Nifty's year-end cheer: The Santa rally effect

By

Arihant Team

Will Nifty participate in the Santa Rally? Historically, global stock markets rise during the last 5 trading days of December and also first 2 trading days of January. In fact, Nifty has delivered gains in 17 of the last 20 years during this period. Will this continue?

In This Article

- Introduction

- What is Santa Claus Rally?

- What's behind this year-end rally?

- The numbers tell an interesting story

- Should you count on it?

- What should investors do?

- Putting it in perspective

Introduction

As the year winds down, the stock market often seems to find its festive spirit. Historical data shows that post-Christmas and stock markets worldwide often end in green.

Investors around the world look forward to what’s known as the “Santa Rally,” a period where equities typically trend higher during the final stretch of December and early January. For those focused on Indian markets, the Nifty has mirrored this pattern quite consistently over the last two decades, making it a seasonal trend worth paying attention to.

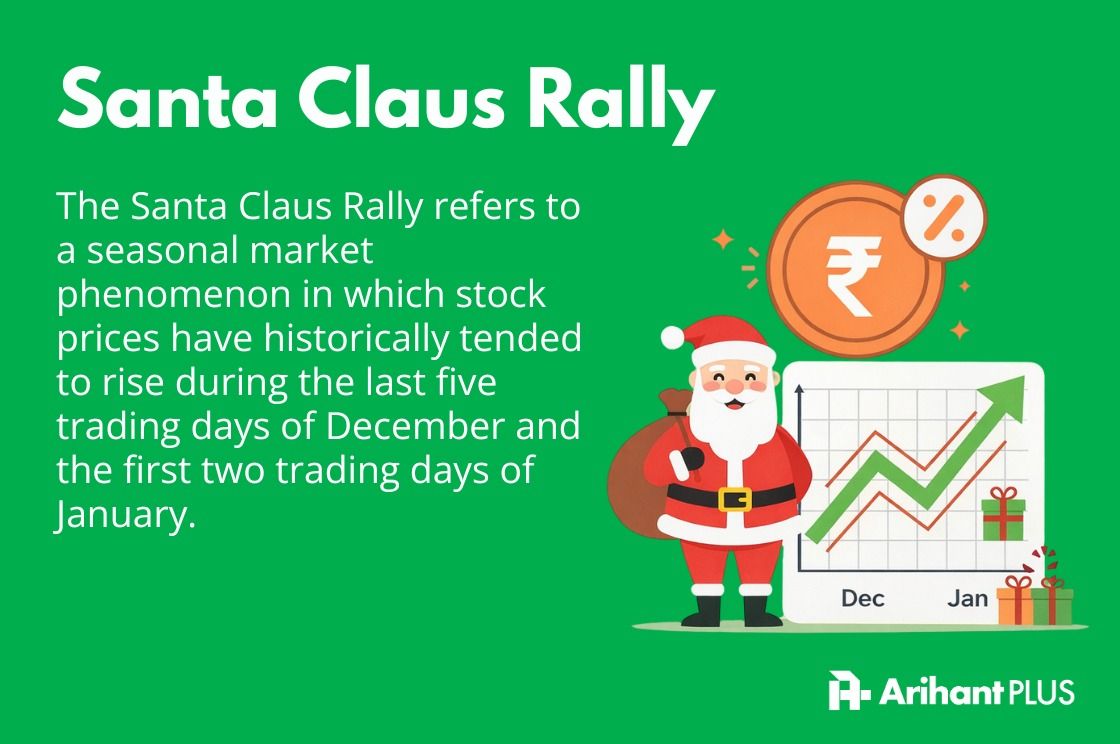

What is Santa Claus Rally?

The Santa Claus Rally refers to a seasonal market phenomenon in which stock prices have historically tended to rise during the last five trading days of December and the first two trading days of January. The term was coined in 1972 by Yale Hirsch, founder of the Stock Trader’s Almanac, based on observed market patterns during this specific period.

Important Considerations

- The Santa Claus Rally is not guaranteed to produce positive returns every year.

- It should not be considered a long-term investment strategy.

- It is not a replacement for diversified goals-based financial planning.

Rather than a reliable rule, the Santa Claus Rally is best viewed as a short-term seasonal market effect, one of many historical patterns that may or may not occur in any given year.

What's behind this year-end rally?

The Santa Rally window runs from December 20 to January 5. During this period, several things happen that can push markets upward.

