ICICI Lombard Q1FY26 Result: Profit jump 28.7%, Strong Margin & Digital Momentum

By

Arihant Team

ICICI Lombard posts ₹747 Cr profit for Q1FY2026, up 28.7% year-on-year (YoY). The company remains focused on profitable growth and underwriting discipline amidst an environment of rising competitive intensity and pricing pressure. Expects the H2FY26 to benefit from improved pricing in motor and commercial lines and from continued momentum in retail health

In This Article

- 📈 Business Outlook

- 💰 Financial Performance

- 🧾 Other Key Highlights

- 🔍 What to Expect

📈 Business Outlook

ICICI Lombard is focusing on smart, profitable growth instead of just chasing market share. In the second half of the year, they expect better earnings from motor and commercial insurance, along with strong momentum in health insurance. Their digital investments and careful product choices are helping them stay efficient and handle risk better.

Gopal Balachandran, Chief Financial officer at ICICI Lombard said, “What we are seeing at this point of time is obviously elevated levels of competitive intensity, and therefore the direction is to be about to be a bit guarded or cautious. In that context, we are happy to kind of let go market share, particularly around these times when the market remains elevated.”

💰 Financial Performance

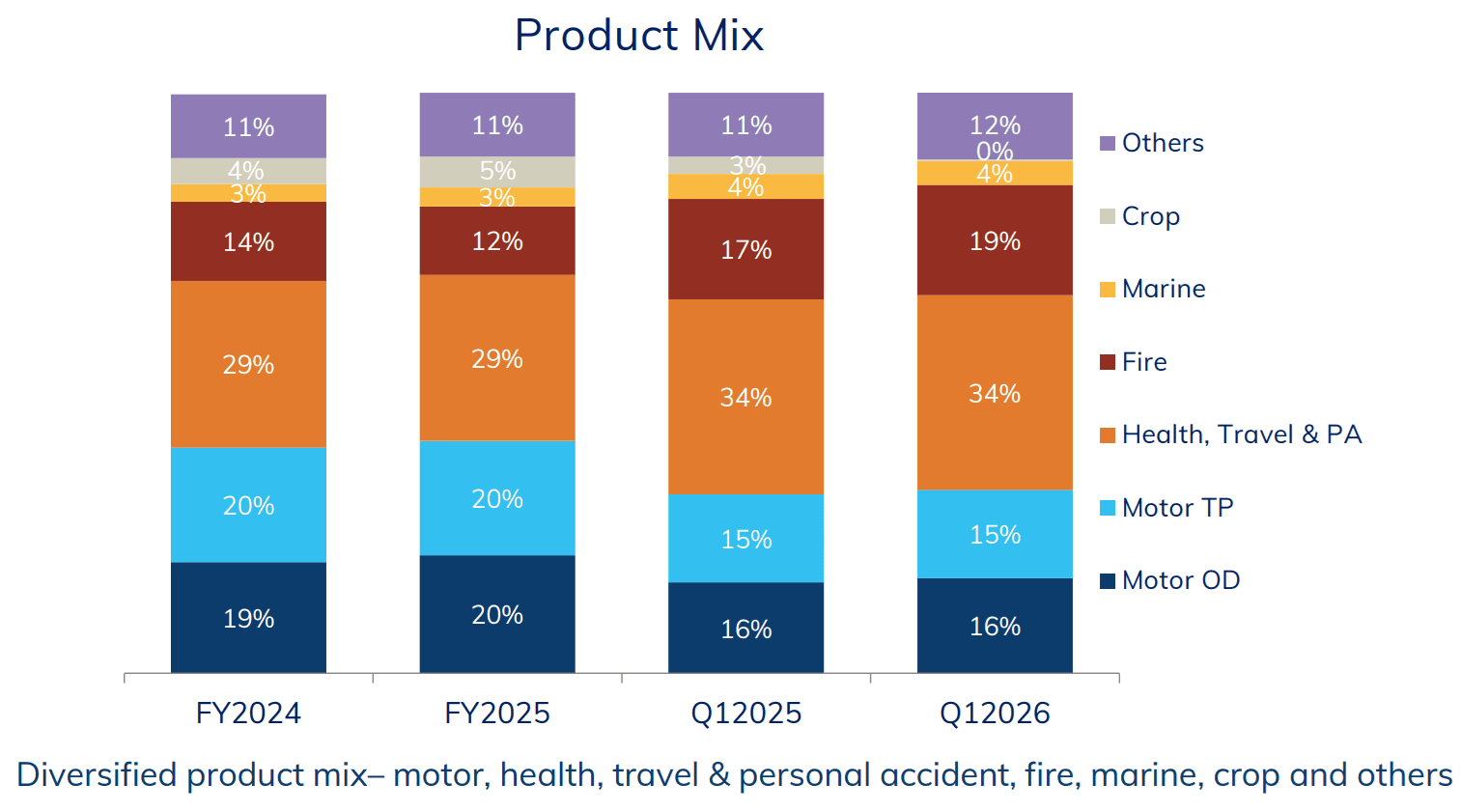

Premiums Collected: Gross direct premium income was at ₹7,735 Cr, up just 0.6% (industry grew 8.8%). This was largely because they were cautious in motor, group health, and crop lines.

Profit Before Tax (PBT): ₹994 Cr, up 28.4%

Net Profit (PAT): ₹747 Cr, up 28.7% YoY

Investment Income: ₹1,288 Cr (vs. ₹1,128 Cr YoY)

Solvency Ratio: ICICI Lombard’s Solvency Ratio is 2.7x, which is well above the regulatory requirement of 1.5x. This means they’re in a very strong position to handle claims, even in worst-case scenarios.

Combined Ratio shows how efficiently an insurance company is running its core business (collecting premiums vs. paying claims and expenses).

✅ If it's below 100%, the company is making money from its insurance operations.

❌ If it's above 100%, it means the company is spending more on claims and expenses than it's earning from premiums.ICICI Lombard’s Combined Ratio in Q1FY26 was 102.9%. This means for every ₹100 they earned in premiums, they spent ₹102.90 on claims and operating costs. It's slightly above 100%, but still much better than the industry average of 112.6%, showing disciplined cost control.

🧾 Other Key Highlights

Retail Health Insurance: Premiums grew 32.2%, gaining market share (2.9% → 3.5%)

Motor Insurance: Grew 3.2% (below industry), focused on profit in commercial vehicles

- Commercial Lines: Grew 6.8%, led by marine and engineering; fire insurance still under price pressure

- Digital Growth: 38% of services now online (vs. 22% YoY); over 1.56 Cr app downloads

- Customer Satisfaction: High Net Promoter Scores (Health: 68, Motor: 69)

- Aviation Claims: Handled in Q1; no major financial impact

- Profitability: Return on Equity rose to 20.5% (from 19.1%)

- Pricing Trends: Motor third-party rates are due for a hike, which could help profits later in the year

- Efficiency: Strong focus on automation, data-driven decisions, and smarter claims handling

Here's an overview of the product mix of ICICI Lombard's insurance portfolio:

🔍 What to Expect

- Health insurance claims (loss ratio) should settle between 65–70% as more people buy policies..

- Prices in commercial and fire insurance should start to improve, boosting profit margins.

- Not expecting much growth in crop insurance this year due to fewer government tenders.

- Strategic focus will remain on profitable underwriting even if it comes at the expense of market share in select lines.

Tags

ICICI Lombard Q1FY26 financial results | Q1FY26 insurance sector earnings India | ICICI Lombard investment income report Q1 FY26 | motor and commercial insurance trends India 2025

Related Topics