How to Monitor and Maintain Trading Algos After Deployment

By

Arihant Team

Monitoring and maintaining deployed trading algorithms is essential to ensure they perform accurately and adapt to market changes. Regular monitoring helps identify performance issues, technical glitches, and risks, while maintenance ensures the strategy remains reliable, efficient, and aligned with current market conditions.

In This Article

- Introduction

- Summary

- Importance of Monitoring and Maintaining Deployed Algos

- Monitoring and Maintaining Algorithmic Trading Strategies

- Key Metrics to Monitor for Algo Trading Strategies

- Common Problems and Warning Signs

- Conclusion

- FAQs

Introduction

Algorithmic trading is one of the most efficient ways to trade the financial markets. Deploying an algo trading bot automatically monitors the markets, executes trades, and manages risk. While deploying a trading algorithm can allow traders to begin their algo trading journey, monitoring and maintaining these algorithms is highly important.

Knowing what to monitor and how to maintain a trading algo can help traders is essential in the dynamic financial markets.

Summary

- Algorithmic trading is a popular way to automate the trading process, but it may not perform as expected as always.

- Monitoring the algorithmic trading strategy is crucial to spotting any errors, flaws, or limits in the strategy.

- Maintenance of the strategy and technological infrastructure can help the algorithm perform consistently and increase reliability.

- Real-time monitoring, performance evaluation, risk monitoring, and backtesting are helpful ways to keep a check and maintain an algo strategy.

Open a free account today

Invest in tomorrow with just one click

Importance of Monitoring and Maintaining Deployed Algos

Before an algorithmic trading strategy is deployed in the live markets, it is thoroughly backtested and put through robustness tests to see how it performs in the various market conditions. Traders often believe that once a strategy is deployed, they can forget about it and enjoy the returns.

However, several risks and factors highlight the importance of continuous management and monitoring of a trading algorithm.

- Continuous monitoring of a trading algorithm is crucial to spot any declines in the performance or success rate of the strategy.

- Keeping a strategy deployed without monitoring or maintenance can lead to underperformance or even losses.

- Monitoring of algorithmic strategies aids traders in spotting flaws or limitations that were not evident during backtesting.

- Regularly maintaining an algorithmic trading strategy can help traders modify and adapt to changes in the market, resulting in consistent results.

- There may be times when an algorithmic strategy may malfunction, lag, or experience high slippages. Regular monitoring can help traders fix these issues and prevent major losses.

For example, a trader deployed an algorithmic strategy and didn’t monitor or evaluate it. The strategy had performed well in backtests, and the trader expected similar results in the live market. The strategy performed in line with expectations in the first month.

In the following month, the market sentiment shifted from bullish to bearish. Since the trader was not monitoring the algorithm, the strategy underperformed and even took on several losing trades. If the trader had monitored and made changes to the strategy, these losses could have been mitigated.

Monitoring and Maintaining Algorithmic Trading Strategies

There are several ways of monitoring and maintaining algo trading strategies.

Real-Time Monitoring

This involves monitoring how the strategy is performing while it is deployed in the live market. This can help analyse the trade execution, slippage, and speed. It can also help spot any glitches or flaws.

Performance Monitoring

Another key component of monitoring deployed trading algorithms is to analyse and evaluate the performance of the strategy. Performance evaluation gives traders key insights into how the strategy is performing. Key metrics such as the strategy’s returns, drawdowns, and fill rates can help traders get a detailed idea about the strategy’s performance.

Backtesting

Backtesting is primarily conducted on strategies before they are deployed in the live markets. Testing a strategy on historic price data can help traders gauge how the strategy might perform in live markets. Through backtesting, traders can modify parameters or test the strategy on different time periods to fine-tune a strategy. Regularly maintaining and making necessary changes can help an algorithmic strategy adapt to various market conditions.

Risk Monitoring

Managing risk is one of the most important parts of any trading strategy. In algorithmic trading strategies, identifying and monitoring key risk factors is vital. Traders should check for any market or external risks that may impact the strategy’s performance. Data points such as leverage, position sizing, or portfolio exposure are key metrics that can help in managing risk.

Infrastructure Maintenance

Algorithmic strategies leverage technology for speedy and accurate trade execution. Traders should regularly maintain their technological and network infrastructure to avoid any downtime. Regular checks can help traders spot and fix any bugs in the code. It is also important to regularly verify and update external data streams or broker APIs. Maintaining your computers and internet connection is also vital for a smooth algo trading experience.