Holiday shopping picks up, which means better sales for companies. Fund managers start adjusting their portfolios before the year closes; they want to show good stocks in their holdings when they report to clients. Many investors finish their tax-loss selling by mid-December, which removes some of the selling pressure from the market. Trading volumes drop as people take time off, and sometimes lower volumes make it easier for prices to drift higher. Then there's the bonus money that starts flowing into markets in early January.

The numbers tell an interesting story

The Nifty has posted gains in 17 out of the last 20 years. That's an 85% success rate. Some years were spectacular. In 2007-2008, the Nifty jumped 9.09% during this window. The 2021-2022 period saw a 6.54% rise, and 2009-2010 delivered 5.90%. Even in the recent past, we've seen positive moves—2020-2021 was up 3.33%; last year gained 0.78%, and this year we're at 0.18% so far. Here's what makes the Santa Rally worth paying attention to:

Year (Period) | Upside / Downside (%) |

2024–2025 | +0.18% |

2023–2024 | +0.78% |

2022–2023 | −1.90% |

2021–2022 | +6.54% |

2020–2021 | +3.33% |

2019–2020 | −0.33% |

2018–2019 | −1.45% |

2017–2018 | +0.61% |

2016–2017 | +2.01% |

2015–2016 | +0.50% |

2014–2015 | +1.49% |

2013–2014 | +0.52% |

2012–2013 | +1.38% |

2011–2012 | +2.44% |

2010–2011 | +2.58% |

2009–2010 | +5.90% |

2008–2009 | +1.43% |

2007–2008 | +9.09% |

2006–2007 | +3.94% |

2005–2006 | +1.97% |

But it hasn't been positive every single time. Three years saw declines: 2022-2023 dropped 1.90%, 2018-2019 fell 1.45%, and 2019-2020 dipped 0.33%.

So the question is, is Santa Clause Rally previal in 2025?

So far, this year's performance doesn't look promising.

Nifty has closed in red in all the sessions since Christmas. With only one trading day left, and two more days after, the markets will need a strong boost to continue the Santa Claus Rally trend!

Should you count on it?

The 85% track record looks solid, but we need to be realistic here.

Past patterns don't guarantee future results. Those three negative years remind us that markets can be influenced by bigger forces—economic slowdowns, global events, and policy changes. The Santa Rally isn't immune to these factors.

Also, many of the positive years saw modest gains. Several years posted returns under 2%. That's nice, but probably not enough to justify making big portfolio changes just to capture this seasonal move.

What's happening in the broader economy matters more than any seasonal pattern. Interest rates, inflation trends, corporate earnings, global market conditions—these drive long-term market direction.

What should investors do?

Rather than trying to time your investments around the Santa Rally, focus on fundamentals. Stay invested if you're already in the market. The data suggests that being present during this period has generally worked out well for long-term investors. There's no need to exit positions just because the year is ending.

If you're investing through SIPs, keep them running. Don't pause or adjust them based on seasonal patterns. Regular investing builds wealth over time, and that's more important than trying to catch a two-week rally.

Year-end is actually a good time to review your portfolio. Check if your asset allocation still matches your risk profile and goals. Rebalance if needed, but do it based on your investment plan, not seasonal trends.

Resist the urge to trade actively during this period. The excitement around year-end moves can tempt investors to make unnecessary trades, which just adds to costs and creates tax complications.

Putting it in perspective

The Santa Rally is an interesting market phenomenon, and the Nifty's track record during this period is genuinely impressive. But investors should note that a Santa rally is not guaranteed. If 2025 has taught us anything — with markets jolted by tariffs, geopolitical tensions, and more—it is to expect the unexpected.

The Santa Rally might add some positive momentum to your portfolio this year. Or it might not. What matters more is your commitment to a disciplined investment approach, your ability to stay invested through market cycles, and your focus on long-term wealth creation.

Use this year-end period to take stock of your investments, review your goals, and plan for the coming year. Make sure your portfolio is diversified and aligned with your financial objectives.

Successful investing isn't about catching every short-term trend. It's about having a plan, sticking to it, and making adjustments based on your changing life circumstances and financial goals—not market timing.

So as we move through December and into the new year, stay focused on what you can control: your investment discipline, your risk management, and your long-term strategy. The Santa Rally is just one of many market patterns you'll encounter in your investment journey. But investors should note that a Santa rally is not guaranteed. If 2025 has taught us anything — with markets jolted by tariffs, geopolitical tensions, and more—it is to expect the unexpected.

Disclaimer: Past performance does not guarantee future results. This article is for educational purposes only. Please consult with your financial advisor before making any investment decisions.

Data Source: NSE

Related Topics