Diwali to Diwali: Gold, Silver, or Stocks Who Outperformed?

By

Arihant Team

short brief - From Diwali 2024 to 2025, gold and silver glittered while stocks struggled. Gold rose 57%, silver soared 68%, and Nifty 50 managed just 3.5%. As investors weigh their options this festive season, the real winner may not be one asset but a balanced mix of gold, silver, and equities.

In This Article

- Introduction

- Gold vs Silver Investment Rally

- How has the Nifty 50 performed?

- Best Gold and Silver ETFs to Invest This Diwali

- Takeaways for investors

Introduction

Diwali is almost here - we’re all gearing up for the festive season busy with the last-minute Diwali shopping, sprucing up our homes and attending & planning Diwali gatherings. But beyond the festivities, if you could turn back time to the last Diwali and choose one asset class to invest in, what would you choose?

Would you put all your money in gold, silver or stocks? The answer would depend on which of these asset classes gave the best returns. While we all know gold and silver have been making record highs this year, let’s find out who truly outperformed the Diwali-to-Diwali season.

Gold vs Silver Investment Rally

Gold returns since last Diwali

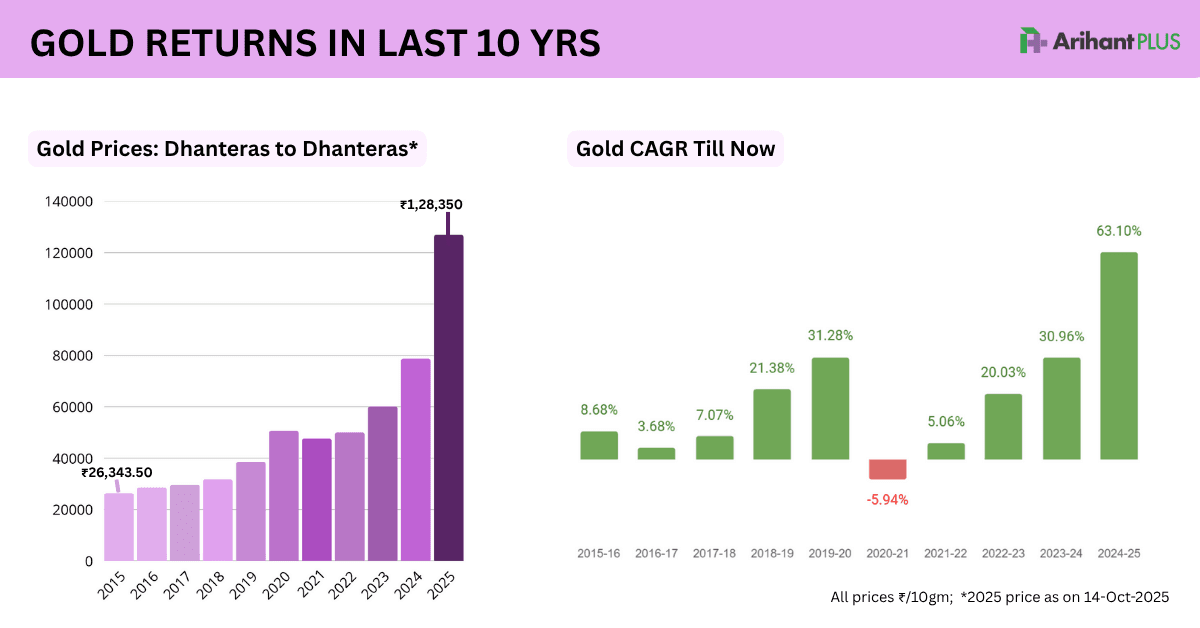

Gold has outshined itself by making record highs this year. This yellow metal is glittering for investors as it delivered a whopping 57% return from last Diwali till date, as its price soared from about ₹80,913 per 10 grams last Diwali (Nov 1, 2024) to ₹1,26,930 today (Oct 14, 2025).

But what has contributed to this rally? Investors always turn to gold during periods of economic turmoil, wars and inflation, viewing it as a safe haven and as a hedge against rising prices. This time is no different. With the continued geopolitical tensions, strong gold demand from central banks around the world as a consequence of geopolitical tensions, political uncertainty in the world’s largest economy (the US government shutdown only added to the woes), have all contributed to this rally.

Analysts project further upside. They expect the yellow metal to touch ₹1,30,000 by Diwali 2025. Do you think it is a good idea to invest in gold at these levels?

But while gold enjoyed its safe-haven status, silver overpowered gold.

Silver returns since last Diwali

To everyone’s surprise, silver has been an outperformer this year. The silver metal rose from ₹87,755 per kg on Nov 1, 2024 to ₹1,47,575 on Oct 14, 2025, a dazzling ~68% jump over this Diwali-to-Diwali period.

