Gold & Silver Taxes After Budget 2026 Explained

By

Arihant Team

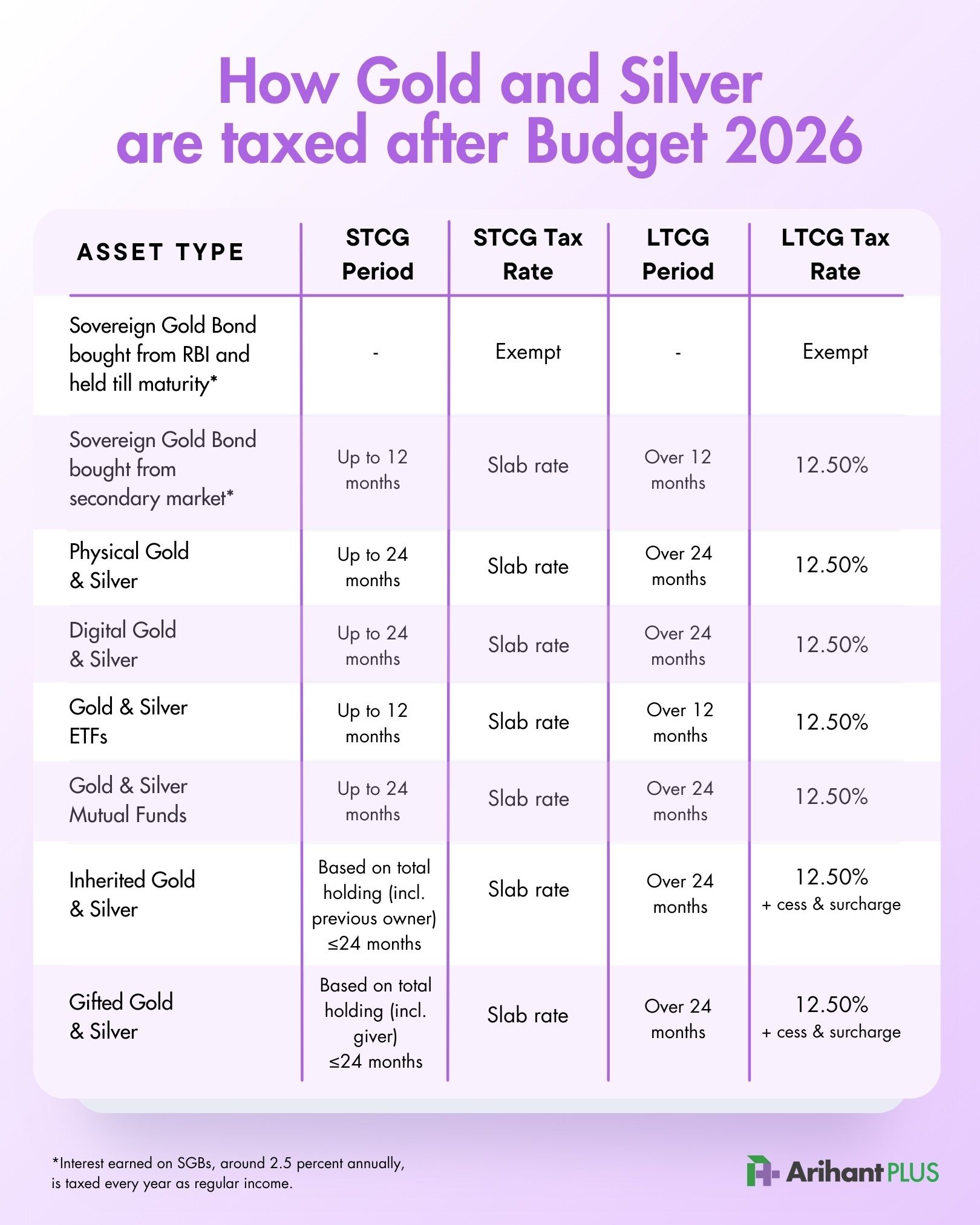

Starting April 1, 2026, Sovereign Gold Bonds (SGBs) lose their tax-exempt status if purchased via the secondary market or redeemed prematurely. You should review your holdings now to optimize post-tax returns before these rules kick in.

In This Article

- Introduction

- SGB Taxation

- Physical & Digital Gold

- The ETF vs. Mutual Fund Arbitrage

- Inherited Gold & Silver

- Gifted Gold & Silver

- Gold and taxes: What you need to remember from 1 Apr 2026

- The bottom line

Introduction

Budget 2026 tweaked how some forms of gold and silver investments are taxed, leaving many of you wondering what this means for your portfolios.

Precious metals have had a strong run especially at a time when equities delivered relatively muted returns but now the spotlight has shifted from prices to post-tax returns.

So what exactly changed, and how does it affect you? Let’s break down the new tax fine print.

Open a free account today

Invest in tomorrow with just one click

SGB Taxation

Before Budget 2026, SGBs were fully tax free at maturity, and most investors didn’t worry about where they bought them from. Now that’s changed. Your tax now depends on how you purchased the gold bonds.

Secondary market SGB purchases have lost their tax-exempt status upon maturity. If you buy SBGs from the stock market, you will now be liable for capital gains tax at redemption, regardless of the holding period. However if you purchased SGBs at the time of primary issue, you will not be taxed anything if you held these bonds until maturity.

Here’s the difference outlined clearly:

Naturally, this raises an important question: Do the new tax rules affect investors in older SGB tranches like Series XI (Feb 9, 2021) and Series XII (Mar 9, 2021)? The answer depends on how you bought your bonds.

