $4492.9 | ₹1,36,680 |

8 Jan 2026 | $4470.0 | ₹1,36,000 |

9 Jan 2026 | $4469.0 | ₹1,35,770 |

These are meaningful gains in an extremely short timeframe. Safe-haven demand kicked in almost instantly as investors priced in geopolitical risk, potential sanctions, and broader global spillover effects.

Why are gold and silver rising?

This rally was not random. Several forces converged at the same moment.

1. Geopolitical shock and risk-off behaviour

The Venezuela situation triggered a classic “risk-off” response. Investors trimmed equity exposure and rotated into assets historically perceived as stores of value during uncertainty.

2. Safe-Haven demand

Gold has retained its role as the ultimate hedge against instability—whether the threat stems from war, sanctions, rising debt, or currency volatility. In moments like these, gold’s appeal lies not in yield, but in trust.

3. Structural strength in silver

Silver’s move was not driven by fear alone. It has been supported by a combination of:

- Investment demand

- Industrial usage

- Energy-transition themes

As highlighted by global financial media through 2025, precious metals were already in an uptrend. The Venezuela shock didn’t create the rally—it accelerated an existing one.

Gold in 2026: Absorbing fear, not chasing it

To understand why gold remains compelling, investors must step back from headlines. Gold does not need a crisis to rise in 2026.

The broader backdrop is already supportive:

- Global debt levels remain elevated

- Policy uncertainty is widespread

- Geopolitical alliances look fragile

- The US dollar no longer dominates global reserves as decisively as before

In such an environment, gold doesn’t chase fear—it absorbs it. That structural role is what makes 2026 one of the most interesting setups for gold in years, even if geopolitical tensions ease temporarily.

Silver: No longer gold’s “Little Brother”

Silver has quietly stepped out of gold’s shadow.

Thanks to its unmatched electrical conductivity, silver is not just a precious metal, but it also has important industrial applications. It is an essential component for:

- Solar panels

- Wind turbines

- Electric vehicles

- Energy storage systems and advanced electronics

Why silver stands out

- Industrial demand: Central to the global energy transition

- Outperformance: Funds rotating from gold into silver in 2025 saw stronger relative returns

- Dual role: Acts as a safe haven during crises while also behaving like a growth asset

This combination makes silver unique — defensive in downturns, but opportunistic in growth cycles.

So should I invest in silver now? The Gold–Silver ratio (GSR): What it’s signalling now

Historically, whether the price of silver is overvalued or not is often measured by gold-to-silver ratio, commonly known as the GSR. Generally, a high ratio, exceeding 80:1, suggests that silver is undervalued relative to gold, while a low ratio, under 50:1, implies gold is a better relative value. In September, the GSR stood at 85:1, however, as of early January 2026, the GSR stands around 58–59:1.

How to Read the GSR

- 80:1 or higher: Silver looks cheap relative to gold

- 50:1 or lower: Silver looks expensive; gold may offer better value

- 58–59:1 (current): Neutral zone

What this means for investors

The GSR of 58:1 indicates that this isnt the right time for investors to get into silver. The ratio isn’t giving a strong signal for aggressively buying (or even selling) silver right now. The smarter approach is to keep your portfolio allocation to what it is right now. Watch for clear cues when GSR moves above 75-80:1, which could be a potential buy opportunity for silver or 50 that could be a potential rebalacing zone.

- If the ratio moves toward 80 → silver could become more attractive

- If it drops below 50 → gold may offer better relative value

Having said that, no decision should be made in silos. GSR is just one of the valuation indicators for silver. There are several other factors at play, which you must research well or get the help of an expert before making an investment decision.

Institutional positioning: The quietly bullish factor

In case you’re still wondering why gold and silver are rallying, you should know that this rally isn’t being driven by retail sentiment alone.