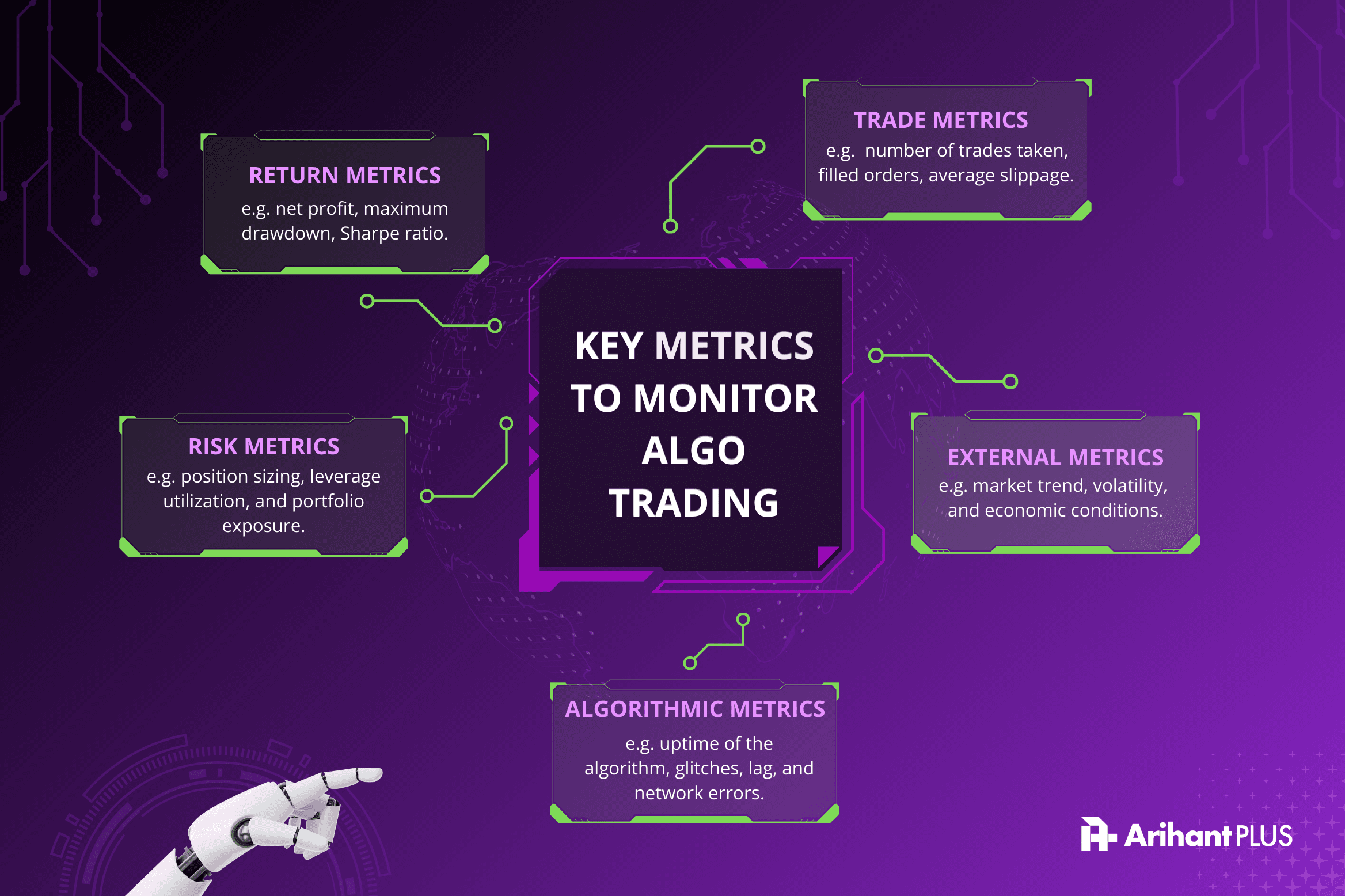

Key Metrics to Monitor for Algo Trading Strategies

Here are some essential metrics that one should keep track of while monitoring deployed algo trading strategies.

- Returns metrics: net returns, total drawdown, Sharpe ratio.

- Execution metrics: order fills, cancelled orders, latency, slippage.

- Risk metrics: position sizing, leverage, market exposure, portfolio concentration.

- Market metrics: trends, volatility, key events, market sentiment.

- Technological metrics: algorithm uptime, data errors, connection errors.

Common Problems and Warning Signs

After deploying an algorithmic trading strategy, there are several common problems or warning signs that a trader should be on the lookout for. Monitoring your strategies can help you spot these problems and fix them promptly.

Drop in Performance

One of the most common problems or warning signs that a trader should look out for is a sudden or rapid drop in performance. If your strategy is seeing a steep drawdown all of a sudden, it is advisable to take a look at the strategy.

Increased Slippage

Slippage is the difference between the expected trade execution price and the actual price of trade execution. An increase in the average slippage can impact the overall performance of the strategy. Changes in position sizing, better liquidity, or network connection can help lower slippage.

Technical Errors

Having a stable and reliable technical infrastructure is crucial for the functioning of an algorithmic trading strategy. If you are facing technical errors often, it is important to conduct a thorough review and maintenance of your devices, network connections, and algorithms.

Unexpected Behavior

At times, an algorithm may act unexpectedly. This can cause the algorithm strategy to completely fall apart and take on incorrect trades. If you spot any suspicious or unexpected behaviour, it is advisable to immediately monitor the strategy to identify and fix the underlying issue.

Conclusion

One of the key drivers behind the popularity of algorithm trading strategies is the convenience and automation of the trading process. Although traders can significantly benefit from this, not monitoring and maintaining an algo after deployment can lead to major consequences.

Through regular monitoring and periodic maintenance, one can fine-tune a strategy which can be adaptable, reliable, and consistent.

FAQs

Is it important to monitor an algo trading strategy?

Yes, monitoring an algorithmic strategy after deployment is important as it can help spot any errors, flaws, or limits in the strategy.

How often should you monitor your algorithmic trading strategy?

It is important to regularly monitor your strategy to make sure it is performing as expected.

What are some key metrics to look out for?

While monitoring an algo strategy, look out for metrics such as the returns, drawdowns, trade execution, slippage, and risk exposure.

How to maintain an algorithmic trading strategy?

To maintain an algorithmic strategy, analyse the performance, conduct robustness tests, and conduct periodic tests on the tech and network infrastructure.

Can market conditions impact how often a deployed algo needs to be monitored?

Yes. During periods of high volatility, major news events, or changing market trends, algorithms may need closer and more frequent monitoring to ensure they continue to perform as expected.

Related Topics