- Purchased from RBI

Earlier, primary SGB subscribers didn't need to worry much about timing. Whether they redeem now or hold until full maturity, their capital gains remain tax free. Currently, even premature redemption after the five-year lock-in qualifies for this tax exemption.

However, a new rule effective April 1, 2026 changes that.

After this date, premature redemption will no longer be tax exempt. So if you’re considering an early exit and need funds soon, redeem before April 1, 2026 so you will not pay any tax on the gains.

- Purchased from RBI, sold in the secondary market

If a primary SGB subscriber sells the bonds in the secondary market, the gains are taxable at 12.5% LTCG, no matter when the sale happens.

The tax exemption applies only if the bonds are held until maturity and redeemed through the RBI.

Example: : Mr A bought SGBs in the 2020 original issue at ₹5,100 per gram. If he sells them today in the market at around ₹14,800 per gram, his gain is ₹9,700 per gram. On this, he would pay 12.5% LTCG tax, which comes to roughly ₹1,213 per gram.

- Bought and sold in the secondary market

If you bought SGBs from the secondary market, tax applies in every exit route. If you sell them on the exchange, gains are taxed as STCG (slab rate) if held for up to 12 months, and LTCG at 12.5% if held longer.

- Bought in the Secondary Market and Redeemed at Maturity

Now, for bonds bought from the secondary market, redemption at maturity will also be taxable from April 1, 2026 onward.

This means even if you hold such bonds until maturity, your gains will be taxed at 12.5% LTCG. For example, if someone bought SGBs from the market in 2021 and holds them till maturity, they will still need to pay tax on the gains.

It would be a good idea to sell them before 1 April 2026, so you won’t have to pay tax, especially because the gains would be considerable given gold recent rally.

So, what are the conditions for tax exemption now?

If you want to qualify for tax exemption on redemption, the following two conditions must be met:

- Original subscriber only: You should have bought the SGB at the time of primary bond issue. If you bought bonds through secondary market transactions (either transfer or purchase) you will not be eligible for tax exemption.

- Held until maturity: You must hold the bonds until the redemption on maturity to get the tax exemption benefit on any profits from the bonds. If you redeem the bonds prematurely, even if done after the completion of the prescribed lock-in period, you will not qualify for the tax exemption and will be taxed

Physical & Digital Gold

Physical gold (jewellery, coins, bars) and digital gold continue to follow the 24 month holding rule for capital gains.

- Sold within 24 months (Short Term): If you sell your gold within 24 months of purchase, the gains from the sale will be added to your total income and taxed as per your income tax slab. So if you fall in the 30% bracket, your gold gains will also be taxed at 30%.

- Sold after 24 months (Long Term): If you sell your gold after 24 months of purchase, the gains from the sale will be taxed at a flat 12.5%. Earlier, investors could use indexation to adjust the purchase price for inflation and reduce taxable gains. That benefit is now gone which means your tax is calculated on the full profit, without any inflation adjustment.

While the Budget 2026 did not change these GST rules, it deserves a mention. Remember that tax on gold starts when you buy it, not just when you sell.

When you buy physical gold, you pay 3% GST on the gold value, and for jewellery, an additional 5% GST on making charges.

With digital gold or silver, you only pay the 3% tax because there are no making charges involved.

The ETF vs. Mutual Fund Arbitrage

No changes were made to gold and silver ETF taxation in Budget 2026. Gold and silver ETFs continue to be treated as listed securities for tax purposes.

- Sold within 24 months (Short Term): If you sell within 12 months, gains are taxed at your income tax slab rate.

- Sold after 24 months (Long Term): If you sell after 12 months, gains qualify as long-term and are taxed at 12.5% without indexation.

Now, because ETFs are listed, they turn long-term in just one year. But gold and silver mutual funds require a 24 month holding period to get the same 12.5% LTCG rate.

So if liquidity and faster tax efficiency matter to you, ETFs offer a shorter runway without the extra year of holding.

Inherited Gold & Silver

When you inherit gold or silver, there is no tax at the time you receive it. But tax does apply when you sell.

For tax purposes, the government looks at when and at what price the original owner bought it. Your holding period includes the time your grandmother (or whoever you inherited it from) held it. Your purchase cost is taken as either the original price they paid or the market value as of 1 April 2001 (if it was bought long ago). This helps decide how much capital gains tax you pay when you sell.

Gifted Gold & Silver

If you receive gold or silver as a gift from close family members like parents, spouse, or siblings, you don’t pay tax when you receive it.

But if the gift comes from a non-relative and its value is more than ₹50,000, then it becomes taxable as income in that year.

Later, when you sell the gifted gold or silver, capital gains tax applies. Your purchase price for tax calculation will be either what the original owner paid (if it was from a relative) or the value on which you already paid tax (if from a non-relative). The earlier owner’s holding period is also counted to decide whether your gain is short-term or long-term.

Gold and taxes: What you need to remember from 1 Apr 2026

Here’s an overview for how your SGBs and other gold investments will be taxed from the new financial year.

The bottom line

Gold plays an important role in a diversified portfolio, but it comes with tax rules budget 2026 made some important changes that can impact your tax bill. From 1 April 2026, the popular sovereign gold bonds will no longer enjoy a complete tax-exempt status. SGBs purchased through secondary markets or sold in secondary market will now be taxed.

As you prepare for the next financial year, take time to review how your gold investments were structured and how they were sold can, to avoid surprises at the time of preparing your tax returns.

Related Topics