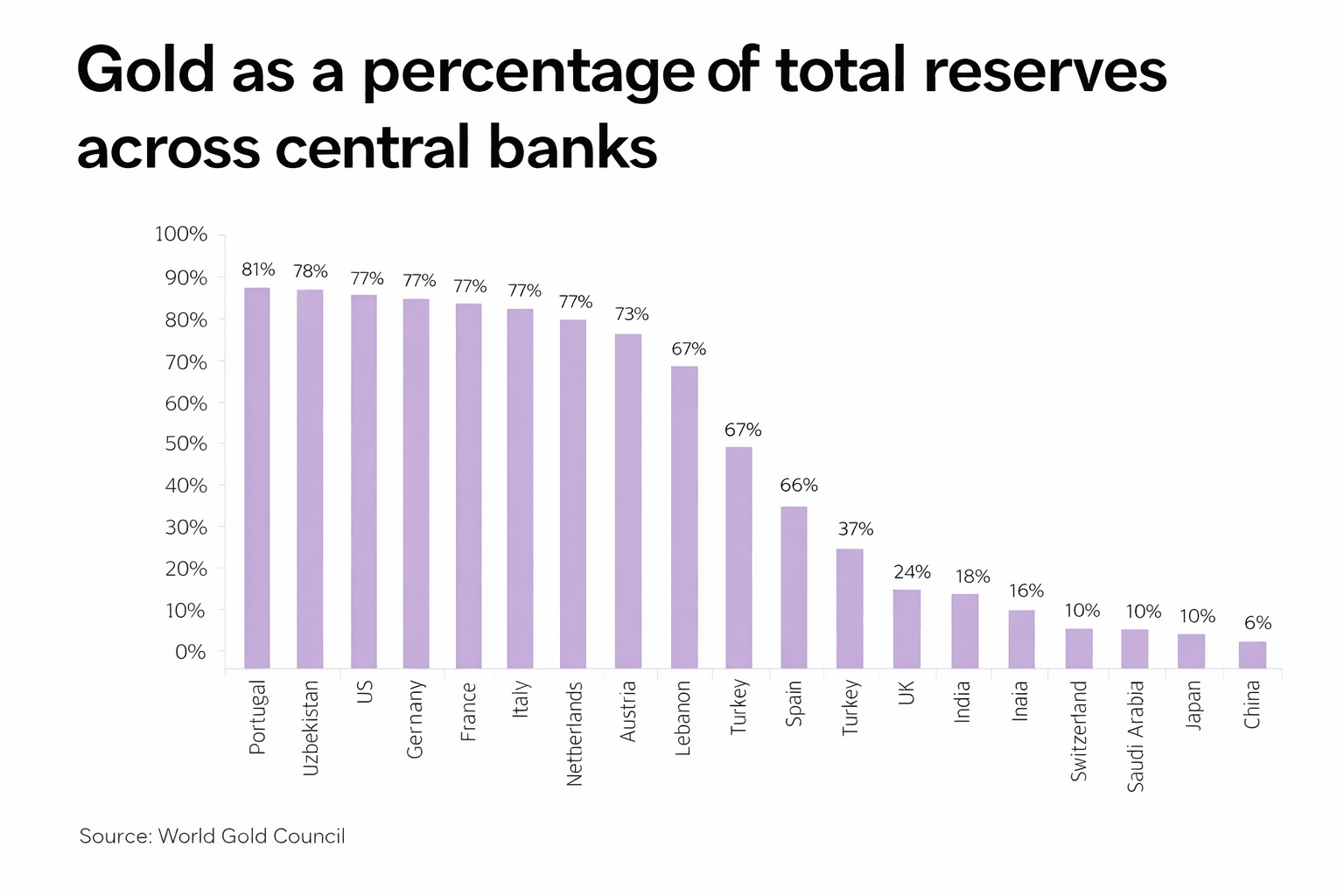

Some countries already hold more than half of their foreign reserves in gold. Others—such as China and Japan—still remain in single-digit allocations. That imbalance creates significant long-term demand potential.

If countries like Saudi Arabia, China or Japan which hold less than 10% of their reserves in gold, add even a small portion of gold to rebalance their reserves, structural demand could remain strong regardless of short-term price volatility.

Should you buy gold and silver now?

It's important to note that no asset class wins all the time. Besides, each asset class plays its own role:

- Gold is not for compounding or predictability but insurance in uncertain times and a hedge against inflation

- Equity is to build wealth through compounding

- Debt offers stability

As a smart investor, you need to have a well-diversified portfolio designed to suit your risk profile and investment horizon.

So, make sure to create a multi-asset portfolio that also has exposure to equity and debt.

A disciplined approach matters more than reacting to headlines. Here are some key points to consider:

1. Use dollar-cost averaging

Avoid lump-sum buying after sharp rallies. SIPs or staggered purchases help manage volatility.

2. Stay diversified

Gold and silver are important—but they should complement, not replace, equities, debt, and other real assets.

3. Watch key technical levels

If major support levels hold, the rally could extend. If they break, expect short-term corrections.

4. Seek professional advice

Precious metal exposure should align with your risk profile, investment horizon, and financial goals.

Risks to keep in mind

- Silver volatility: Higher upside comes with sharper price swings

- Geopolitical de-escalation: If tensions ease, safe-haven demand may soften

- Cost considerations: Physical metals involve GST and making charges; ETFs or digital gold may be more efficient

Bottom line

The US–Venezuela conflict has reignited safe-haven demand, pushing gold and silver higher—but the real story runs deeper than one geopolitical event.

- Gold offers stability in an uncertain world.

- Silver offers upside, driven by industrial and clean-energy demand.

- Maintain a well-diversified multi-asset portfolio

The smartest move isn’t chasing the rally. It’s staying disciplined, diversifying intelligently, and letting strategy—not emotion—drive decisions.

Because smart investing doesn’t begin with headlines.

It begins with understanding the bigger picture.

Related Topics