So, what happened to silver that it became a party animal? What is driving its rally? Silver’s soaring industrial demand coupled with growing investor’s appetite for the precious metal has led to a global supply crunch of gold’s humble cousin, pushing prices up.

Silver is not just a precious metal used for jewelry or investment it also has several industrial applications. As global manufacturing picked up and the clean energy transition accelerated (think solar panels and EV batteries), demand for silver soared. Experts say, unlike before, silver’s price is now being shaped by real demand and real scarcity, not paper speculation.

Don’t be surprised if you see silver cross ₹1,50,000 per kg by Diwali. A higher gold-silver ratio (GSR) is also one of the reasons why silver can continue to rally. GSR is a widely used valuation indicator used to tell if silver is cheaper or more expensive than gold. A higher ratio means silver is cheaper, and a lower ratio implies it is more expensive than gold.

How has the Nifty 50 performed?

Now, let’s turn from metals to equities. From Diwali 2024 to Diwali 2025 {almost}, Nifty 50 has delivered a modest return of 3.54% on absolute terms rising from 24,304.35 on muhurat trading session on Nov 1st 2024 to 25,145.50 on Oct 14, 2025.

Indian stock markets have delivered a lackluster performance from last Diwali to this, owing to geopolitical tensions, higher valuations, muted corporate earnings among other reasons.

Does this mean you should stay away from investing in the share market during this muhurat trading session and stick to gold and silver ETFs?

What if we tell you there were Nifty 50 bluechip stocks that delivered better returns than gold since the last Diwali? Here’s a list of Nifty 50 stocks that outshone gold returns:

Stock Name | 1Y Return (as on 14-Oct-25) |

~76% | |

~65% |

And if you expand the universe, companies like Force Motors, Gabriel India, Sundaram Finance and La Travenues have delivered three-digit returns of 139%, 170%, 104% and 100% respectively.

Will you still skip stocks and only invest in gold?

So, who won the Diwali-to-Diwali race?

Here’s the scoreboard:

Asset | Diwali 2024 Price | Diwali 2025 Price* | Return |

Gold (10g) | ₹80,913 | ₹1,26,930 | ~57% |

Silver (kg) | ₹87,755 | ₹ 1,47,545 | ~68% |

Nifty 50 | 24,304.35 | 25,145.50 | ~3.54% |

(*as on 14 Oct 2025)

So what should you pick for this DIWALI - gold, silver or stocks?

Let’s take each one of them one-by-one:

- Gold has historically been considered a great investment because it offers a cushion in terms of uncertainties, acts as a hedge against inflation and is a great portfolio diversifier. Unlike industrial metals or silver, gold is not closely correlated with the economic cycle since it has limited industrial use. It has very low correlation with other asset classes such as stocks, hence it provides stability when markets turn volatile.

- Over half of silver’s total demand comes from industries like electronics, automobiles, and renewable energy. This precious metal powers everything from your smartphones and electric vehicles (EVs) to solar panels. That’s why silver often moves in sync with the economy. When growth picks up, silver demand, and consequently prices, also see a jump.

- Stocks definitely lagged in performance compared to previous metals this year. But remember, equities as an asset class have always outperformed metals over longer periods. Given how volatile equities can be its returns can turn overnight. If you believe in India’s growth story, then having equity in your portfolio is a must. After all, equity has always been known as the best asset class for long-term wealth creation.

Gold and silver have rallied due to periods of elevated economic and policy uncertainty. But can this rally sustain?

History has shown that no asset class consistently outperforms. Every asset class has a cycle, and hence diversification is the key to successful investing. Also remember, past returns are no guarantee of future glory. If you blindly follow a one-year trend and focus only on gold and silver while ignoring stocks, you may regret it in the future. Then what should you do? Whether it’s gold, silver, or stocks, the real sparkle comes from disciplined investing, diversification, and patience through the ups and downs.

Best Gold and Silver ETFs to Invest This Diwali

Exchange traded funds (ETFs) are one of the best ways to invest in gold and silver this Diwali, as you can invest in them with as low as ₹15, there are no making charges involved, they’re 100% pure and secured.

Best Silver ETFs | AUM | Best Gold ETFs | AUM |

₹7,256.7 | ₹11,378.6 | ||

₹1,664.2 | ₹8,770.3 | ||

₹1,369.2 | ₹8,315.4 |

Takeaways for investors

If you invested in gold or silver during the last Diwali, you are sitting on unprecedented 57-68% gains. Congratulations! But as the market gears up for another year, remember that diversification is your best gift to yourself this Diwali.

Hold some gold for safety, some silver for innovation, and a fair share of stocks for long-term growth. With India’s domestic demand, policy support, and the global shift towards green energy, the coming year could see equities catching up and possibly even outshining the metals.

So, this Diwali, as diyas brighten your home, let your portfolio shine too, not just with sparkle, but with strategy.

Related Topics